Journal of Financial Market Infrastructures

ISSN:

2049-5404 (print)

2049-5412 (online)

Editor-in-chief: Manmohan Singh

Illustrative industry architecture to mitigate potential fragmentation across a central bank digital currency and commercial bank money

Need to know

- The adoption of CBDCs risks fragmenting payments markets and retail deposits.

- Placing CBDCs and commercial bank money on similar footing could mitigate fragmentation risk

- An industry architecture with a common programmability layer could use both forms of money.

Abstract

Central banks are actively exploring central bank digital currencies (CBDCs) by conducting research, proofs of concept and pilots. However, adoption of a CBDC can risk fragmenting both payments markets and retail deposits. In this paper, we aim to provide a mitigation to this fragmentation risk by presenting an illustrative industry architecture that places CBDCs and commercial bank money on a similar footing. We introduce the concept of ecosystems providing a common programmability layer that interfaces with the account systems at both commercial banks and the central bank. We focus on a potential UK CBDC, including industry ecosystems interfacing with commercial banks using open-banking application programming interfaces.

Introduction

1 Introduction

A central bank digital currency (CBDC) is a digital payment instrument, denominated in a national unit of account, that is a direct liability of a central bank (Bank for International Settlements 2021). Central banks are actively exploring CBDCs (Boar and Wehrli 2021),11 1 URL: http://www.atlanticcouncil.org/cbdctracker/. with various motivations such as

- (i)

continuing access to central bank money,

- (ii)

improving resilience,

- (iii)

increasing payments diversity,

- (iv)

encouraging financial inclusion,

- (v)

improving cross-border payments,

- (vi)

supporting privacy, and

- (vii)

facilitating fiscal transfers (Group of Central Banks 2021b).

The design of a CBDC and its underlying system could potentially lead to significant risks, ranging from cyber security risks (Bank for International Settlements 2021) to financial stability risks (Group of Central Banks 2021a). In addition, we identify a further risk of fragmentation in payments markets and retail deposits unless there is interoperability between CBDCs and existing forms of money.

In the UK, the Bank of England (BoE) and HM Treasury established the CBDC Taskforce to coordinate the exploration of a potential UK CBDC as well as two external engagement groups – the CBDC Engagement Forum and the CBDC Technology Forum – to gather input on the nontechnological and technological aspects, respectively, of CBDC.22 2 URL: http://www.bankofengland.co.uk/the-digital-pound. Bank of England (2021c) stated that the BoE and HM Treasury were also to launch a consultation in 2022, which set out their assessment of the case for a UK CBDC.

In this paper, we focus on a potential UK CBDC and describe an illustrative industry architecture based on the BoE’s (2020) “platform model”. Our contribution is the concept of ecosystems that provide a common programmability layer across both CBDC and commercial bank money and thereby place both forms of money on a similar footing. We hope the architecture presented in this paper will stimulate discussion and look forward to ongoing industry engagement on CBDC.

2 Central bank digital currency models and architectures

Central banks have described, proposed and piloted several models and architectures for CBDCs. The Bank for International Settlements (BIS) has described a range of CBDC architectures, including a single-tier “direct” architecture, two-tier “hybrid” and “intermediated” architectures and an “indirect” architecture (Auer and Böhme 2021). The BIS has also described models for multi-CBDC arrangements to make cross-border payments more efficient, namely, “compatible” CBDC systems, “interlinked” CBDC systems and a “single” CBDC system (Auer et al 2021). The People’s Bank of China has initiated a CBDC pilot that uses a two-tier architecture, with the central bank issuing digital fiat currency to authorized operators who take charge of exchange and circulation (Working Group on E-CNY Research and Development 2021). The Estonian Central Bank is experimenting with a bill-based CBDC money scheme built on a partitioned blockchain architecture (Group of European Central Banks 2021). The Federal Reserve Bank of Boston and the Massachusetts Institute of Technology have prototyped two CBDC systems with central transaction processors, one with an “atomizer” architecture and the other with a “two-phase commit” architecture (Brownworth et al 2022).

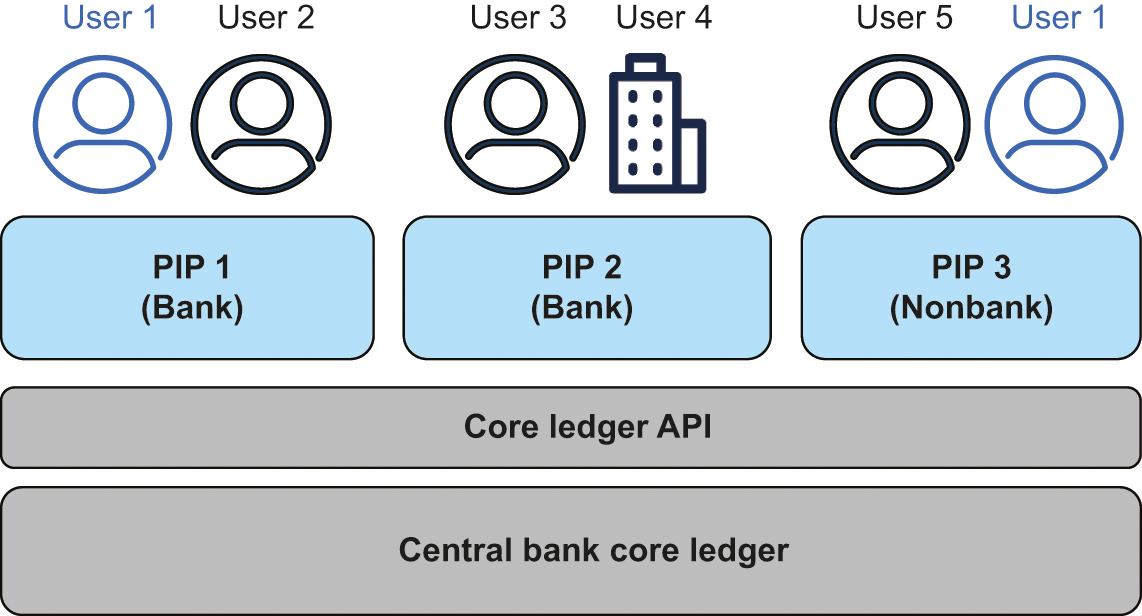

The BoE has described several potential models for CBDC provision, including a “platform model”, a “pooled account model”, an “intermediated token model” and a “bearer instrument model” (Bank of England 2021a). The “platform model” (Figure 1), which we adopt in this paper, comprises the BoE operating a core ledger and providing access via application programming interfaces (APIs) to authorized and regulated payment interface providers (PIPs) that provide users with access to CBDC.

3 Illustrative industry architecture

In this section, we describe an illustrative industry architecture for a potential UK CBDC by identifying the initial requirements, describing the logical architecture and analyzing how it meets the requirements. We adopt the BoE’s platform model; that is, we do not consider other models in the remainder of this paper.

3.1 Initial requirements

We first identify the following initial requirements as a basis for developing the architecture.

- Characteristics:

-

the architecture should support the characteristics of a CBDC system identified by the BoE (Bank of England 2021b), namely it should be (Bank of England 2021b)

- (i)

reliable and resilient,

- (ii)

fast and efficient, and

- (iii)

innovative and open to competition.

- (i)

- Technology choices:

-

the architecture should align with the BoE’s current views on potential technology choices on topics such as ledger design, privacy, simplicity and programmability (Bank of England 2021b).

- Interoperability:

-

the architecture should avoid fragmentation by ensuring CBDCs and commercial bank money are interoperable and have similar operational capabilities.

3.2 Logical architecture

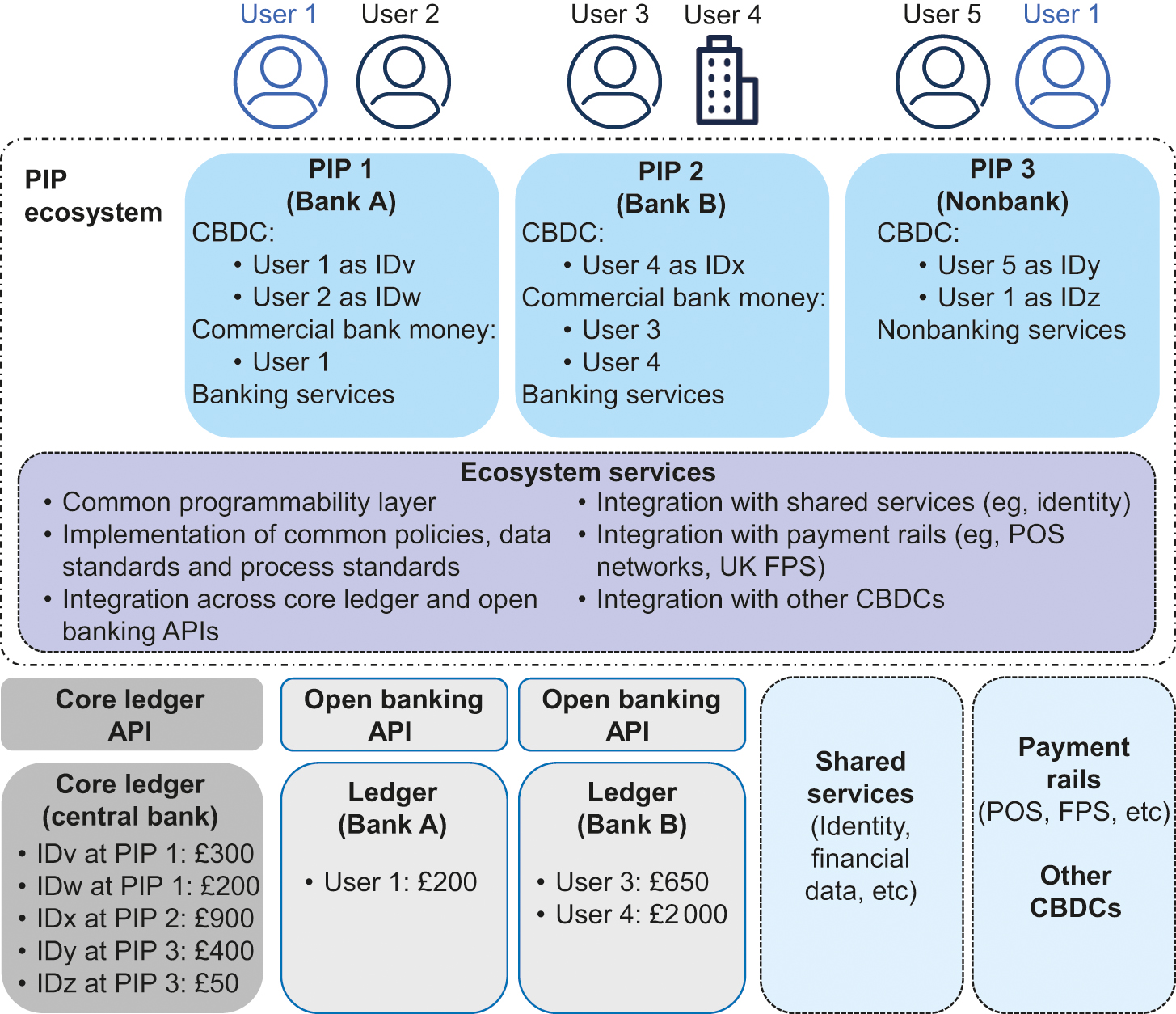

Figure 2 depicts the logical architecture. The key aspects of this architecture, which extends the platform model, are summarized below.

- (i)

The BoE operates the core ledger that records the CBDC value and processes the payment transactions made using the CBDC, and it provides access to the core ledger via APIs. Users are linked to their CBDC balances and payment transactions on the core ledger with pseudonymous identities. We highlight that the core ledger APIs could potentially be similar to open-banking APIs,33 3 URL: https://standards.openbanking.org.uk/api-specifications/. with some enhancements such as new APIs for opening and closing CBDC accounts.

- (ii)

We introduce PIP ecosystems that provide competing services, including

- (a)

the implementation of common policies, data standards and process standards;

- (b)

integration across the core ledger APIs provided by the BoE and open-banking APIs provided by commercial banks;

- (c)

integration with shared services such as identity providers and financial data vendors;

- (d)

integration with other payment rails such as the UK Faster Payments Service (FPS) and point of sale (POS) networks;

- (e)

integration with other CBDC systems; and

- (f)

a programmability layer that operates across all of these services and provides a foundation for creating new automated behaviors and innovative products.

- (a)

- (iii)

PIPs are authorized and regulated firms, which can include both commercial banks and nonbanks. They onboard retail and business users, provide customer services and fulfill regulatory requirements such as know-your-customer (KYC) and anti-money laundering (AML). PIPs also pseudonymize user identity and intermediate user access to the CBDC system. Note that PIPs could potentially deliver these capabilities by leveraging ecosystem services.

3.3 Analysis

| Requirements | Analysis |

|---|---|

|

Characteristics: (i) reliable and resilient, (ii) fast and efficient, and (iii) innovative and open to competition |

(i) The BoE can exercise control and oversight over the core ledger to ensure it is secure, compliant and private. Well-designed platforms can deliver resiliency, scalability and availability at the core ledger and ecosystem layers. (ii) The architecture introduces ecosystems as a layer between PIPs and the core ledger API, but the overhead of this indirection should be minimal and ecosystems can provide significant benefits including operational efficiencies. (iii) PIP ecosystems can build competing and innovative services while using common policies and standards to ensure interoperability. |

|

Technology choices: (i) ledger design, (ii) privacy, (iii) simplicity, and (iv) programmability |

(i) The API-based layered architecture allows the technology choices for the core ledger to be generally independent of the technology choices for other layers such as the ecosystems. (ii) The use of pseudonymous identities ensures only appropriate parties are aware of user identities, which facilitates privacy while retaining the ability to conduct KYC and AML. (iii) The core ledger infrastructure can be kept relatively simple because more complex functionality is provided by PIP ecosystems instead. (iv) Implementing programmability in the PIP ecosystems layer, instead of in the core ledger, should reduce security risks and complexity at the core ledger. Programs running in PIP ecosystems would leverage the core ledger acting as the authoritative data store. Each ecosystem could implement programmability using its platform of choice. |

|

Interoperability |

The PIP ecosystems would provide common policies, data standards and process standards across both CBDC and commercial bank money. This would avoid fragmentation by ensuring CBDCs and commercial bank money are interoperable and have similar operational capabilities. |

We now analyze the architecture against the initial requirements and summarize our findings in Table 1.

4 Summary and further work

This paper focused on a potential UK CBDC and presented an illustrative industry architecture that

- •

adopts and extends the BoE’s platform model for CBDC provision;

- •

aligns with the BoE’s currently identified system characteristics and views on potential technology choices for CBDC infrastructure; and

- •

mitigates the risk of fragmentation in payments markets and retail deposits by introducing the concept of ecosystems providing a common programmability layer across CBDCs and commercial bank money.

Barclays is developing a prototype based on the illustrative industry architecture. Potential further work includes the analysis of any changes needed to open-banking APIs in order to integrate with the common programmability layer, prototyping the specification of the core ledger APIs and elaborating key customer journeys using the architecture. We hope this architecture paper will stimulate discussion, particularly regarding methods to reduce fragmentation risk by placing CBDCs and commercial bank money on a similar footing, and we look forward to ongoing industry engagement on CBDCs.

Declaration of interest

The authors report no conflicts of interest. The authors alone are responsible for the content and writing of the paper.

Acknowledgements

We thank Vikram Bakshi (Barclays) for his helpful feedback.

References

- Auer, R., and Böhme, R. (2021). Central bank digital currency: the quest for minimally invasive technology. BIS Working Paper 948, Bank for International Settlements, Basel. URL: http://www.bis.org/publ/work948.pdf.

- Auer, R., Haene, P., and Holden, H. (2021). Multi-CBDC arrangements and the future of crossborder payments. BIS Paper 115, Bank for International Settlements, Basel. URL: http://www.bis.org/publ/bppdf/bispap115.pdf.

- Bank for International Settlements (2021). CBDCs: an opportunity for the monetary system. In BIS Annual Economic Report, Chapter III, pp. 65–95. Bank for International Settlements, Basel. URL: http://www.bis.org/publ/arpdf/ar2021e3.pdf.

- Bank of England (2020). Central bank digital currency: opportunities, challenges and design. Discussion Paper, March, Bank of England, London. URL: https://bit.ly/3Zqu1ME.

- Bank of England (2021a). Item 2: models of CBDC provision. Presentation at the CBDC Technology Forum November Meeting, Bank of England, London. URL: https://rb.gy/80qn6.

- Bank of England (2021b). Item 2: recap of some assumptions around CBDC technology. Presentation at the CBDC Technology Forum September Meeting, Bank of England, London. URL: https://bit.ly/452csDS.

- Bank of England (2021c). Statement on central bank digital currency next steps. News Release, November 9, Bank of England, London. URL: https://bit.ly/451oiOG.

- Boar, C., and Wehrli, A. (2021). Ready, steady, go? Results of the third BIS survey on central bank digital currency. BIS Paper 114, Bank for International Settlements, Basel. URL: http://www.bis.org/publ/bppdf/bispap114.pdf.

- Brownworth, A., Lovejoy, J., Fields, C., Virza, M., Frederick, T., Urness, D., Karwaski, K., and Narula, N. (2022). Project Hamilton phase 1: a high performance payment processing system designed for central bank digital currencies. White Paper, February, Federal Reserve Bank of Boston and Massachusetts Institute of Technology Digital Currency Initiative. URL: http://www.bostonfed.org/-/media/Documents/Project-Hamilton/Project-Hamilton-Phase-1-Whitepaper.pdf.

- Group of Central Banks (2021a). Central Bank Digital Currencies: Financial Stability Implications. Bank for International Settlements, Basel. URL: http://www.bis.org/publ/othp42_fin_stab.pdf.

- Group of Central Banks (2021b). Central Bank Digital Currencies: System Design and Interoperability. Bank for International Settlements, Basel. URL: http://www.bis.org/publ/othp42_system_design.pdf.

- Group of European Central Banks (2021). Work stream 3: a new solution -â Blockchain & eID. Report, July, European Central Bank. URL: https://shorturl.at/tTVXZ.

- Working Group on E-CNY Research and Development (2021). Progress on research & development of E-CNY in China. Report, July, People’s Bank of China. URL: https://bit.ly/46i7ynm.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net