Webinars

About our webinars

Our webinars are built around expert journalism and provide news, opinion and insight on the latest industry developments.

Upcoming Webinars

The future of intelligent automation for next-level risk management

This webinar explores pivotal market factors and trends regarding risk management and automation, providing insights on how to automate tasks safely and effectively, plus an understanding of impactful benchmarks that practitioners could use when managing complex risks in this dynamic environment.

Read more Sign up to the webinarMaximising revenue assurance: unveiling the secrets of the quote-to-cash process

In this webinar, we’ll explore the challenges facing revenue assurance and what solutions can be implemented to plug leaks in the quote-to-cash process by utilising data analytics and artificial intelligence/machine learning driven insights. The event will explore strategies to ensure robust revenue assurance by providing actionable insights to mitigate risks and bolster revenue stability.

Read more Sign up to the webinarPrice sensitive: maximising value from IPV and valuation control

Financial firms face the challenge of managing vast amounts of data, requiring effective sorting methods to discern valuable insights. Traditional reliance on historical data has become problematic amid recent crises and market complexities. Patchy liquidity complicates asset valuation even further. independent price verification (IPV) is becoming increasingly vital in the valuation control framework of financial institutions, ensuring internal prices align with independent third-party sources.

Read more Sign up to the webinarDeciphering Dora and developing operational resilience

The Digital Operational Resilience Act (Dora), was introduced by the European Union nearly 18 months ago and will apply to all firms offering financial services across the bloc in early 2025. This webinar will explore the practical and operational implications firms need to consider when complying with Dora, and the organizational best practices firms should look to develop internally and adopt as a means of mitigating the business, and the regulatory and reputational risks.

Read more Sign up to the webinar

Previous Webinars

Charting the course for structured credit markets in 2024

This Risk.net webinar, in collaboration with Numerix, explores the intricate world of structured credit markets in 2024. The discussion reviews the key market dynamics in 2023, and looks ahead to 2024 to observe how practitioners are handling the…

Operational resilience using the cloud

This webinar focuses on the business and operational benefits to firms on the back of their cloud strategies, across an industry that is often unforgiving to those not able to guarantee 100% uptime, operational robustness and competitiveness

From silos to solutions: ensuring resilient digital banking in a dynamic regulatory environment

The digital banking landscape is undergoing rapid and profound change. As the promise of technological advancement beckons, so too do the challenges of maintaining resilience, security and regulatory compliance. This webinar explores the multifaceted…

Early warning signals of credit deterioration to save on potential losses

With financial institutions facing market volatility and high interest risks in 2023, the warning signals cannot be overlooked. It is crucial to have access to reliable and timely indicators of credit deterioration to prevent significant losses. This…

Risk optimisation and hedge accounting to stabilise regulatory capital

Continual interest rate increases have been reshaping banks’ balance sheets worldwide. With these historic interest rate hikes, regulatory capital has been exposed to volatility driven by flawed hedge accounting programmes or hedges failing effectiveness…

A renewed focus on operational risk: mitigating new risks while deriving a competitive advantage

Regulators are preparing to introduce sweeping capital rule alterations with relatively short implementation periods. Firms that address operational risks in a holistic and integrated manner will realise risk and compliance benefits, and boost strategic…

Reimagining the insurance industry with technology

Innovation and technological advancement have become key components of how firms stay competitive and efficient in today's insurance industry. Across actuarial, finance, analytics and IT departments, there is pressure on the industry to stay ahead of…

XVA dynamics from a buy-side perspective: the latest strategies and insights

XVA components have once again gained prominence as crucial factors impacting the earnings of financial institutions. This webinar explores key aspects of XVA from a buy-side perspective, shedding light on strategies to navigate this complex terrain and…

Future-proofing regional and tier two banks: harnessing technology for agile stress-testing and regulatory compliance

The financial landscape is in flux. As the shadow of the regional bank crisis lingers, regulatory expectations are evolving rapidly. This webinar delves into the convergence of heightened regulations, the pivotal role of technology and how financial…

New trends in interest rate and liquidity risk management

A recent series of Risk.net webinars explored the banking crisis, interest rate risk and revamping banking asset-liability management practices. In the series, panellists dissected what went wrong and identified early lessons. Fast forward to the close…

Revolutionising credit decisioning in digital banking: harnessing AI/machine learning, LLM and alternative data sources

This webinar explores how financial institutions can leverage artificial intelligence, machine learning, large language models and alternative data sources, including open banking data, to modernise credit risk assessment and application fraud prevention

Achieving net zero with carbon offsets: best practices and what to avoid

The race to net zero is on, with tens of thousands of firms now signed up to carbon reduction targets. The use of carbon offsets from voluntary and compliance markets will play a key role in helping firms reach their net-zero and decarbonisation goals…

Empowering risk management with AI

This webinar explores how artificial intelligence (AI) can strip out the overheads and effort of rapidly modelling, monitoring and mitigating risk

The tech revolution: equipping institutions for risk and regulatory challenges

Unveiling the impact of cloud technology and data analytics, empowering institutions to enhance their calculations and cut operational costs. Redirecting focus to critical business decision-making and profitability follows suit

Shining a light on fixed income

Traditionally, fixed income as an asset class has presented market participants with several challenges due to the over-the-counter (OTC) model by which the bulk of securities are traded. Observable market data, especially for infrequently or thinly…

From sinking banks to peaking rates: what’s next?

In a webinar hosted by Risk.net, panellists explored the evolution of risk management and shared their views on best practices

The evolution of buy-side risk: managing the emerging importance of liquidity and climate risk

Risk managers have a tried and tested toolkit for market risk, but recent events and developments have highlighted the need for increasing rigour around liquidity risk and climate risk. This webinar explores the evolving scope of buy-side risk management…

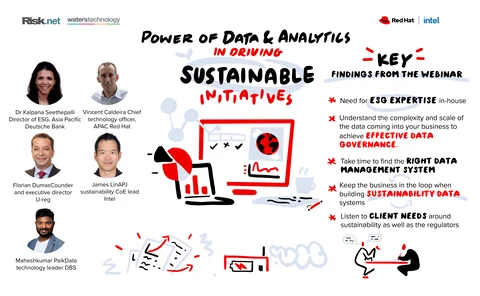

The power of data and analytics in driving sustainability initiatives

The challenges with current data approaches are data availability, reliability and transparency. It is, therefore, crucial to use data platforms and data mesh to enhance the process of obtaining accurate information, both for sustainability reporting and…

Navigating IFRS 9: strategies for effective implementation and moving beyond

There has been constant change within the landscape of financial reporting, and IFRS 9 has proven a critical component. Watch this webinar to find out how financial institutions can effectively implement IFRS 9 while remaining forward-looking and…

Risk and compliance in a transforming Asia: accelerating change, regulation and technology

Risk and compliance frameworks are undergoing an intense period of change throughout Asia. Amid the response to the Covid-19 pandemic, increasing dependence on third parties, the prevalence of cyber attacks and a need to protect privacy, there are…

Navigating market turmoil with robust credit risk management

In today's fast-paced and ever-evolving financial world, firms must master credit risk management to navigate market volatility. This webinar explores the dynamics of credit risk management and offers insight into risk assessment techniques, challenges…

Zero-day options: ticking time bombs or high alpha trades?

Zero-day-to-expiration (0DTE) options have surged in popularity over the past several years, with 0DTE options now exceeding 40% of daily trading volumes in S&P 500-linked options by recent estimates. A panel of market experts provide their perspectives…

New developments in XVA: an inside view on bank strategy in a changing world

This webinar addresses market issues and explores banks' strategies for optimising capital efficiency, shedding light on how banks are adapting to changing regulation, how they minimise the impact of market volatility on capital requirements and how…

Cloud control: optimising cloud for risk management gains

Cloud adoption has accelerated rapidly among capital markets participants in recent years. This Risk.net webinar explores how firms can optimise their usage of cloud, driving greater efficiency, avoiding common pitfalls and keeping costs to a minimum