Model risk

Anatomy of a model: Valuation of physical assets

Quant ideas paper dissects layers of valuation models for physical assets

Time to see models and shocks for what they are

Market shocks are earthquakes, not a game of roulette

Top 10 op risks 2015: model risk

Avoiding model failure will be a key issue in 2015

Black box blues: Fed starts model validation row

"They all fall short," says one expert, as banks try to vet vendor models

Fed orders banks to break open black boxes

Banks struggling to prise information out of vendors after Fed clamps down

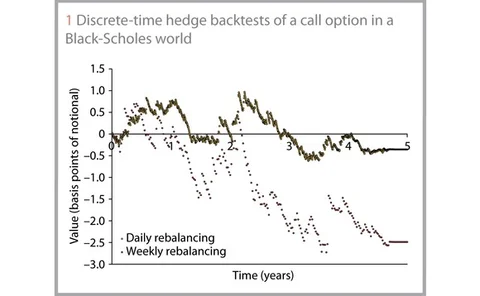

Hedge backtesting for model validation

Derivatives pricing and expected exposure models must be backtested as a basic regulatory requirement. But what does this mean exactly, and how can it be used to reserve against model risk? Lee Jackson introduces a general backtesting framework for…

Portfolio optimisation via replication

Filippo Della Casa and Michele Gaffo propose a new framework to run portfolio optimisation for life insurance business, by exporting the replicating portfolio technique from risk management to investment management. In particular, they develop a new risk…

Applied risk management series: Integrating stress tests with risk management

Stress testing is a vital part of successful risk management, but risk managers at energy trading firms frequently face obstacles in designing and implementing successful stress testing programmes. In this article, Carlos Blanco provides some advice on…

Risk managers too focused on model outputs, Lloyd’s risk head says

Risk managers need to look beyond models and consider a wider universe of risks, says Reeves

Hedge backtesting for model validation

Hedge backtesting for model validation

Quant Congress Europe: Test models as you build them, says BAML expert

With the 'London Whale' modelling failures still casting a shadow over the industry, BAML model risk head advocates ongoing testing

Copulas and credit models

Copulas and credit models

Non-linear mixture of asset return models

Non-linear mixture of asset return models

A model future (part I)

Models that use factors such as key risk indicators, or KRIs, for inputs align the op risk function with credit risk and market risk - and may increase the effectiveness of operational risk within an organisation. Marcelo Cruz looks at key factors in…

On humility

It's nice to see op risk managers becoming more aware of their limitations

Beware of data leverage

Beware of data leverage

OpRisk North America: Crisis highlighted op risk model failures, says Adachi

Model risk emerged as a key lesson from the crisis – and a significant variation in op risk modelling approaches exists today, says Sigor chair

Solvency II modelling could cause systemic risk, industry warns

Industry experts warn uniform modelling under Solvency II could lead to risk contagion

Bayesian lessons for payout structuring

Bayesian lessons for payout structuring