Credit risk

Japan’s SMBC expects to issue synthetic CLO in early December

Japan’s Sumitomo Mitsui Banking Corporation (SMBC) is preparing to launch a synthetic balance-sheet collateralised loan obligation (CLO) referenced on ¥500 billion worth of loans extended to 1,500 Japanese small to medium-sized companies.

A question of priorities

Japan's banks are aware of the need to prepare for Basel II, but it is just one of a number of urgent issues that need to be resolved in the Japanese banking sector.

Loan hedgers shy away from CDS market

Despite a surge in European lending activity during the past three months, many banks have decided not to hedge their risk with credit default swaps (CDSs), according to research by Morgan Stanley.

Isda reports 75% increase in collateral use for derivatives trades

Collateral use in over-the-counter derivatives transactions and related margined activities such as repos and structured products increased 75% from $250 billion in 2001 to $437 billion this year, said the International Swaps and Derivatives Association…

Data hurdles

The risk management rumour mill has been buzzing in recent weeks with the story that US banking regulators have told the senior management of the country’s 30 largest banks that they will be expected to implement the advanced internal ratings-based (IRB)…

Credit ratings come into FX focus

Credit ratings are becoming increasingly significant to foreign exchange market players, with downgrades increasing in the current economic downturn, market participants told RiskNews ' sister publication FX Week .

Unsystematic credit risk

Although Basel has shifted its treatment of unsystematic credit risk from the first, capital rules pillar (where it was called the ‘granularity adjustment’) to the second, supervisory pillar of the forthcoming Accord, this issue is of great practical…

Sponsor's article > Basel II and pro-cyclicality

The main argument for making regulatory capital requirements more risk-sensitive is to improve allocational efficiency. But this may lead to intensified business cycles if regulators fail to take measures to prevent such an impact.

Sponsor's article > Credit derivatives: will the market keep expanding?

This article aims to give a brief overview of some of the main trends in the credit derivatives market and also proposes to analyse some of the underlying reasons why this market is experiencing such a boom.

An overwhelming problem

Introduction

Reacting to spreads

Credit derivatives

Fighting credit risk demons

Credit risk

A question of priorities

Basel Accord

Managing housing loan risk

Mortgage-backed securities

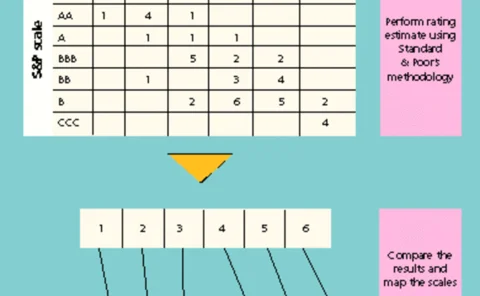

Internal risk rating systems for banks

Sponsored article

Trouble from above

Pension funds

JPM Merits CDOs

Credit tech

Commerzbank: kaput?

Credit of the month

Fuelling doubts

Violence and uncertainty in the Middle East have caused energy market volatility to soar, testing the mettle of even the most sophisticated corporate hedgers. Will it prove to be the last straw for the world’s ailing airlines? Navroz Patel reports

RiskNews review

October’s leading stories from RiskNews. Breaking news on derivatives and risk management, see RiskNews – www.RiskNews.net