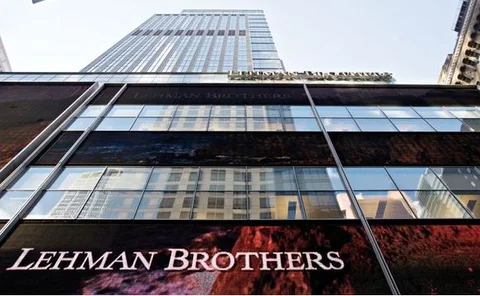

Lehman Brothers

Consequences of the cleanup

The UK Financial Services Authority must bolster laws designed to protect investors while ensuring that it takes these actions in sympathy with regulations being introduced at a European level. Richard Jory reports on the actions of the regulator and the…

India finds some forward momentum

The global financial crisis could easily have sounded the death knell for India’s nascent structured products market. But as the country’s equity markets have resumed their upward trend, dealers say equity-linked structures are catching on fast.

Statement of intent

Aviva Investors has made a decisive leap into the global structured products market, hiring an industry veteran to lead its multi-asset-class rollout. Sophia Morrell talks to Stephane Rougier, the ex-Lehman Brothers banker who is leading the push.

Winding down Lehman

In an exclusive interview with Risk, the administrators of Lehman Brothers International (Europe) discuss their role in handling the largest bankruptcy in corporate history, revealing how the process has raised questions about prime brokerage agreements,…

Regulators and accumulators

Asian economies have suffered less from the global financial downturn than they did during the regional crisis of 1997. Risk levels are now lower, while the money that has been accumulated after more than 10 years of extraordinary wealth creation is back