This article was paid for by a contributing third party.More Information.

Making technology count in a C/ETRM world

As businesses grow, so does their need for modern, agile and cost-effective commodity/energy trading risk management (C/ETRM) solutions. Pioneer Solutions explores how its next-generation, highly configurable C/ETRM systems take advantage of the latest technology to deliver the functionality to do more with less

The digital transformation of the C/ETRM space is one of the hottest topics right now for industry participants.

Digitisation – the process of converting information from an analogue into a digital, computer-readable format – is increasing the efficiency of business processes across different companies in the commodity/energy space, and it has been happening apace.

In this new world of digital transformation, forward-looking trading companies are leveraging automation to accomplish what their competitors are still performing manually in C/ETRM, and it is yielding many use cases and advantages for businesses.

Those changes now span such areas as artificial intelligence (AI), machine learning, robotic process automation (RPA) and digitisation itself.

AI has been around since the 1950s, while machine learning is a more recent trend. It can be considered a current application of AI based around the idea of allowing machines to access data and letting them learn for themselves, as opposed to rules-based systems prepared by humans – which is seen more traditionally as AI.

To further improve the efficiency and speed of those workflows, RPA is also being looked at as a means of reducing or eliminating the repetitive processes via a virtual worker, especially the routine and rules-driven tasks in the back office.

Virtual workers can be deployed 24/7, driving higher levels of productivity, just as industrial robots have been revolutionising the manufacturing industry by creating higher production rates and improved quality.

However, before many of these new processes can be implemented, digitisation and a level of automation must be introduced firm-wide – not just in the front office.

While legacy C/ETRM systems have traditionally automated front-office processes for deal entry and risk management, they were not conceived with the back office as the starting point. As a result, they fall short of capturing and configuring contracts ready for settlement and invoicing to a level where this can be automated.

Consequently, the digitisation of standard contracts does not reach to the next level of automation, whereas complex billing of non-standard contracts is done outside those C/ETRM systems via manual processes – altogether a costly, error-prone and inefficient approach. Given the market conditions companies face – where margins have become slimmer and every penny counts – this is now garnering attention within commodity/energy trading organisations.

Just as digitising C/ETRM produces numerous cost savings and efficiency advantages, the automation of these processes will be

the next step in the evolutionary framework

for C/ETRM. Once that has been established, most businesses can take the next step to using techniques such as AI and machine learning to push the business further away from manual tasks.

With the increase in availability of digital information, both rules-based systems and machine learning have a lot to offer. The energy trading market has been recognising the benefits in their promise of automating mundane tasks and offering creative insight. Next-generation ETRM systems have adopted AI, thereby embedding intelligence in various functional applications as routine technology.

Digitisation in practice

Working examples of digitisation come in various forms.

A neural network method is used to load and price forecasting where it will use historical price and demand data, forecast weather data and calendar attributes – such as on-peak hours, off-peak hours, weekdays, weekends and holidays.

Under the neural network method, historical input data is divided into train and test sets. By taking the train dataset, the method performs optimisations in an iterative fashion and provides optimised model parameters. These model parameters are used in the test data for model validation. Once the models are validated, the optimised model parameters with new input data are fed in the model for the load and/or price forecasting.

In the trading world, algorithms are used to simulate or optimise operations. Modern ETRM systems support the ability to create ‘what-if’ scenarios, to see the impact of price and volume changes on portfolios and profit and loss.

Mechanisms can be set up in support of market strategies based on set levels, averages, deltas, or targets for volume and price. A ‘live’ ETRM system facilitates such operations by reporting position changes and receiving market information in real time, and by having direct interfaces with the various trading exchanges.

For gas flow optimisation, a linear programming simplex method can be used to allow users to schedule gas from a receipt point to a delivery point. Gas can be scheduled manually, or the system can propose an optimised flow based on constraints such as location, pipelines, contracts, delivery paths, and supply and demand side.

Flow optimisation can automate complex equity gas nominations and the optimisation of gas flows to meet demand. Based on the results the optimiser provides, remaining path maximum daily quantity (MDQ) and end positions on the supply and demand side will change.

The flow optimisation/scheduling process also creates nomination records that can be submitted to the pipeline.

Finally, after having digitised and automated the standard settlement process, it is then ready for the next level of optimisation for operational accuracy, costs and speed: RPA software. The combination of a highly configurable C/ETRM module – such as Pioneer’s SettlementTracker – with RPA will deliver the flexibility for constant adjustment of robot operation to the C/ETRM system software. It enables digitalisation and robotisation.

Achieving automation

While robotisation cannot be applied everywhere, digitisation is a prerequisite of automation. Many C/ETRM systems can only support standard deal and contract settlement, and sometimes can’t even produce something as basic as an invoice. Instead, companies are deploying an army of settlement analysts to manually account for their structured trades and imbalance calculations – a time-consuming and costly exercise.

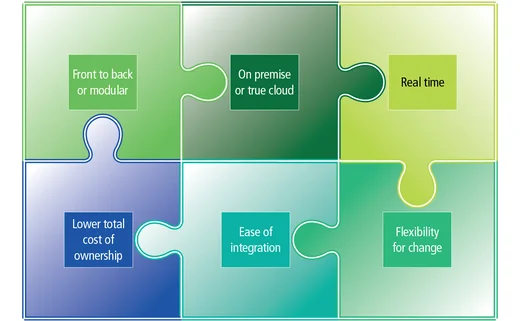

When a C/ETRM system provides an integrated solution, the back office will benefit from straight-through processing and built-in workflow management, streamlining the contract-to-bill process.

A C/ETRM system that has a notion of billing determinants and charge types will be able to automate 95% of all contracts, whether a European Federation of Energy Traders or International Swaps and Derivatives Association master agreement, a complex power purchase agreement, an intercompany or generation and renewables contract.

The combination of a highly configurable C/ETRM module that can capture and automate rules-based invoicing and RPA will free up human resource capital and allow companies to achieve and maintain operational excellence.

This is combined with market demand for less costly solutions, proven and easy-to-implement functionality, and reasonable flexibility as businesses change to meet the needs to drive profitable growth.

Too often, growing businesses are held back by entry-level software systems that stifle growth and unreliable manual processes that cut into performance and profitability.

As a true innovator, Pioneer Solutions not only provides specialised solutions for back-office processes and an enterprise-grade front-to-back integrated C/ETRM system, but also an award-winning Software-as-a-Service (SaaS) offering for non-enterprise level companies.

This introduces another technology the

C/ETRM market is taking advantage of in terms of cost and scalability: cloud-hosted solutions. Across the software industry, these solutions are overtaking traditional delivered software.

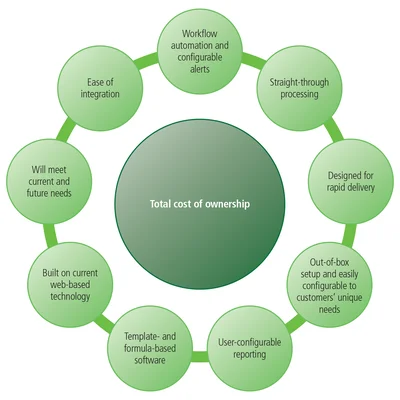

When a modern C/ETRM system – such as Pioneer Solutions’ TRMTracker – offers a high degree of user configurability, reliance on the vendor will reduce for a lower cost of ownership over time.

Moreover, with TRMTracker already web-based, it offers additional attractiveness for SaaS – it is delivered within a shared cloud infrastructure with no need to install, maintain or host software on-site. Combining those two key properties paved the way for Pioneer Solutions to take it a step further: a self-serving, rapid deployment environment for C/ETRM SaaS.

TRMTracker.com differentiates from other

C/ETRM SaaS offerings by providing a standard set of enterprise-grade tools across front-, middle- and back-office functions, including workflow, data importing and innovative reporting capability. TRMTracker.com does not have the restrictions of pre-configured solutions. Instead, within the provided set of functionalities, customers can configure their commodity trading risk management (CTRM) software to fit their business from front to back office.

After receiving a short tutorial and some basic implementation support, users can perform this self-configuration and expect to be up and running in one to two weeks. This includes entering actual trades, reviewing mark-to-market, monitoring credit risk, producing invoices and performing reporting.

TRMTracker.com also leverages its superior ability to configure customer business processes from Pioneer’s flagship CTRM software system. It allows users to configure and change templates, formulas, book structures and data import/export rules supporting a slew of formats from flat files to XML, Simple Object Access Protocol and Representational State Transfer web service application programming interfaces.

To minimise the future cost of maintaining customisations, the system allows users to add defined fields. Finally, innovative reporting options offer easy report creation and ensure user adoption, if the intuitive screens haven’t done that already.

In a challenging commodities market – and among rapid technology changes – you can’t afford inertia of your C/ETRM vendor. Growing businesses need modern, agile C/ETRM solutions that are cost-effective, scale rapidly and future-proof their company for long-term innovation and growth. Next-generation C/ETRM systems are highly configurable, take advantage of the latest technology and deliver the functionality to do more with less.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net