This article was paid for by a contributing third party.More Information.

Profit emergence under IFRS 17

Major changes are expected under the new IFRS 17 regime – insurance companies must make efforts to comprehend and communicate the full impact of changes to profit emergence under different scenarios, and its sensitivity to different methodology choices, writes Steven Morrison, senior director, research, at Moody’s Analytics

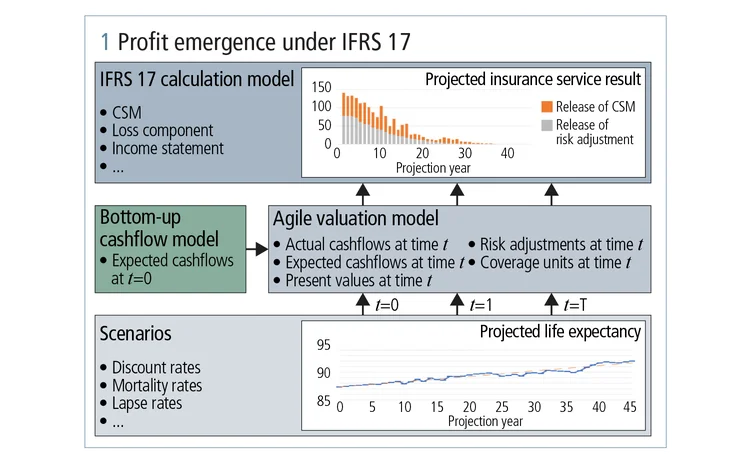

Many insurance companies are currently focused on implementing systems to support calculation and reporting of IFRS 17 financial statements. However, the introduction of IFRS 17 ultimately requires insurance companies to be able to perform more than point-in-time calculation and reporting. Insurers also want to project these statements in the future under different scenarios. Such a projection capability serves at least two important purposes:

- To better understand the timing and volatility of profit emergence, which could change significantly relative to existing reporting. This could have a major impact on many areas, including the payment of dividends, tax and remuneration. This information is important not just for insurance companies’ management but also their investors, who will want to understand the effect of IFRS 17 on profits, and any resulting impact on management strategy.

- To understand the impact of methodology decisions not prescribed by the standard. For example: transition methodology, level of contract grouping, choice of coverage units and risk adjustment methodology. These decisions impact on the timing of profit emerging under different scenarios.

Under IFRS 17, the new contractual service margin (CSM) plays an important role in profit emergence, ensuring profit is not realised at contract inception but released over time as services are provided. It also partially absorbs the impact of changes in certain assumptions on fulfilment cashflows. However, this does not mean profits are entirely predictable or stable. Indeed, under certain scenarios they could be highly volatile. In particular, when assumption changes are sufficiently extreme, the CSM is eliminated, the contract group becomes onerous and further variability is recognised immediately in profit and loss (P&L) – until a CSM is re-established.

To fully understand profit emergence, companies should consider the effects of different scenarios. In particular, it can be useful to consider other scenarios in addition to best-estimate forecasts. Companies may find it useful to understand which scenarios result in a contract group becoming onerous, and how this changes depending on methodology decisions.

Such scenarios could be hand-picked – typically, to reflect a narrative – or generated using a stochastic scenario generator. In choosing the type and number of scenarios to investigate, companies will face a trade-off between the amount of information provided and the complexity of implementation. Projection under many stochastic scenarios can provide detailed information but may not be feasible using existing actuarial cashflow models. Where these do not support efficient IFRS 17 projections, ‘agile’ or ‘proxy’ models may provide an alternative approach.

Companies also need to consider the impact of changes in financial assumptions on assets measured under IFRS 9. The interaction between these two standards can be complex, with resulting net profit depending on the classification of assets and liabilities. For example, the impact of financial risk on participating contracts varies depending on whether they qualify for measurement under the variable fee approach (VFA) or the general measurement model. Furthermore, under the VFA, the impact of financial risk varies depending on whether risk mitigation techniques are recognised.

Even for non-participating contracts, financial risk impacts both assets and liabilities through the effect of discounting. Companies can choose to recognise the effect of changing discount rates immediately through P&L or other comprehensive income. Similarly, the effect of changing interest rates on assets depends on their classification under IFRS 9. Companies will need to consider classification and the choices available under both standards to ensure these are aligned and accounting mismatches are avoided where possible. Projections under different scenarios can be used to investigate these options.

Read more articles from the 2019 IFRS 17 special report

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net