This article was paid for by a contributing third party.More Information.

Managing Japanese interest rate risk and creating trading opportunities

With an anticipated rise in Japanese interest rates, 3-Month Tokyo overnight average rate (Tona) Futures have attracted the interest of investors worldwide since debuting on the Osaka Exchange (OSE) in May. Kensuke Yazu, general manager for derivatives business development at OSE, discusses the factors driving growth in this market

Global players have long been aware of Libor’s limitations, with its interest rates based on panel banks’ estimated interbank overnight lending interest rates rather than on actual transactions. Demand has grown over many years for more robust risk management tools, based on more transparent benchmark interest rates. This has led global regulatory bodies to enforce a transition away from the various Libor rates.

In Japan, Tona was adopted as the risk-free rate to replace Libor under the Bank of Japan’s (BoJ’s) Tona First initiative, advancing its conversion much faster than interbank offered rates in other currencies. Tona is a volume-weighted average of actual transactions in the Japanese yen unsecured overnight money market. According to BoJ statistics, the daily trading volume of unsecured overnight call transactions exceeded JPY9 trillion in the first half of 2023.

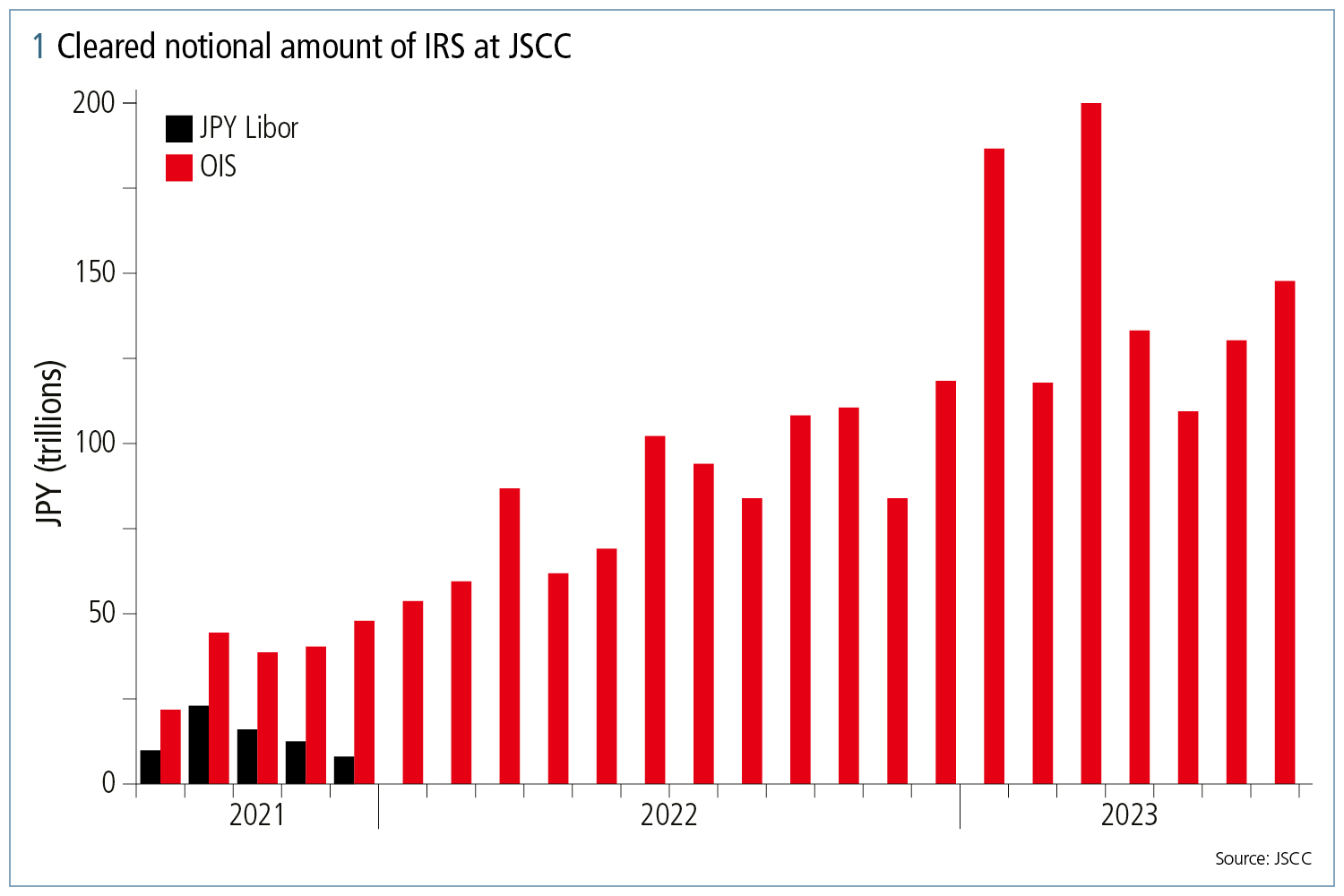

Following the permanent suspension of Japanese yen Libor publication at the end of December 2021, the majority of Japanese yen over-the-counter (OTC) interest rate swaps (IRS) shifted to Tona-based transactions. In March, Japan’s OTC IRS clearing house, Japan Securities Clearing Corporation (JSCC), recorded single-side cleared notional Tona-based IRS of around JPY200 trillion.

What are the benefits of Tona as a benchmark?

Tona is a short-term interest rate that has long been regarded as a monetary policy target for the BoJ. In Japan, forecasting the supply and demand of short-term funds can be done extremely accurately – and the BoJ can smoothly intervene in the supply and demand of interbank lending by adjusting current account balances.

What factors are influencing investor participation in Japanese interest rate markets?

Investors are watching the current situation in Japan and preparing for any potential policy adjustments by the BoJ. Although the bank took a further small step by adjusting its yield curve control policy on July 28, policy-makers have repeatedly stressed the need to maintain the existing ultra-lenient policy, with the short-term policy interest rate at -0.1% until consumer prices consistently reach the BoJ’s 2% target. The BoJ has said it wants to see how the Japanese public reacts to rising prices as wage growth continues slows.

Inflation caused by post-Covid-19 pandemic supply chain issues and the first-order effects of the weakening Japanese yen against other major currencies was widely expected among market participants to be transitionary, and to slow rapidly before picking up again in 2024. The BoJ’s new governor, Kazuo Ueda, said that the BoJ would see good reason to shift monetary policy if it became reasonably certain that inflation would accelerate into 2024 after a period of moderation.

However, as the Japanese yen has continued to weaken and inflationary expectations have become more entrenched, it has fuelled speculation by global market participants that the BoJ will be forced to make further policy adjustments. In the medium term, the market expects the BoJ would need to hike interest rates, as Japan is the only major economy that continues to maintain a negative interest rate policy. Anticipation of such a policy shift would drive global players to seek out liquid short-term interest rate hedging tools, such as 3-Month TONA Futures.

What factors are convincing investors to trade Tona products?

Regardless of how the BoJ’s longer-term policy shift plays out, the market appears convinced that policy normalisation will occur – possibly not too far in the future, although there is wide and varied speculation about the timing of any potential policy shift. A normalisation path would inevitably lead to increased volatility in Japan’s interest rate markets, boosting demand from investors for liquid products to hedge against the risk of higher interest rates, or trading strategies that allow them to benefit from rising volatility.

OSE’s 3-Month TONA Futures provide investors with a valuable trading tool for hedging in advance of the BoJ’s potential normalisation process, as do OSE’s long-standing and highly liquid 10-year Japanese government bond (JGB) futures. Indeed, many global investors – such as hedge funds, especially those managing global macro strategies, and relative-value traders – have already recognised they can access a range of strategies by trading OSE interest rate futures and Japanese yen IRS.

Following the May 2023 launch, OSE’s 3-Month TONA Futures got off to a strong start, with average daily trading volume of around 2,000 contracts and open interest reaching nearly 10,000 contracts.

About OSE’s 3-Month TONA Futures

Tona is the overnight interest rate for Japanese yen unsecured money lending and borrowing in the call market. However, 3-Month TONA Futures are not based on the daily value of Tona itself, but on a financial indicator derived by subtracting three-month compounded Tona from 100 – similar to other interest rate futures traded globally.

Contract specifications

The product specification of OSE’s 3-Month TONA Futures is similar to CME Group’s three-month secured overnight financing rate (SOFR) futures, such as quarterly contracts reflecting the Tona expected difference between international monetary market dates and a minimum price fluctuation of a quarter basis point.

When designing the contract terms, OSE determined that three months would be the most efficient length of time, as it is the term most actively traded on global exchanges, in addition to the greatest market demand for a three-month term.

Additionally, to fulfil the risk management needs of the widest range of participants, OSE has specified the contracts to cover 20 consecutive contract months – out to five years.

Once 3-Month TONA Futures are fully adopted by the market and have built robust and deep liquidity, OSE anticipates adding related products to its interest rate product suite, such as options on 3-Month TONA Futures, and shorter- or longer-tenor Tona futures.

Streamlined market access

By utilising 3-Month TONA Futures, global investors can seamlessly trade Japan’s long- and short-term interest rate futures through OSE’s trading platform. For ease of access by global investors, 3-Month TONA Futures are available during the same trading hours as JGB futures, which cover both the US and European trading days. More than 60% of the trading volume in 3-Month TONA Futures takes place during US and European trading hours.

In addition, OSE’s 3-Month TONA Futures are cleared at JSCC, enabling investors to increase margin efficiencies by offsetting exposures with existing JGB-listed derivatives portfolios.

How can US customers access Japanese yen swap clearing?

Japanese yen IRS can be cleared at both JSCC and LCH, but, due to US Commodity Futures Trading Commission (CFTC) regulations, US investors are unable to clear Tona overnight index swaps (OIS) at JSCC, even though around 70% of Japanese yen IRS is now cleared at JSCC globally, following the onboarding of institutional investors, ranging from Cayman Islands-domiciled hedge funds to sovereign wealth funds. Therefore, while swaps traders in most other major jurisdictions clear Japanese yen IRS at JSCC, US investors are obliged to clear at LCH. To access OIS prices available at JSCC, they must trade synthetic products, such as swaptions, which are outside of the scope of global clearing mandates.

This discrepancy creates a price difference between the two clearing venues – a so-called ‘JSCC-LCH spread’ – due to the differing views of investors at the two venues, as well as differing supply-and-demand dynamics. Currently, the 10-year Japanese yen IRS spread between JSCC and LCH hovers around three basis points, and arbitragers always monitor this closely if the basis widens.

Given this market structure dynamic, futures can be attractive to some global investors – especially those based in the US – as they can access OSE's 3-Month TONA Futures, which have very similar prices to JSCC-cleared OIS swaps, as the CFTC’s restrictions do not apply to exchange-traded futures.

What is the outlook for 3-Month TONA Futures?

Market structure changes – such as the permanent suspension of Libor – and the potential for the BoJ to implement monetary policy changes have sown the seeds for the 3-Month TONA Futures market to grow. This market is expected to blossom as more global investors enter the market.

On the trading side, OSE introduced market-maker incentives for 3-Month TONA Futures to nurture initial on-screen market liquidity. As a result, there are now almost 20 market-makers actively participating in the market.

Furthermore, as off-screen block trading is commonly used for SOFR futures in the US market, OSE is arranging with interdealer brokers to provide further off-screen trading solutions for dealers who trade 3-Month TONA Futures together with Japanese yen IRS. This scheme is expected to contribute to increased off-screen matching opportunities – particularly as trading packs and bundles transactions benefit from cross-margining where both futures and swaps are cleared at JSCC.

In this context, OSE and Ueda Tradition Securities – a joint venture between Tradition Group and one of the leading interdealer brokers in Japan – agreed to form a business partnership to facilitate the trading of 3-Month TONA Futures via off-screen trading. This is a small step, but will become a giant leap towards bridging the gap between listed and OTC markets in the short-term interest rate world.

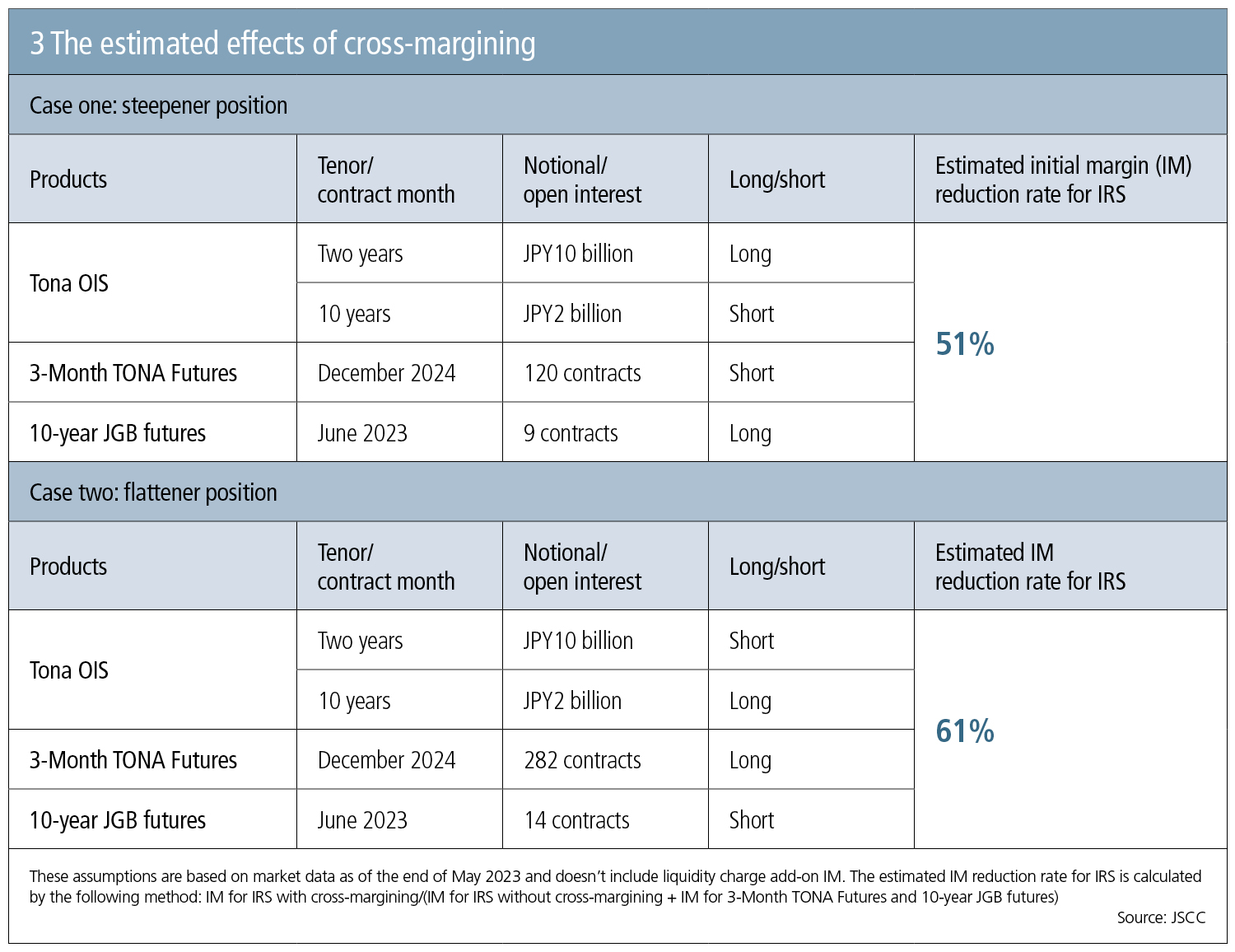

On the clearing side, in the first quarter of 2024, JSCC plans to launch cross-margining between Japanese yen IRS and OSE’s 3-Month TONA Futures, both of which are cleared at the JSCC. The estimated cross-margining effects could generate a 50–60% reduction in margin for a sample portfolio holding Tona-OIS, 3-Month TONA Futures and 10-year JGB futures positions. Such a margin benefit will become increasingly beneficial, given the expected rise in the capital costs for Japanese margin.

Interest rate normalisation requires injecting much-needed volatility into Japan’s interest rate markets, including cash JGBs, OTC IRS and listed derivatives, thereby reviving market function, moving away from fixed yields and enabling investors to take advantage of structural market moves. With the introduction of 3-Month TONA Futures – for both execution and clearing – OSE is providing a complete suite of solutions for hedging Japanese interest rates and for investment opportunities worldwide.

More information

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net