This article was paid for by a contributing third party.More Information.

Stemming the tide of rising FX settlement risk

As the trading of emerging markets currencies gathers pace and broader uncertainty sweeps across financial markets, CLS is exploring alternative services designed to mitigate settlement risk for the foreign exchange market

The world is experiencing a period of challenging economic and geopolitical conditions, most recently compounded by market instability and a lack of confidence in certain sectors. As regulation, rising interest rates and shrinking central bank balance sheets further strain the availability of liquidity and increase its cost, market participants naturally seek ways to optimise liquidity and further mitigate market and operational risk.

Created more than two decades ago as a financial market infrastructure to mitigate settlement risk in the FX market, CLS keeps a close eye on these changing dynamics and continually engages with market participants to adapt its services to their needs.

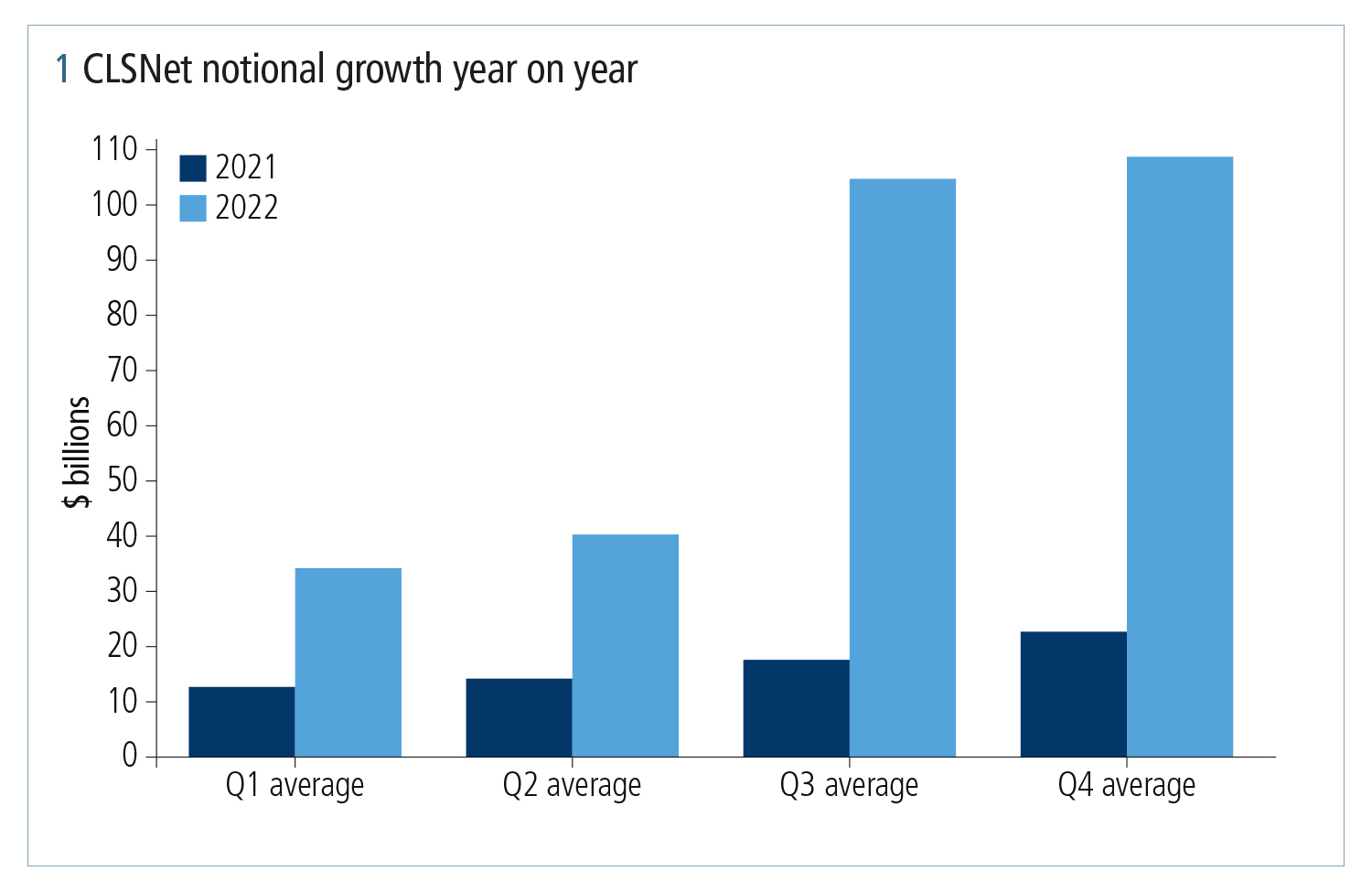

Demand for its primary settlement solution, CLSSettlement, has risen steadily in the past few years. Average daily settled values are now more than $6 trillion following recent growth that has outpaced the FX market. Likewise, appetite for the firm’s bilateral payment netting calculation service, CLSNet, continues to grow, and it exceeded the $200 billion daily notional netted barrier for the first time in September 2022.

Much of this growth in CLSSettlement has come from the asset management community, which accesses the service through CLS member banks. The past three years alone have seen an increase of nearly 25% in legal entities from around the globe settling through CLSSettlement via member banks, representing about 30,000 third parties, including banks, funds, non-bank financial institutions and multinational corporations. It is estimated that approximately 80% of the top 250 investment managers are now settling through CLSSettlement via their custodian banks.1

According to Lisa Danino-Lewis, chief growth officer at CLS, the firm has prioritised raising awareness of settlement risk to a wide array of market participants in order to extend settlement finality benefits to more FX trades.

“CLS and our members go out to the market to educate firms on how to mitigate that risk,” she says. “Over the wider FX industry, market participants are now more aware of settlement risk than ever. With significant growth in third‑party participation in the past few years, that work has paid off.

“Removing the underlying settlement risk over the years has helped the FX market grow and evolve, because the more comfort asset managers and other market participants have in the settlement of their trades, the more activity there will be in FX.”

Tackling regulators’ concerns over rising settlement risk

Despite the growing number of financial institutions choosing to settle their trades through a payment-versus-payment (PvP) solution like CLSSettlement, international regulators have expressed concern over rising FX settlement risk, especially in growing segments of the market that lack PvP arrangements.

CLS wholeheartedly supports the industry’s push for further adoption of PvP settlement mechanisms, including those recommended in the industry’s FX Global Code, and the search for credible solutions to address settlement risk in currencies not currently eligible for CLSSettlement. However, data studies conducted by the firm, in collaboration with a number of its global bank members, provide a refined perspective. This work involved a scientifically robust analysis of member banks’ trades over one month to determine how they were settled, thereby providing a good indication of the market’s management of settlement risk, and the range of methods and mechanisms used to settle FX flows.

Of the CLSSettlement-eligible transactions (which comprise approximately 80% of the total global FX market according to a 2022 Bank for International Settlements survey), on average, 51% of the traded notional is settled through CLSSettlement. The majority of the remainder relates to interbranch and inter-affiliate trades (35%), and trades where either settlement occurs via a single currency cashflow or over accounts within the banks’ direct control (combined, 8%). This leaves around 6% of trades exposed to FX settlement risk that could – and in theory should – be settled via PvP in CLSSettlement, explains Keith Tippell, chief product officer at CLS.

“As our analysis has shown, a significant amount of traded notional looks as though it should settle via a PvP service. However, in practice, it is either not possible – for example, when settlement occurs via arrangements where a single currency net cashflow representing realised profit and loss is exchanged – or not generally considered required, such as for intergroup trades,” he says. “While the results from our analyses are aggregated, the findings from each of the exercises carried out with our members show a high degree of commonality.

“The remaining 6%, which is clearly addressable, is the target of our ongoing efforts to increase adoption of CLSSettlement. While much of that activity is related to the ‘long tail,’ given the progress we’ve made in recent years, we’re confident of capturing incrementally more on an ongoing basis.”

Tackling settlement risk in emerging market currencies

CLS shares regulators’ concerns about rising settlement risk among some of the more widely traded, deliverable emerging markets currencies, which currently cannot settle through CLSSettlement or any other scalable solution. In the past decade, trading in some of these currencies has increased severalfold, most notably in renminbi, which is now the fifth most-traded currency in the world.

Adding currencies to CLSSettlement requires ongoing support from the central banks on both sides of the currency flow, and sometimes necessitates changes in the target jurisdiction’s laws and regulations. Given these factors, and the current geopolitical climate, CLS is exploring several avenues to expand PvP coverage, and has conducted a pilot exercise to define an alternative PvP service for certain currencies.

“The exercise took about a year to complete, and included extensive input from 12 of our global bank members. We are now confident we have identified an optimal alternative PvP service design for those target currencies,” says Tippell. “The design includes many of the primary features of CLSSettlement, yet factored in key requirements and considerations of the particular emerging market jurisdictions. Further testing has also shown that the technology that forms the backbone of CLSSettlement can be calibrated to meet these requirements.”

He adds: “We know we have the right technology and a well-validated service design, as well as the support of major market participants but, ultimately, it’s not a technology problem. Any solution of this type needs firm support from all the central banks related to all sides of the currency flows.”

Notwithstanding these challenges, Tippell explains that the growth and development of CLSNet help mitigate the risks that can be addressed now and, importantly, the CLSNet platform forms the foundation on which subsequent potential new settlement services might operate.

He comments: “In our conversations with market participants, we hear a strong desire to mitigate risk and centralise the processing of trades, which, for whatever reason, don’t make their way into CLSSettlement.”

CLSNet supports 120 currencies and a wide range of trade types, including non-deliverable forwards. With this enhanced industry focus, the flows streaming into CLSNet soared throughout 2022, and have continued to increase in 2023.

“The majority of the interbank transaction flow through CLSNet is, for the most part, the large deliverable emerging markets currencies, which represent the biggest concern for our members in terms of settlement risk,” Tippell says. “The expansion of the CLSNet network has been well received by our members as they can mitigate risk and achieve greater operational efficiency for a broader set of their currency flows. As well as adding support for new trade flow categories, such as trading activity that is intermediated, and functional support for other aspects of the trade lifecycle that remain manual or prone to failure, we hope to one day take that a step further by operating distinct settlement sessions for certain currency/trade tranches.”

As with its CLSSettlement counterpart, where members benefit from a tradedown of around 99% of their total gross notional before settlement, Tippell says that efficient netting is an important cornerstone of CLSNet and any future settlement and liquidity optimisation-related enhancements.

Supporting the industry through the SA‑CCR transition

CLS is also actively engaged with its members and central counterparties (CCPs) to gauge its role in supporting the FX industry, as market participants seek to optimise their capital in light of the regulator-mandated transition to the standardised approach for counterparty credit risk (SA-CCR). The industry has invested in a variety of multilateral mechanisms to mitigate this risk, whether CLS members prefer to create bilateral overlay trades to flatten their currency deltas as they do today, or choose in the future to centrally clear certain tranches of outright FX trades – such as forwards and swaps – for the purpose of capital optimisation, CLS stands ready to support its members through this evolution of the FX ecosystem.

“CLS is carefully tracking this evolution,” Tippell points out. “As we engage with our members, CCPs and optimisers, we constantly consider the role we can play to best support that process. The primary focus from our standpoint is to make sure that, whatever methods market participants choose to use for capital optimisation, the resulting FX flows are optimally and safely settled. Conversations in the industry are ongoing, and this evolution is likely to continue for the next couple of years.”

Resilience for the future

While CLS continues its market engagement and development of future product road maps, the firm will continue to invest heavily in the operational resilience of CLSSettlement and CLSNet.

“Solutions such as CLSSettlement and CLSNet are valuable for market participants as their networks have scale and there is widespread industry adoption,” says Tippell.

“As a systemically important financial market infrastructure, it’s critical we remain resilient. We engage with the market to ensure ecosystem developments and the broader global operating environment are factored into our work to ensure the ongoing functional and operational robustness of our services. We’ve made enormous efforts in the past few years to ensure the technology underpinning our services is state of the art and that we can operate with the highest degree of resilience.”

1. Excluding Chinese-based investment managers

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net