This article was paid for by a contributing third party.More Information.

One size does not fit all: Smart beta explained

Smart beta is not a single strategy – it is a variety of custom-made options for investors to choose from. And transparency and education are paramount in identifying the right smart beta approaches, says ETFs expert WisdomTree.

The exchange-traded funds (ETFs) industry has continued to gain momentum in Europe with no signs of abating any time soon. And, with this type of positive growth, the next ‘big thing’ is always just around the corner. That, right now at least, is smart beta, which represents around 20% of the almost $3 trillion global ETF market. But, for those trying to invest in smart beta, let us take a step back to see what it actually means.

First of all, it is important that investors realise that smart beta is not a single strategy, but an all-encompassing term to describe a multitude of strategies ranging from the very simple to the very complex. Second, smart beta strategies are rules-based. They aim to achieve better risk-adjusted returns but in a systematic way. The difference between the smart beta types includes the ways in which each will select and weight specific securities or investment objectives.

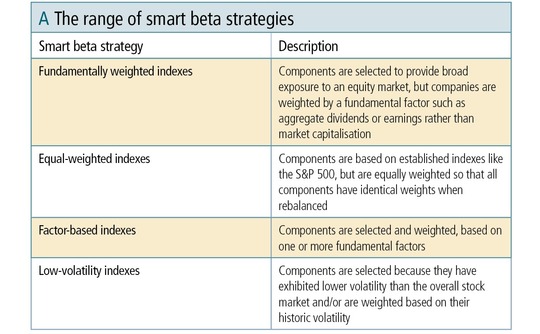

Some of the smart beta strategies we believe to be attracting attention are presented here in table A.

Within these strategies a multitude of different products is offered, ranging from those weighting by a single factor, such as dividends, to those skewed towards multiple factors within a single ETF. Added to this is the discussion about what drives returns. For example, there has been some research pointing to smart beta strategies performing well only because money has flowed into them. In other words, investor enthusiasm has driven returns by bidding up valuations. We find this unlikely given the short history of smart beta and the relatively small scale of investment.

This may be applicable to more traditional market capitalisation-weighted indexes that assign more weight to a stock as its price rises. On the other hand, we weight the companies in our fundamental ETFs by their annual cash dividends in a proprietary methodology called the Dividend Stream®.

We believe that dividends offer an attractive objective measure of a company’s health, value and balance-sheet strength and, therefore, this weighting serves as the foundation for most of our ETFs in Europe. And, because stocks owned by smart beta strategies could become overvalued or no longer representative of the factor(s) under consideration, we also rebalance to a measure of fundamental value annually.

Different strokes for different folks

Ultimately, transparency and education will be key to the future success of the smart beta sector. Therefore, those investing in ETFs need to take a closer look at the providers’ smart beta strategy: what the approach is, what it invests in, whether it complements what they already own, and what type of exposure it gives.

It can certainly be challenging to distinguish all that is out there. When it comes to identifying truly smart beta strategies, we think investors should seek the following:

- A rules-based, repeatable methodology that offers broad, representative exposure to an asset class.

- Alternative weighting methods that allow for ample investment capacity.

- High correlations to established benchmarks.

- An established track record on a total return and risk-adjusted basis.

- Regular rebalancing.

WisdomTree Europe Ltd is an appointed representative of Mirabella Financial Services LLP, which is authorised and regulated by the Financial Conduct Authority. For professional clients only. The value of an investment in exchange-traded products may go down as well as up, and past performance is not a reliable indicator of future performance.

Read/download the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net