This article was paid for by a contributing third party.More Information.

Equities & the Fed: A Dependent or Codependent Relationship?

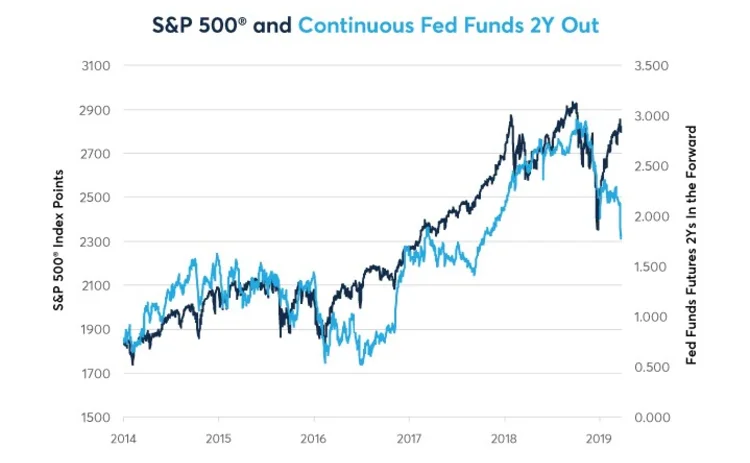

Higher stock prices eventually translated into expectations that the Fed would hike rates while lower equities would cause (or at least coincide) with fixed-income investors backing off rate-hike expectations.

Since the beginning of 2019, however, a yawning gap has developed between what equity investors and fixed-income investors expect (Figure 1).

Between the day after Christmas and the first full day of spring this year, the S&P 500 rose over 21%. Much of gains was stoked by expectations that the Fed would hold off on rate hikes following the Q4 2018 equity selloff. But now that the Fed is on hold, fixed-income investors are changing their opinions once again: merely unchanged rates is no longer enough to support stocks.

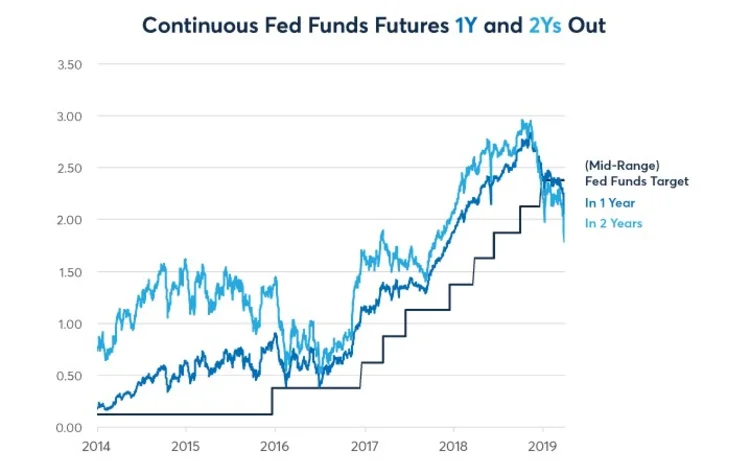

Increasingly, Fed funds futures are calling for outright rate cuts – and frequently, with the Fed seen cutting rates 2-3 times between now and the end of 2020 (Figure 2).

Yet, the Fed’s recent dot plot and statements didn’t contain even the slightest hint that anyone on the policy-making Federal Open Markets Committee (FOMC) thinks that the central bank will be cutting rates between now and the first quarter of 2021.

Even so, the major U.S. equity indices are within a few percent of their record highs at the time of this writing – although they seem to be losing momentum.

This disparity between U.S. equities and rate expectations is likely to get resolved in one of three ways:

- Equity markets continue to rally and Fed funds futures de-price rate cut expectations and maybe even start to price in rate hikes once again in line with the Fed’s dot plot.

- Equity markets sell off and catch up with Fed funds on the downside, probably forcing the Fed to cut rates if the selloff in equities becomes sufficiently severe.

- The Fed cuts rates soon and not under pressure from a sliding equity market, endorsing the expectations of Fed funds while supporting further gains in equities.

The last possibility seems like a fantasy.

The Fed probably won’t cut rates until it is put under duress by a sharp downward move in stocks. Doing so would be tantamount to admitting that it overtightened, and who likes to admit a mistake?

As such, it seems much more likely that either equities will continue to rally and pull Fed funds futures higher (in rate terms, so lower in price terms); or unfulfilled expectations of a Fed rate cut will cause equity investors to begin selling shares, bringing stocks in line with increasingly bearish rate expectations.

Any such selloff might continue until the Fed short-circuits it by easing policy.

Bottom line

- A yawning gap has opened between bullish equity investors and bearish fixed income investors.

- The Fed could resolve this seeming paradox in equity vs fixed income market pricing quickly if it eases policy.

- For the moment, the Fed shows no hint of easing.

- It seems likely that stocks catch up on the downside or short-term interest rate expectations catch up on the upside.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net