This article was paid for by a contributing third party.More Information.

Transitioning beyond Libor: Some key considerations

Liang Wu, vice-president of financial engineering and head of CrossAsset product management at Numerix, explores the transition to Libor alternative rates and the impact on curve construction practices

The development of Libor alternative reference rates (ARRs) are expected to have direct consequences for derivatives contracts. This is particularly the case for those that do not mature until after 2021, which is when the UK Financial Conduct Authority (FCA) will cease to compel banks to use Libor as the benchmark for short-term interest rates in the interbank market.

Important steps have already been taken to begin addressing this change but questions remain, such as how will Libor ARRs impact curve construction practices? This article explores the issue and examines the launch status of the selected ARRs.

Market participants should recognise the risks associated with the cessation of Libor forecast curve production. Today, Libor-based instruments are still heavily relied upon for curve construction. But, given the option to no longer support Libor after 2021, banks are starting to evaluate the impact Libor’s demise will have on curve construction practices for derivatives contracts going forward.

Curve construction implications

As the market evolves, new curve construction approaches could emerge as instruments begin referencing ARRs.

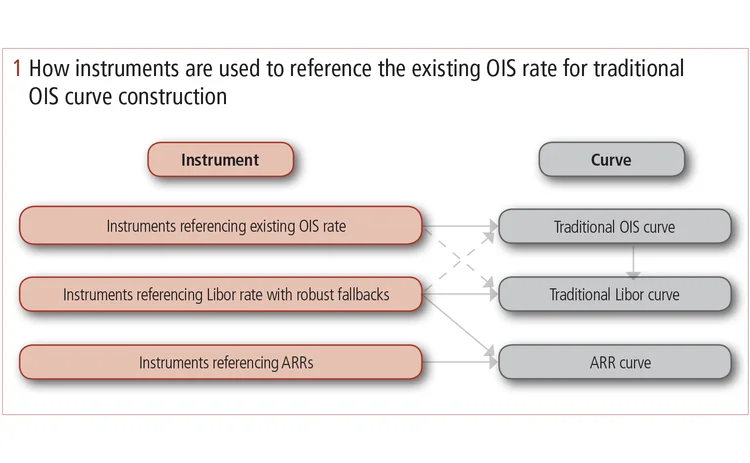

Instruments that reference the existing overnight index swaps (OIS) rate, as well as the OIS basis instrument, can now be used for traditional OIS curve construction (figure 1). On the other hand, if Libor-based instruments are administered, the traditional Libor curve construction can be applied. Direct use of the OIS instruments or OIS basis instruments alongside the Libor instruments can construct a Libor curve and an OIS curve via global solving. If instruments referencing Libor start to include robust fallbacks, this provides the opportunity to use such instruments, as well as these fallbacks, to construct an ARR curve. A new instrument directly referencing the ARR can be used to construct an ARR curve.

Not everything is changing with the potential move away from Libor, though. There is no clear decision so far on the continuation of interbank offered rates (Ibors) not covered by FCA regulation but, if market participants need to reference current Ibors for curve construction, it should be done as needed.

Also, curve adjustment features such as ‘central banks meeting schedules’ and ‘turn effects’ should still be valued and the curve framework used should support them. Cross-currency basis curves do not go away even if Libor is eventually phased out. Lastly, new curve frameworks should be flexible, so if a new instrument becomes very liquid, it can be implemented quickly.

New rates under way

The establishment of new ARRs has been confirmed. In the US, the Federal Reserve and the US Department of the Treasury introduced the secured overnight financing rate (SOFR) earlier this year as a replacement to US dollar Libor. Since then, SOFR has built significant momentum with, for example, CME SOFR Futures reaching $711 billion in cumulative notional volume based on 278,000 contracts – as of August 27, 2018 – which is representative of the large liquid market that exists in futures.

In the UK, the Bank of England has chosen Sonia as its alternative to Libor. Sonia futures were launched by ICE and CurveGlobal earlier this year. Sonia futures were also launched by CME on October 1, 2018. Of particular note is an already well‑established volume in Sonia swaps.

Most recently, the euro short-term rate has been identified as the ARR for the eurozone while, in December 2016, the Bank of Japan selected the Tokyo overnight average rate. In October 2017, the Swiss National Bank, in co-operation with SIX Swiss Exchange, determined that the Swiss average rate overnight would be the alternative to CHF Libor.

However, despite these noteworthy developments, much work still needs to be done to effect a successful transition away from Libor. The way forward is not yet entirely clear, but I expect that industry groups, regulators and market participants alike will work hard to develop solutions to avoid triggering any significant market disruption.

Read more articles from the 2018 Beyond Libor special report

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net