Swaps data: volumes up amid volatility

Data shows strong growth in cleared OTC derivative volumes in second half of 2018, says Amir Khwaja

As 2018 comes to an end, with Brexit dominating the news, trade tensions escalating and the Federal Reserve maintaining its rate-hike path, it is a good time to take stock of global swap volumes.

Instead of hiding from the uncertainty, swap users appear to have instead dived right in. Volumes are up across the board, with third-quarter numbers increasing in 2018 compared with the same period in 2017, and the October-November period following suit.

US dollar credit default swaps and euro interest rate swaps in particular have had a strong end to the year. The latter saw a 176% increase in volumes at Eurex and 63% at LCH in October-November 2018 versus 2017.

The only exception has been yen interest rate swaps, where volumes were down in the third quarter in 2018 versus 2017, but up in October-November 2018 versus the previous year.

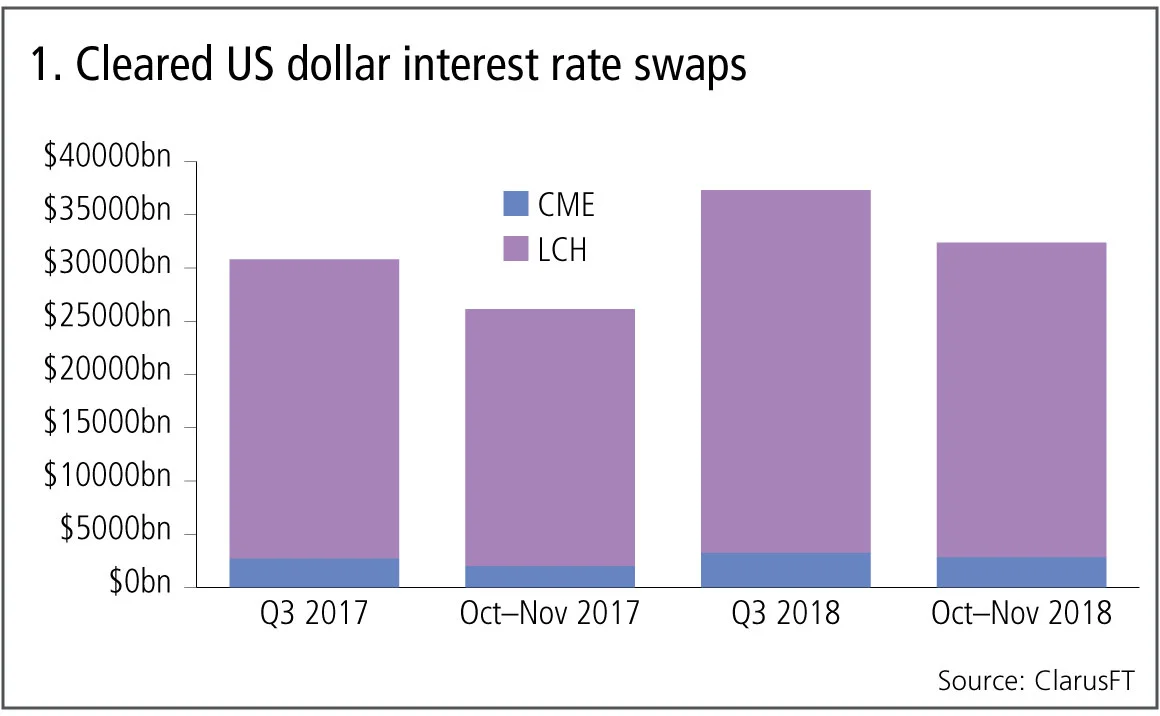

Cleared US dollar swaps

Let’s start with the largest product: cleared US dollar interest rate swaps. We include all clearable types – vanilla fixed vs float, overnight index, basis, zero coupon and variable notional.

Figure 1 shows:

- Volumes are significantly higher in 2018.

- Overall volumes of $37 trillion in Q3 18 and $32 trillion in Oct–Nov 2018.

- LCH SwapClear with 91% share and CME with 9%.

- LCH SwapClear up 22% in each of these periods.

- CME over-the-counter up 20% in Q3 18 and up 40% in Oct–Nov 2018.

Both clearing houses saw significant growth in volumes in 2018 over the corresponding periods in 2017 and the US dollar swap market is in healthy shape.

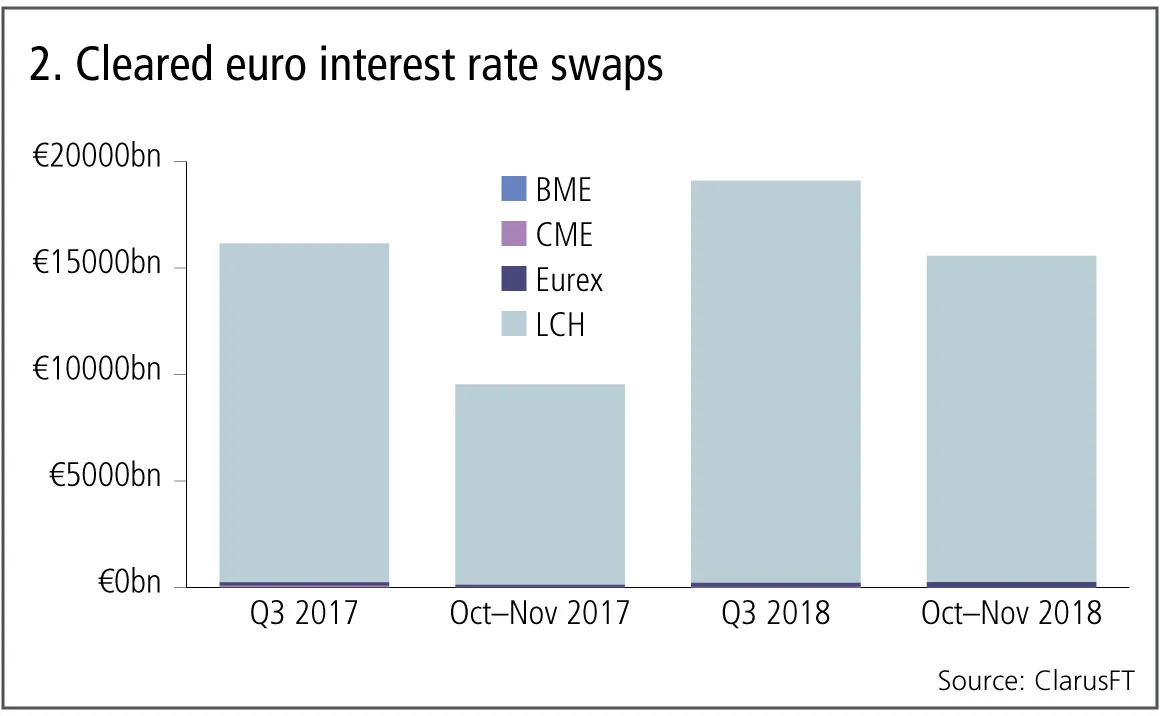

Cleared euro swaps

Next, the second-largest product: cleared euro interest rate swaps, including all clearable types.

Figure 2 shows:

- Volumes also significantly higher in 2018.

- €19 trillion in Q3 18 and $15.6 trillion in Oct–Nov 2018.

- LCH SwapClear with 98.4% share in the most recent period.

- LCH SwapClear up 19% in Q3 18 and a massive 63% in Oct–Nov 2018, driven by 110% growth in OIS volumes and 39% in IRS.

- Eurex with 1.6% share in the Oct–Nov 2018.

- Eurex up 22% in Q3 18 and a massive 173% in Oct–Nov 2018.

- CME OTC down 75%.

- BME with no volume in the recent past.

LCH SwapClear continuing its dominance in euro swap volumes, with signs of Eurex growing fast from a much smaller base.

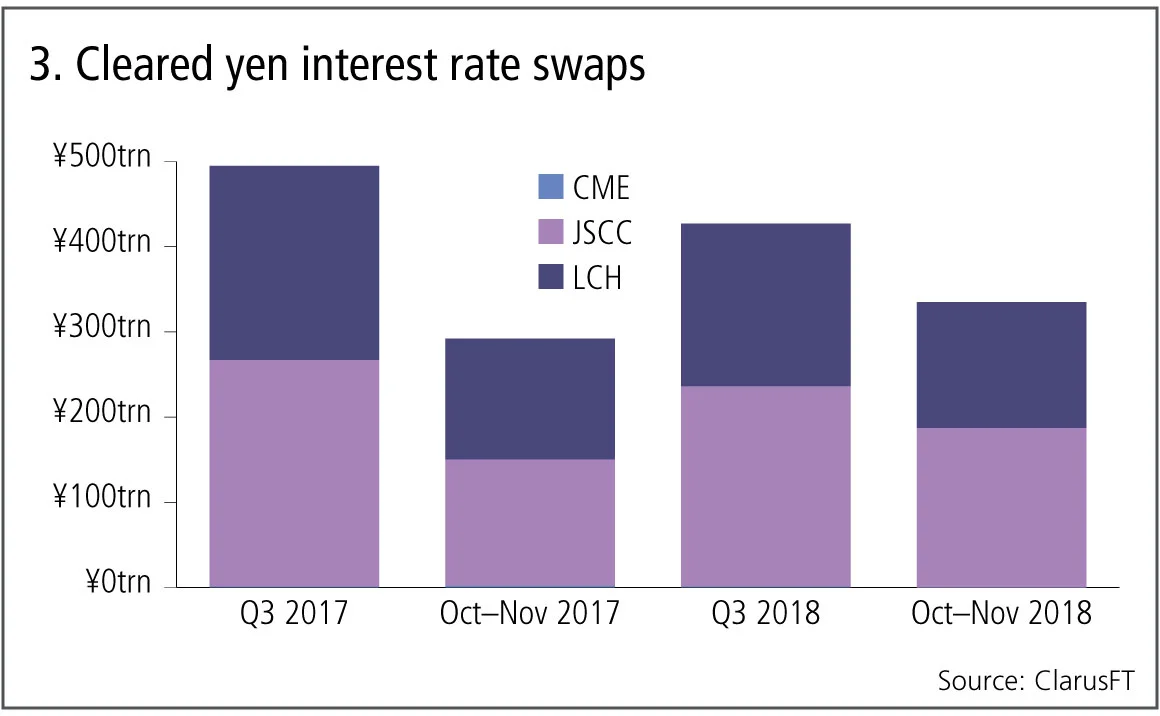

Cleared yen swaps

Figure 3 shows:

- Volumes for yen were down in Q3 18 but up for Oct–Nov 2018.

- 427 trillion yen in Q3 18 and 336 trillion yen in Oct–Nov 2018.

- JSCC with 56% share and LCH SwapClear with 44%.

- JSCC down 12% in Q3 18 and up 27% in Oct–Nov 2018.

- LCH down 16% in Q3 18 and up 4% in Oct–Nov 2018.

After three consecutive down quarters in 2018, finally the fourth quarter looks to be breaking the trend and showing growth and JSCC maintaining its lead over LCH.

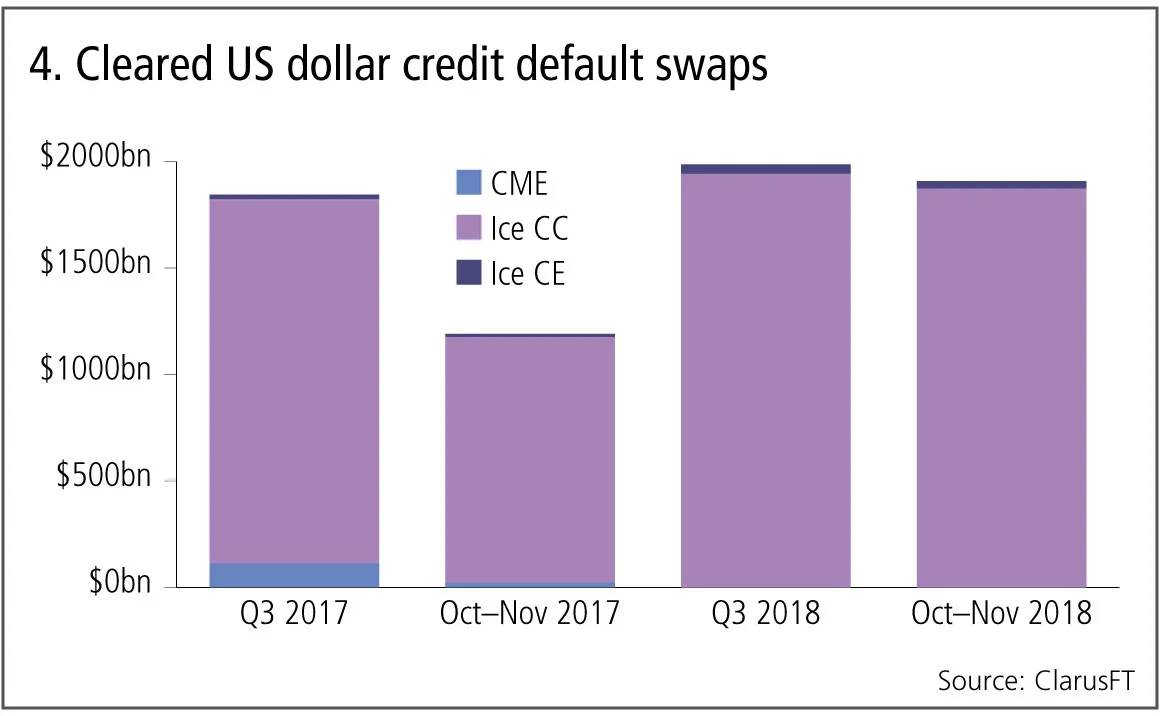

Cleared US dollar credit default swaps

Let’s now switch focus to credit derivatives and the volume of credit indexes and single names in US dollars.

Figure 4 shows:

- Volumes significantly higher in 2018.

- $2 trillion in Q3 18 and $1.9 trillion in Oct–Nov 2018.

- Ice Clear Credit dominates with a 98% share.

- Ice Clear Credit up 14% in Q3 18 and 62% in Oct–Nov 2018.

- Ice Clear Europe also up due to new CDX volume.

- CME shutting down its service.

- LCH CDS with less than $1 billion in each period.

Cleared credit derivatives volumes in US dollars is showing good growth rates, specifically in indexes as opposed to single names.

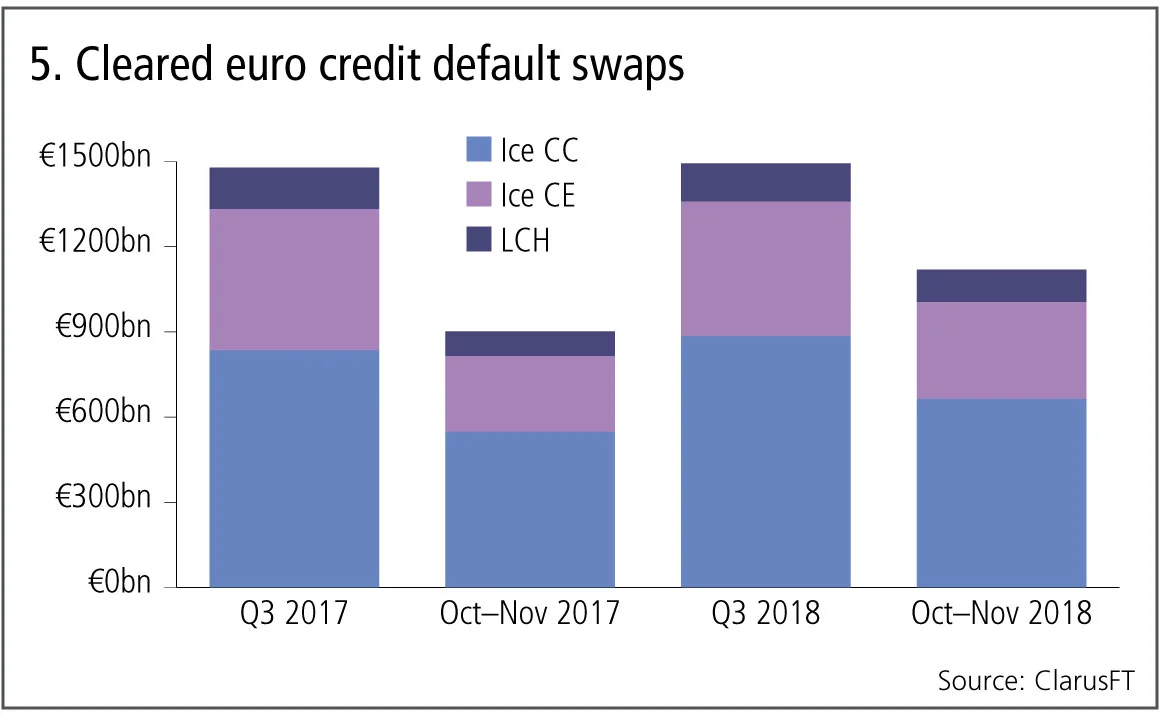

Cleared euro credit default swaps

Next the volume of credit indexes and single names in euros.

Figure 5 shows:

- Volumes higher in 2018.

- €1.5 trillion in Q3 18 and €1.1 trillion in Oct–Nov 2018.

- Ice Clear Credit with 59% share, Ice Clear Europe 31% and LCH CDSClear with 10%, similar to earlier quarters in 2018.

- Ice Clear Credit up 21% in Oct–Nov 2018.

- Ice Clear Europe up 28% in Oct–Nov 2018.

- LCH CDSClear up 32% in Oct–Nov 2018.

Cleared credit derivatives volumes in euros are also showing good growth rates.

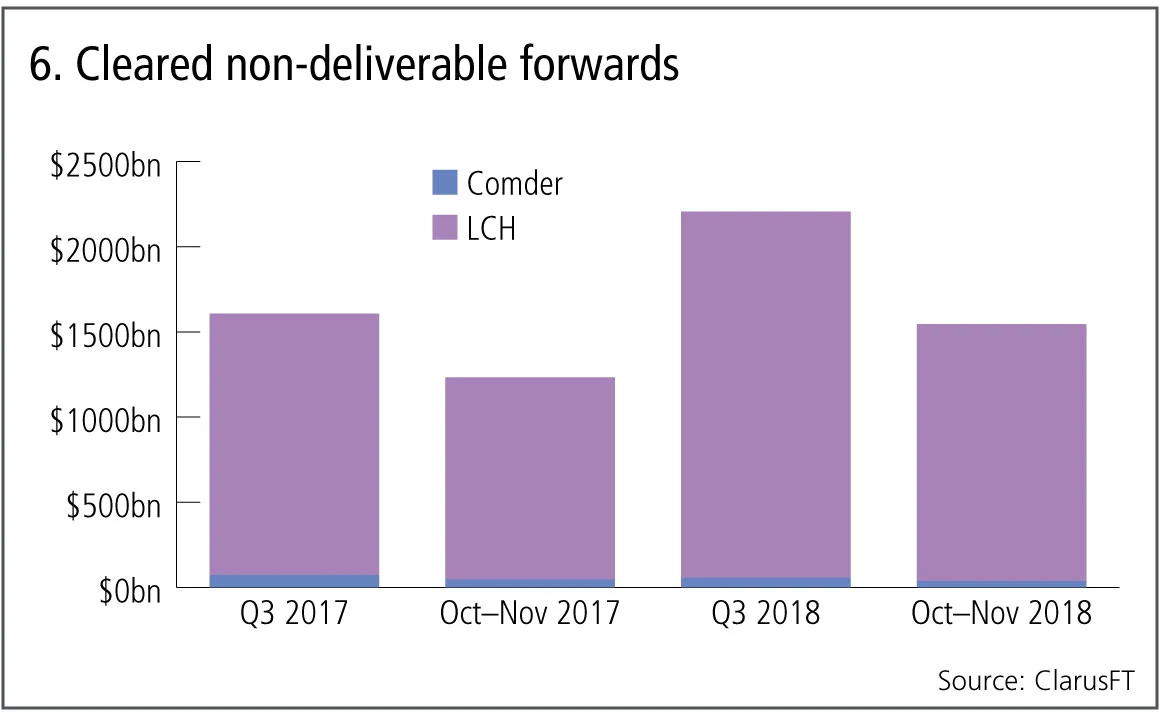

Cleared non-deliverable forwards

Finally cleared non-deliverable forwards.

Figure 6 shows:

- Volumes massively higher in 2018.

- $2.2 trillion in Q3 18 and $1.5 trillion in Oct–Nov 2018.

- LCH ForexClear dominant with 98% share.

- LCH ForexClear up 40% in Q3 18 and 27% in Oct–Nov 2018.

- Comder down 18% in Oct–Nov 2018.

Cleared non-deliverable forwards volumes continue a long running trend of high growth rates.

All the other major cleared OTC derivatives markets that we have looked at have higher volumes in the most recent two months than the corresponding period in 2017, in most cases significantly higher.

2018 has been a year of increased price volatility and this is certainly one factor in the higher volumes that we have seen.

It will be interesting to see if next year maintains the growth trend, it certainly appears that political uncertainty and price volatility show no signs of ebbing away.

Amir Khwaja is chief executive of Clarus Financial Technology.

Editing by Lukas Becker

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Comment

Falling T2 balances bode well for eurozone’s stability

Impact of fragmentation would be less severe today than in 2010s, says Marcello Minenna

Op risk data: Tech glitch gives customers unlimited funds

Also: Payback for slow Paycheck Protection payouts; SEC hits out at AI washing. Data by ORX News

Op risk data: Lloyds lurches over £450m motor finance speed bump

Also: JPM trips up on trade surveillance; Reg Best Interest starts to bite. Data by ORX News

Georgios Skoufis on RFRs, convexity adjustments and Sabr

Bloomberg quant discusses his new approach for calculating convexity adjustments for RFR swaps

In a world of uncleared margin rules, Isda Simm adapts and evolves

A look back at progress and challenges one year on from UMR and Phase 6 implementation

Op risk data: Morgan Stanley clocked in block trading shock

Also: HSBC deposit guarantee gaffe; Caixa hack cracked; reg fine insult to cyber crime injury. Data by ORX News

Digging deeper into deep hedging

Dynamic techniques and GenAI simulated data can push the limits of deep hedging even further, as derivatives guru John Hull and colleagues explain

How AI can give banks an edge in bond trading

Machine learning expert Terry Benzschawel explains that bots are available to help dealers manage inventory and model markets

Most read

- Industry urges focus on initial margin instead of intraday VM

- For a growing number of banks, synthetics are the real deal

- Did Fed’s stress capital buffer blunt CCAR?