Regulatory concerns mount as Dutch insurers maintain guarantees

Dutch insurers have strongly resisted pressure to drop guarantee levels despite plunging interest rates and mounting regulatory concerns. With surplus capital quickly being eaten up to support these uneconomic guarantees, how long can the Dutch market go before the casualties start to mount? Hugo Coelho reports

Click here to view the full article.

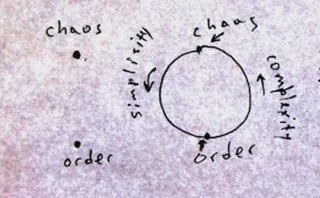

The low interest rate environment has been fuelling a revolution in the business model of life insurers. Falling yields on sovereign bonds have pulled down the level of interest rate guarantees to close to zero and policyholders are being pushed in the direction of a new generation of unit-linked products that follow the market’s ups and downs. This is especially true for insurers in Northern European countries that have a long tradition of high guaranteed

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Asset liability management

ALM technology systems 2023: market update and vendor landscape

Chartis' 2023 ALM research report returns to the key themes highlighted in the 2021 report. This update re-evaluates the complex ALM framework, which broadly comprises distinct segments that include funds transfer pricing, liquidity risk management and…

Incorporating climate risk into ALM frameworks at banks

In this webinar convened by Risk.net in collaboration with SS&C Algorithmics, experts discuss the challenges and benefits of incorporating climate risk into asset-liability management frameworks at banks

ERM reboot: how leading insurers are turning risk decisioning into strategic advantage

An expert discussion exploring how leading insurers are adapting ERM systems in support of a wider range of opportunities, helping to avoid losses, navigate unstable markets and maintain a strong reputation

Incorporating climate risk into ALM frameworks for banks

Banks are coming under increasing regulatory pressure to incorporate climate risk into their risk management frameworks. An emerging focus is incorporating climate risk into the asset-liability management (ALM) function. This webinar explores this new…

ALM and liquidity risk reporting greatly enhanced by big data applications

Sponsored video: Luis Mataias, IBM Watson Financial Services

Leading the way in the risk management (r)evolution

Sponsored feature: Prometeia

Insurers must perform balancing act

Winners' Circle: RBS

Stress testing in non-normal markets via entropy pooling

Ardia and Meucci introduce a parametric entropy pooling approach to portfolios stress testing

Most read

- Too soon to say good riddance to banks’ public enemy number one

- New FICC clearing model still holds fears for buy side

- OCC introduces new intraday risk charge covering zero-day options