This article was paid for by a contributing third party.More Information.

Counterparty credit risk – Why data is only valuable in context

Paul Whitmore, global head of counterparty risk solutions at Fitch Solutions, explains how qualitative data can add colour and insight to quantitative metrics for assessing the creditworthiness of counterparty banks

Banks can access data from a growing wealth of sources, but it is important to place that data in context when assessing the creditworthiness of counterparty banks. Current methods focus on quantitative metrics, but qualitative information is key to shedding light on organisational nuances. However, it is more difficult to identify and assess this type of information in a consistent and robust way.

What credit analysis methods do organisations typically use – and are they adequate?

A rating system used in some form or another by the majority of credit analysts is Camels, which comprises analysis of capital adequacy, asset quality, management quality, earnings, liquidity and sensitivity to market conditions. However, very little qualitative input – other than management quality – is considered under this approach, which prevents analysts from gaining a complete picture of an organisation. For example, a large bank could present positively in terms of quantitative metrics, but as balance sheets are backward-looking, some issues might only be detected through qualitative analysis.

Is there enough emphasis placed on qualitative data by credit analysts in general? Probably not, but sometimes this information is incredibly difficult to understand and interpret with regard to credit risk – as is understanding the influence it may have on the underlying credit risk of the institution being assessed.

Why is it important to incorporate more qualitative data – particularly in relation to assessing banks’ credit risk?

Quantitative models work very well for high-default asset classes where default data is plentiful, and this is an approach banks have been using for a long time. However, low-default markets such as the banking sector typically have much less default data available to prove out robust quantitative models.

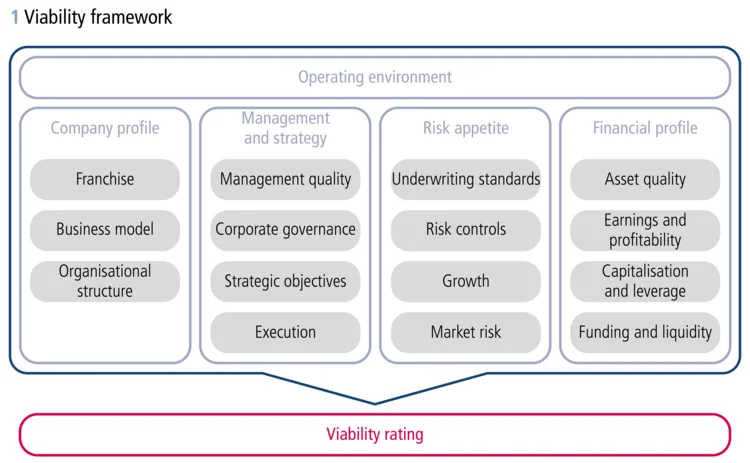

You only have to look at the methodologies of rating agencies to see how much detail qualitative data can add to the credit rating assessment process. With Fitch Ratings, for example, the financial risk profile of the bank is just one of four pillars – or ‘risk dimensions’ – considered by the analysts. Within each of the ‘heads of analysis’, subcomponents are considered and scored by the ratings analyst, and all of these elements contribute to the overall viability rating.

Are banks finding it difficult to incorporate qualitative data into the credit risk analysis process at the moment?

Yes, they are. They understand the qualitative factors that should be considered, but the difficulty often lies in recognising the influence this has on overall creditworthiness. You can only truly determine this if a consistent approach or methodology has been used for a period of time, so long-term observations can be recorded. With rating agency methodologies, clear guidance and explanatory notes are published with regard to both the quantitative and qualitative aspects of their analysis.

This is one of the reasons banks choose to align themselves with the methodologies used by rating agencies – they provide consistent, established approaches based on historical observations.

Why should a bank consider adjusting the emphasis placed on qualitative versus quantitative factors in the credit risk analysis process now?

There has always been an emphasis on due diligence, and this really goes above and beyond quantitative models. However, with the final reforms of Basel III coming into effect from January 1, 2022 – with particular emphasis on the treatment of unrated banks when it comes to to risk-weighted capital – banks’ due diligence of their counterparties is going to be firmly in the spotlight.

Streamline credit risk analysis of your bank portfolio

With Fitch Solutions Bank Scorecard, an expert judgement scoring and analysis tool, you can leverage Fitch data on more than 36,000 banks and the Fitch Ratings Bank Rating framework to easily generate consistent standalone credit scores. Find out more

Sponsored content

More from sponsor

Fitch Solutions Pulse Survey – The economic impact of Covid-19

The global health crisis precipitated by the Covid‑19 pandemic has dealt a sharp, swift blow to the global economy. As companies emerge from the initial shock, Fitch Solutions surveyed its global client base to understand how business leaders view the…

Credit risk – Building on a foundation of quality data

Credit risk analysts at emerging market banks not only need high-quality data, but also the necessary tools to manage it. Improving consistency and reducing the risk of errors in credit risk data create more time to concentrate on the core activity of…

Credit risk – The bank data challenge in frontier markets

As the regulatory net tightens, banks working in and across frontier regions are under pressure to source and maintain more accurate data in the assessment of counterparty credit risk, but some are investing in tools to tackle the problem

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net