This article was paid for by a contributing third party.More Information.

Turning challenges into solutions

With margin requirements a potential drain on financial resources, delivering healthy returns while meeting regulatory obligations is paramount. To help participants optimise more of their risk, Varqa Abyaneh, chief product officer, Quantile, discusses the uncleared margin rules (UMR) and central clearing, how they impact the margin landscape and how participants can leverage multilateral optimisation to reduce their margin costs

Designed to improve the safety and stability of markets, regulation inevitably increases the cost of trading. Participants are still expected to deliver healthy returns while keeping pace with the evolving regulatory obligations – and, to thrive, must carefully manage their resources.

Ensuring banks meet their minimal capital requirements is no longer the only focus, and the trend of transforming regulatory capital into funding requirements looks set to stay.

The funding challenge

One of the main resource-consuming issues is the cost of funding the margin requirements globally. Without careful management, the requirements can consume critical financial resources and have an adverse effect on the returns of the derivatives book, as well as the pricing and liquidity of the underlying derivatives trades if left unchecked.

From UMR to the greater use of central clearing, Quantile investigates the trends and requirements, their impact on the margin landscape, and provides solutions as to how participants can proactively optimise their portfolios to avoid higher costs and minimise the funding drag.

The requirements and current state of play

Since 2016, participants trading non-centrally cleared derivatives including foreign exchange options, non-deliverable forwards, swaptions and hedging trades have been subject to new margin requirements.

Initial margin (IM) is one of two types of collateral required to protect participants in the event a counterparty defaults. The other type – variation margin (VM) –

is paid daily from one side of the trade portfolio to the other, to reflect the current market value of all trades in the portfolio. IM, however, is held to cover the losses that could arise in the period between the defaulter’s last VM payment and the point at which the surviving party is able to hedge or replace the trade.

For cleared trades, IM is normally calculated using an expected shortfall method that aims to protect the central counterparty (CCP) beyond the 99.7% quantile. This calculation usually involves deriving a daily time series of historic market data shocks, typically over the previous 10 years.

For bilateral trades, the margin calculation – the standard initial margin model (Simm) – is a simpler analytic function that involves the calculation of counterparty risk using predefined parameters. This methodology, because of its simplicity and standardisation, enables easier adoption and implementation of the UMR across all counterparties.

From big to bigger

The phased approach of UMR has seen the largest market participants already go live with their IM requirements, and the industry is now moving towards phases five and six, which will increase the number of counterparties involved and the amount of collateral posted. From September 2022, it is estimated upwards of an additional 1,000 entities will be subject to UMR for IM.1

There have been material increases in the amount of regulatory IM held, purely driven by new trading activity. For example, 2020 saw a 23% increase in the amount of IM collected by the 20 largest market participants globally, despite no new counterparties coming in-scope. The key driver of this increase was new trading activity around the time the US Federal Reserve Board announced its emergency rate cuts in response to the economic threat associated with the Covid-19 pandemic.

These types of increases, coupled with the new in-scope counterparties, are set to turn funding IM into an even bigger challenge.

The wider margin landscape

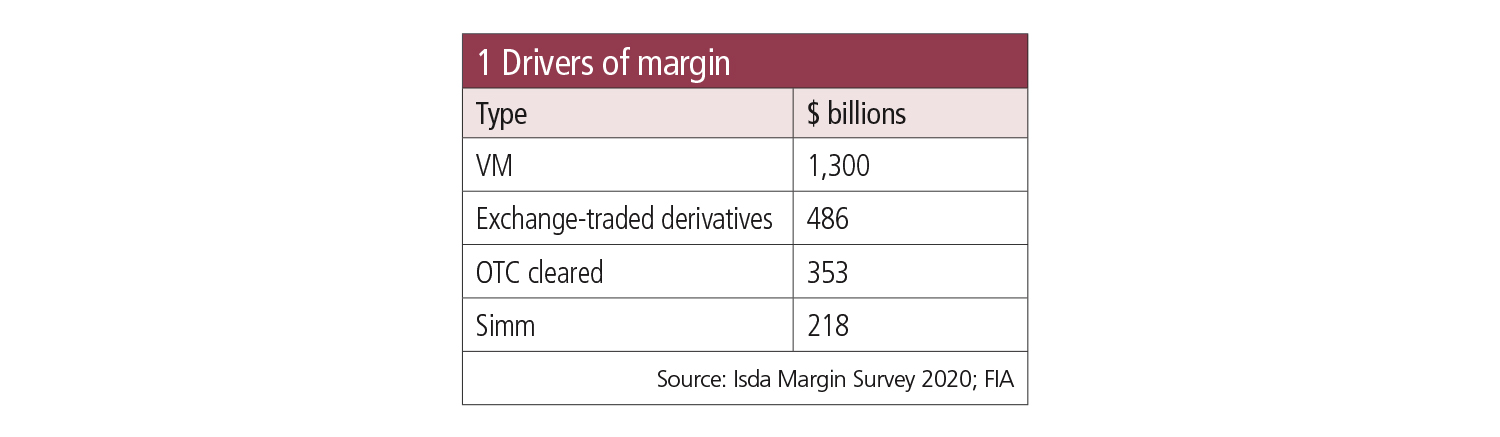

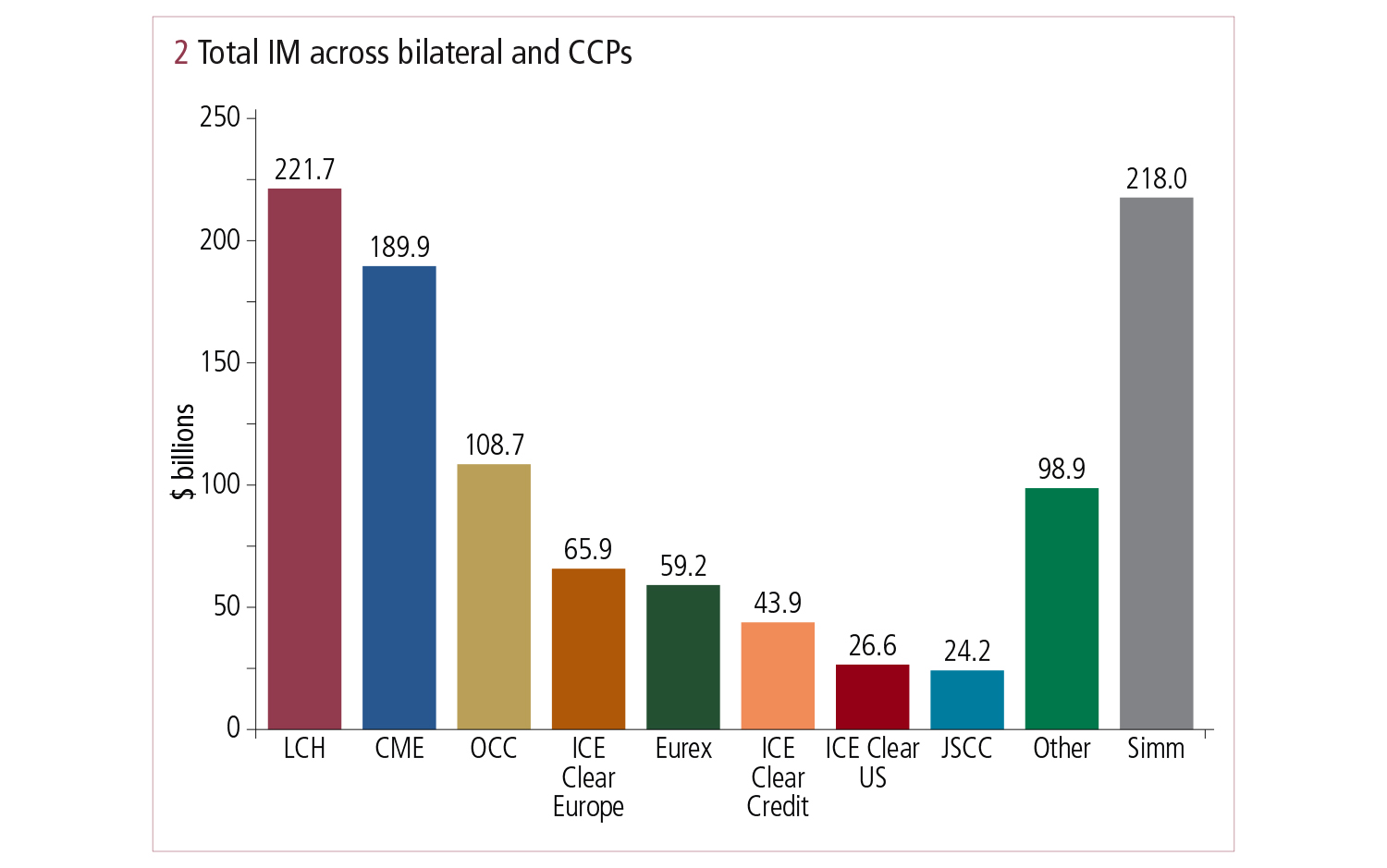

The margin landscape is vast, and the regulatory measures impacting uncleared derivatives account for roughly $200 billion of the total margin out there – which is close to $1 trillion. Outside of this, participants must post margin for exchange-traded and cleared over-the-counter (OTC) derivatives positions (see figures 1 and 2).

The clearing mandate of 2011 has had a major impact on the margin landscape and driven the numbers to new heights – as seen by LCH SwapClear driving the majority of cleared OTC volumes ($220 billion of $416 billion). Of the $839 billion of total cleared margin, approximately 50% is now driven by cleared OTC derivatives and around 50% by exchange-traded futures (see figure 1). The listed margin is driven by CME Group ($152 billion) and Eurex ($36 billion).

It is clear regulatory IM is a big industry challenge that continues to grow since the introduction of UMR. However, compared with the wider margin landscape, it is part of a much bigger picture.

Flexibility versus fragmentation

Participants have the ability to enter into and hedge risk positions in multiple ways. For example, a dealer wishing to hedge interest rate PV01 can do so by trading cleared interest rate swaps, interest rate futures or uncleared products, such as swaptions, where appropriate.

This choice allows for more competitive – and hence tighter – pricing, which is a good thing for the market. However, it also results in the fragmentation of liquidity pools, which increases margin costs. A firm that has zero net risk spread across multiple liquidity pools (bilateral, cleared OTC and exchange traded), will still have to post margin for the risk taken in each liquidity pool. If the risk is bilateral, the firm must post margin based on the bilateral risk against each counterparty due to UMR; if the risk is cleared, then margin must be posted for the risk taken against each CCP independently.

Finding new efficiencies through clearing

The use of central clearing has enabled participants to hold risk more efficiently. Trades executed with multiple counterparties can be cleared to a CCP where the exposures are netted down. This netting, especially against a highly rated/low risk-weight counterparty, means a CCP is an ideal place for banks to net down risk and reduce costs so they can use their capital more efficiently.

However, the increasing use of central clearing in itself is not enough to tackle the margin funding challenge. Not all products can be cleared and not all firms are able to clear at the same CCPs – so it is unlikely a firm will be able to entirely net down its bilateral risk to zero. That said, there is always an optimal solution from a risk and margin perspective for how bilateral risk should be moved to the CCP that adheres to the necessary constraints.

Reducing risk through multilateral optimisation

Despite the fragmentation across multiple liquidity pools, UMR have created an opportunity, and an incentive, to innovate new ways to systematically reduce risk and margin costs for both cleared and uncleared portfolios. As participants trade with multiple parties in multiple locations, the key is to approach the issue multilaterally. Multilateral portfolio optimisation creates more opportunities to net down risk in a highly automated and scalable manner, enabling firms – and their counterparties – to benefit from superior risk reduction.

Quantile pioneered multilateral margin optimisation by launching a service in 2017 that reduces counterparty risk and the costs associated with funding IM. Quantile’s mission was simple – to help the market tackle the margin challenge as a combined force. Recognising that participants trade across a vast network, Quantile brings that network together to drive new levels of efficiency.

Trade together, optimise together

Quantile’s IM optimisation service works by analysing the risk configuration of the entire participating network and proposing a set of new market risk-neutral trades that deliver margin cost reductions without changing net risk positions. The resulting optimisation proposal is validated and accepted by participants, and the execution of new trades is fully automated via electronic trade capture and confirmation platforms, such as MarkitWire and Refinitiv Trade Notification.

The service allows for risk to be moved across different liquidity pools (cleared and OTC), and offers the freedom for participants to constrain the optimisation to suit their requirements. With an extensive network, including all of the G15 banks, the service operates across FX, interest rate and equity asset classes to deliver a material reduction in participants’ IM funding costs – often in excess of 50%.

Just getting started

Quantile is determined to make a long-term impact in the derivatives market and help participants optimise more of their risk, irrespective of where they choose to execute or clear.

There is immense capacity to help market participants manage the challenges arising from new regulations through multilateral optimisation services, and Quantile will continue to work closely with market participants to develop the material infrastructure required to navigate these challenges and help the industry reach a healthy, steady state.

Further information

To learn more or to join Quantile’s next run, visit quantile.com or contact info@quantile.com.

Initial margin – Special report 2021

Read more

Notes

1. Isda’s data estimates that, between them, phases five and six will cover 1,090 entities: 315 in phase five and 775 in phase six.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net