This article was paid for by a contributing third party.More Information.

Adoption of SOFR and SONIA as Floating Rate Note Benchmarks

2017’s announcement by the UK Financial Conduct Authority that it would no longer require global banks to submit interbank offered rates set off a race to adopt USD and GBP money market alternatives.

- In the US, the Alternative Reference Rates Committee (ARRC) chose the Secured Overnight Financing Rate (SOFR), a repo-based rate administered by the New York Federal Reserve.

- In the UK, the Working Group on Sterling Risk-Free Reference Rates selected the reformed Sterling Overnight Interbank Average (SONIA), administered by the Bank of England.

Both are based on bona fide market transactions, promising more resilience than survey-based benchmarks. Through the latter half of 2018 and early 2019, each has seen adoption in the floating rate note (FRN) market, with support from major institutional borrowers.

SOFR Note Issuance

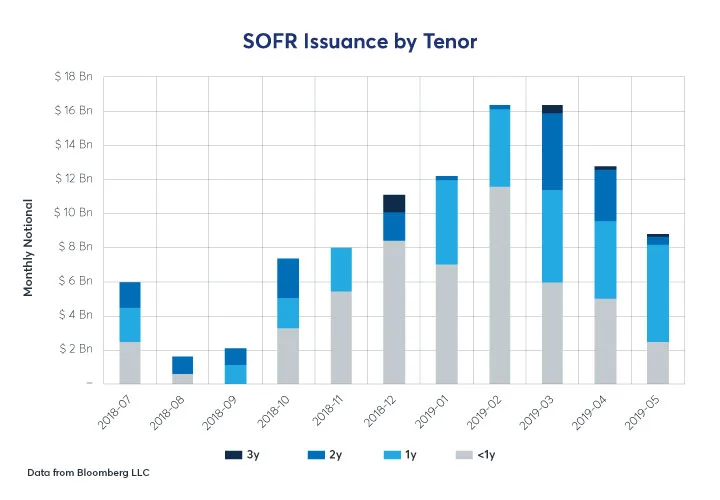

In the eight months since Fannie Mae issued the first SOFR FRNs, issuance has topped $100 billion (bln) face value. Twenty-two institutions have participated, half with multiple issues, for a total of 99 outstanding FRNs at the start of May 2019.

Term to maturity at origination is still on the short-dated side, averaging just over 1 year, with 80% of issues less than 18 months, but there are 19 FRN issues in the 2-3 year range. Increased activity in the deferred months of CME SOFR futures and, in the longer term, in SOFR-reference swaps is expected to facilitate longer-dated issuances.

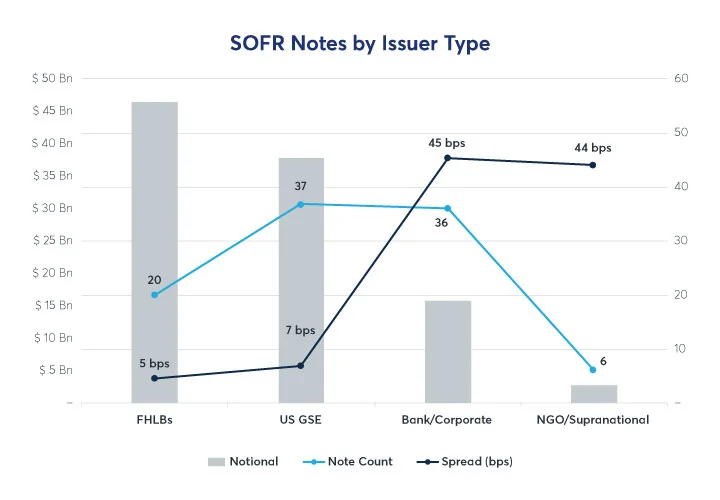

Government sponsored enterprises have led with half of issues, and 80% of outstanding principal:

- The combined Federal Home Loan Banks lead with 20 issues totalling $46 bln

- Fannie Mae and Freddie Mac follow with 29 issues for $35 bln

- Major commercial banks have issued 36 FRNs for $16 bln

- Supranational agencies such as the World Bank account for 6 issues totalling $4 bln

Non-government entities typically pay a spread over SOFR of 30-60 bps. Buy-side participation was initially dominated by money market funds, but has expanded to include fund managers, banks, insurance companies, and state and local governments.

SONIA Note Issuance

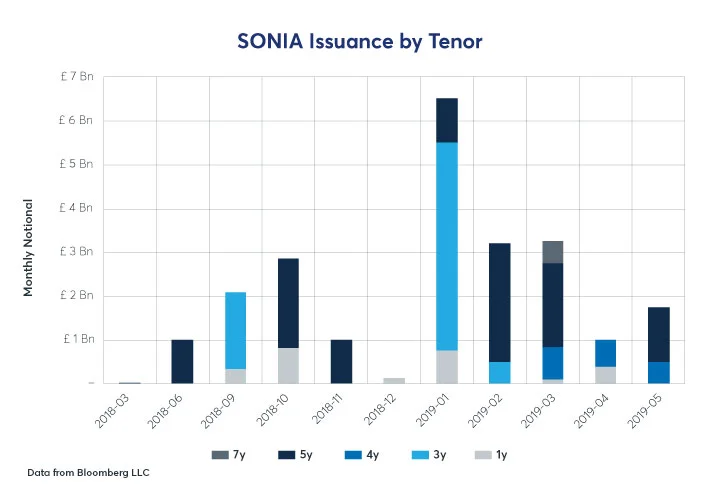

Although SONIA has been an established benchmark since 1997, it saw no FRN-related use (beyond a 2010 exploratory issuance by the European Investment Bank) until March 2018. After modest initial volumes, SONIA-linked FRN issuance ended 2018 quietly, before renewed interest in 2019 pushed it to £23 bln total principal.

Terms to maturity extend further in SONIA FRNs than for SOFR, with 80% of aggregate face value concentrated at 3-years (31%) and 5-years (48%), and with EIB notes reaching out to the 7-year point, perhaps due to established activity in the SOFR-OIS market.

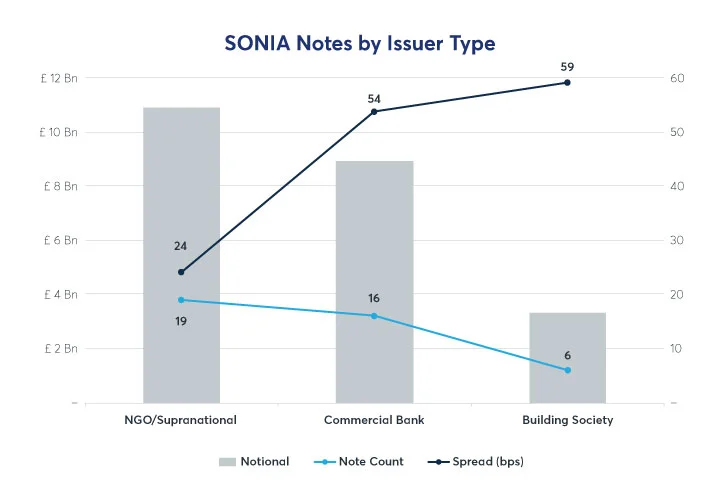

The distribution of both issues and principal value is relatively balanced among issuer types:

- Supranational agencies (like the EIB) lead with 19 FRN issues totalling £11 bln

- Commercial banks follow closely with 16 issues totalling £9 bln

- Building societies account for 6 note issues totalling just over £3 bln

- The latter two pay about double the spread (50-60bps) over SONIA vs. public entities (24bps)

[1] Andrew Bailey, Chief Executive of the FCA. The Future of LIBOR, July 2017.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net