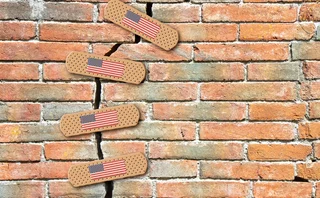

Philippines central bank to implement Basel III liquidity rules

Central bank governor says local banks ready for the new rules

Banks in the Philippines should be able to cope with the liquidity coverage ratio (LCR) that the central bank will shortly introduce, but this may depend on what constitutes a high-quality liquid asset, says the governor of the country's central bank Amando Tetangco.

The Central Bank of the Philippines (BSP) has taken a tough line implementing Basel III: it required full compliance with the capital rules by 2014 and recently announced a 5% leverage ratio for its banks – one of the highest

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Regulation

UK investment firms feeling the heat on prudential rules

Signs firms are falling behind FCA’s expectations on wind-down and liquidity risk management

The American way: a stress-test substitute for Basel’s IRRBB?

Bankers divided over new CCAR scenario designed to bridge supervisory gap exposed by SVB failure

Industry warns CFTC against rushing to regulate AI for trading

Vote on workplan pulled amid calls to avoid duplicating rules from other regulatory agencies

Bank of Communications moves early to meet TLAC requirements

China Construction Bank becomes sole remaining China G-Sib not to have released TLAC plans

Industry pushes to extend review for Emir active accounts rule

Fears that compressed timeframe leaves less than a year to test if controversial policy is working

Banks will not be frowned upon for discount window borrowing – Fed official

Risk Live: more banks have completed paperwork to access Fed lending facility than a year ago

Capital One puts OCC’s tough stance on mergers to the test

Proposed Discover deal should be approved but will go under the microscope, ex-regulators say

As FCMs dwindle, regulators fear systemic risk

Panellists highlight dangers of clearing membership becoming more concentrated

Most read

- Top 10 operational risks for 2024

- The American way: a stress-test substitute for Basel’s IRRBB?

- Filling gaps in market data with optimal transport