Insolvency: A survival guide

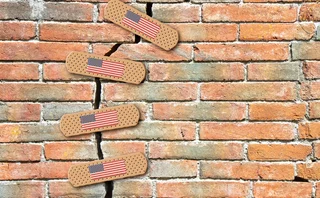

What’s the difference between administration and receivership? Do you know your German restructurings from your Italian fallimento? Oliver Holtaway guides you through this regulatory minefield with a look at how Europe’s insolvency regimes are evolving

In the days following the collapse of the Parmalat empire last November, Italian legislators rushed new bankruptcy laws through the Italian parliament. The food giant was clearly headed for insolvency, and while at that point 95% of insolvent Italian firms tended to end up in liquidation, Italian politicians were adamant that Parmalat would not. In order to save jobs (and therefore, they hoped, votes), legislators contrived a way to keep the company alive.

The entire incident was a wake-up call to both European and international investors: a reminder that European bankruptcy laws vary substantially from country to country, and often result in liquidation with low recovery rates. Many US credit investors, stung by the Parmalat scandal, quickly began to brush up on their European insolvency law.

“It is remarkable how little investors have looked into the variations between the insolvency regimes of different countries,” says Peter Bloxham, insolvency lawyer at Freshfields.

But while the Italian emergency laws may have been hastily assembled in the midst of a crisis, they formed part of a growing trend in Europe. Investors, judges and politicians are starting to recognise that companies in financial difficulties should be rehabilitated rather than liquidated. Reforms are taking place across Europe, reflecting the increasingly common preference to repay debt from cashflow rather than through a fire sale of a company’s assets.

Going into rehab

European bankruptcy law, particularly in southern Europe, has historically stigmatised bankruptcy and encouraged the liquidation and removal from the market of insolvent companies. But as Ed Eyerman, senior credit analyst at Fitch Ratings, argues: “These days, companies tend to go bust not so much because they are fundamentally flawed companies, but because they perhaps made one ill-advised acquisition, or were subject to unforeseen events such as fraud.” Where the core operations of a company remain strong, Eyerman insists that the key to achieving the best results for creditors is successful rehabilitation.

This focus on company survival is enshrined in the US Chapter 11 bankruptcy procedure, which revolves around the ‘debtor-in-possession’ principle. Debtors are given the opportunity to manage their firms out of trouble, whilst being protected against the claims of creditors. In Europe, by contrast, creditors assume control of the company sooner, usually through a court-appointed administrator.

The arrival in Europe of US fund flows brought pressure for Chapter 11-style bankruptcy proceedings in Europe. While market participants warn against trying to understand recent changes in Europe solely through reference to Chapter 11, many elements of the US philosophy towards bankruptcy are being adopted.

In Europe, for example, there has always been a tendency to hand over insolvent companies to the courts; but insolvency practitioners are beginning to realise that this is not always the best way. There is a trend towards a lighter touch from the judiciary, who are more inclined to allow the incumbent management to carry on running the company.

French legislators are currently working on a draft reform bill to improve a bankruptcy system that already emphasises company survival: with 90% of insolvent French companies liquidated, the current system is clearly not effective enough.

Inspired by the Alstom crisis, the central plank of the reform is the introduction of the sauvgarde procedure, a pre-insolvency measure that allows companies to obtain protection for creditors’ claims before they become insolvent. The debtor remains in possession of the firm, although the courts will be able to appoint administrators to assist the management. The debtor will also now have access to new money while it is in this pre-insolvency procedure. Previously, distressed lending was illegal in France.

“It’s very important that new money lending in French restructurings will now be made possible,” says Barry Russell, insolvency lawyer at Bingham McCutchen. “This can make a significant difference in the prospects for a restructuring where a firm has the asset coverage to support it.” Rhodia is an example of a firm that suffered from this.

To aid distressed lending, the reforms propose to relax France’s strict lender liability regime. As in most European countries, lenders to French firms can be sued for both abusive support and abusive withdrawal – that is, pouring more money into a distressed company at preferential rates, or accelerating a repayment schedule. Clawback suits to recover fees from abusive support are common in France and Italy – many of Parmalat’s bank lenders are currently being sued on this basis (see Credit, September, p. 5). Lenders in a French pre-insolvency situation are understandably reluctant to lend more. Under the new reforms, existing lenders will be exempted from any abusive support litigation if they agree to lend the firm more money.

While overreliance on the courts may have been the chief flaw in southern European bankruptcy law, the insolvency systems of northern European countries such as the UK, Netherlands and Germany have traditionally given creditors – and particularly secured creditors – strong powers to enforce their claims, often at the expense of an insolvent firm’s survival. These countries have also taken steps to move towards a more rehabilitative approach to insolvency proceedings.

The UK’s Enterprise Act 2002, which took effect last year, attempts to improve the chances of successful rehabilitations by confronting an anachronistic flaw common to many insolvency regimes: the excessive powers of secured creditors.

Historically, secured creditors were the focus of bankruptcy proceedings. Insolvency laws assumed a concentrated group of creditors, primarily relationship banks. Those who drew up the procedures, many of which date from the late nineteenth century or earlier, did not anticipate multiple creditor classes or complex financial structures. As a consequence, unsecured creditors have frequently been sold short when companies default. As Eyerman says: “No one wants to be unsecured: even high-yield deals have guarantee provisions. In an out-of-court settlement, you generally need to have some security to get involved in negotiations.”

Eyerman argues that unsecured bondholders need a neutral, transparent, rehabilitative insolvency process. “When bondholders are asked to delay the maturity of the debt they hold, they don’t necessarily know that the company will be run in their interests as well as the banks. They need a neutral framework to protect their rights,” he says.

There has been reform in the UK and Germany to recognise the disintermediation of credit financing – and to help unsecured creditors. The French reformers are also attempting to toughen up their conciliation process. At present, out-of-court restructuring agreements in France are conducted on a contractual basis – that is, they require the approval of all creditors. In the Alstom case, however, efforts to reach agreement were persistently vetoed by one of the secured creditors: a bank. Under the new system, creditors will be able to make decisions through some form of majority voting, still to be finalised.

The course towards more modern insolvency practice is not always smooth. Previous attempts to move European regimes towards the Chapter 11 debtor-in-possession model have foundered on local idiosyncrasies. Germany’s 1999 insolvency law was hailed at the time as the German Chapter 11. But the strong stigma of bankruptcy has meant that new procedures are barely used. Nor should one see Chapter 11 as the Holy Grail of insolvency law. Chapter 11 proceedings can be very expensive; they are not therefore suited to some of the smaller European companies.

That said, most practitioners agree that Chapter 11 contains many welcome features. James Roome, insolvency lawyer at Bingham McCutchen, says: “The main features of Chapter 11 are commonly found in out-of-court restructurings in Europe.”

It is perhaps more instructive to look at the origins of Chapter 11 law and its precursors. Bankruptcy law in the West has almost invariably been developed piecemeal, in response to historical crises. The European Union set out over a decade ago to harmonise bankruptcy regimes. It gave up, realising that the differences between nations were too great, and rooted in fundamental social policy law. Step by step, insolvency law in Europe is adapting to the new reality of a disintermediated creditor community.

![]() France

France

The French insolvency system is structurally geared towards the survival of insolvent companies and the protection of jobs. The influence of the courts is particularly strong, and creditor rights particularly weak.

French insolvency law provides for action to be taken before the firm becomes insolvent. Pre-insolvency action begins with an alert mechanism (droit d’alerte). This can be triggered by a variety of players, including shareholders, workers’ groups, auditors or the courts themselves – but not creditors.

Creditors’ best hope is to keep pre-insolvency negotiations out of court. Restructuring agreements can be made on a private basis, although the terms of these agreements can be later overturned in court. Alternatively, the company can apply for amicable proceedings (reglements amiables). If the application is accepted, a court-appointed conciliator works with creditors and the company to find a restructuring solution. This process can last no longer than four months, during which time the conciliator can freeze all legal action by the creditors and prevent the debtor from making payments. Any agreement that is reached must be approved in court, but only binds those creditors who have accepted it.

If pre-insolvency measures are not taken, or fail to produce an agreement, the formal insolvency process begins. The company is usually the applicant, although creditors or the courts may initiate the process. If the company meets a basic insolvency test, it must apply to a commercial court for an insolvency order within 15 days.

At this point, the court can either immediately liquidate the company, or appoint an administrator to look into the company’s affairs and assess the chances that a restructuring or partial asset sale will work. During this period, which can last up to 20 months, the management stays in control of the company’s everyday administration, but needs consent from the administrator for any asset sales or repayment to creditors. Creditor enforcement action is blocked.

After this period of observation, the court decides whether the firm should be liquidated, sold or restructured. If the firm is to be rehabilitated, the courts can either draw up a continuation plan, effectively a debt rescheduling, or a disposal plan. The court cannot reduce a creditor’s claim without his consent, but can force creditors to accept delayed repayment. Creditors may choose to reduce their claims in return for swifter repayment.

![]() Germany

Germany

Both company and creditors can start insolvency proceedings if a company’s finances become insolvent. The company can also start insolvency procedures if it believes insolvency to be unavoidable in the short term. Companies must file for insolvency within three weeks of becoming illiquid.

Usually, a debt restructuring is negotiated with creditors on an informal basis during this time. If this fails, the company applies for insolvency proceedings to open. The court determines whether insolvency proceedings are in fact appropriate.

Once formal insolvency proceedings are opened, the court appoints an insolvency receiver to take control of the company, disposing of assets where necessary. In rare circumstances, the company will retain control, overseen by an administrator. All outstanding creditor claims are accelerated.

The receiver is obliged to serve all classes of creditor, but creditor oversight of the insolvency process is limited. The creditors’ meeting (Glaubigeversammlung), for example, must in theory approve any substantial sale of businesses proposed by the receiver. But such transactions will stand even if approval is not obtained.

The creditors must meet within three months of insolvency proceedings opening. The receiver recommends to the creditors that the company either be liquidated or rehabilitated. Creditors can make the final decision to liquidate the company. Senior creditors can achieve this with a majority of outstanding claims. Both secured and unsecured creditors vote as equals at this point. If the receiver liquidates the company, proceeds go first to secured creditors, then the costs of the proceedings are covered, and finally the remainder goes to senior and subordinated creditors.

Alternatively, creditors can ask the receiver to devise an insolvency plan. The voting system to approve this is different, however. Different classes of senior creditor, that is, secured and unsecured, vote among themselves to approve the plan. The vote is carried by simple majority of outstanding claims. Each class of senior creditor must approve the plan. In other words, an investor holding 51% of secured debt cannot be outvoted into an insolvency plan, even if his debt represents only 5% of overall outstanding debt – unless it can be proved in court that the proposed plan does not prejudice the secured creditor. The court must then approve the insolvency plan.

![]() Italy

Italy

Italy’s legislators are currently planning an extensive reform of the insolvency system, given impetus by the collapse of Parmalat. Under the current system, Italian bankruptcy law is heavily geared towards satisfying creditors, usually by liquidating insolvent companies. There are five types of insolvency proceedings designed to ensure debt repayment.

Fallimento is a straight bankruptcy declared by the court, wherein the company is liquidated by a court and the creditors repaid according to their priority ranking.

For firms subject to certain sector regulations, there is liquidazione coatta amminstrativa, or compulsory administrative liquidation. A court-appointed administrator takes control of the liquidation procedure, without consent or input from the debtor or creditors.

Concordato preventivo, or creditor agreement, allows the company to avoid bankruptcy. To do so, it must provide for the full repayment of all secured creditors, and at least 40% of unsecured creditors. Creditors must approve any agreement by a two-thirds majority according to debt outstanding.

Amministrazione controllata, or controlled administration, allows companies in temporary difficulties to avoid liquidation where there is evidence that the firm could survive in the long term. In a controlled administration, a court-appointed commissioner takes charge of the company’s affairs for a maximum period of two years. During this time, creditors cannot enforce their claims against the firm’s assets.

A fifth procedure was added in 1999. Amministrazione straordinaria, or extraordinary administration, is designed to help very large companies to survive – particularly where liquidation would mean massive job losses.

The details of the proposed reforms are still being hammered out, but they will probably reduce the number of procedures to two: a pre-insolvency and an insolvency procedure. A pre-insolvency procedure will allow the debtor to remain in control of the company for up to two years, during which time creditors will be unable to enforce their claims. The company will have six months to devise a restructuring plan, which must be approved by the courts and by two-thirds of creditors. If the plan fails, the company will be declared bankrupt.

In an insolvency proceeding, all parties will have 90 days to submit alternative solutions to liquidation. Failing that, the firm’s assets will be liquidated by the courts over a two-year period, by private bids.

![]() Netherlands

Netherlands

Both the debtor and the creditors may apply for bankruptcy proceedings – as can a public prosecutor. Secured creditors are able to enforce their claims in a bankruptcy situation. The purpose of the bankruptcy procedure is to satisfy the claims of the creditors by liquidating the company. However, the procedure need not end in liquidation if the debtor is able to enter into an Akkord, or scheme of arrangement, with its creditors.

The debtor – and only the debtor – can also apply for a suspension of payments, provided that it can show evidence that its difficulties are temporary in nature. The suspension of payments does not affect the claims of secured creditors, which can still be enforced. The court will appoint an administrator to manage the company’s affairs with existing management. The administrator can place the firm in bankruptcy proceedings at this point if it sees fit.

In theory, companies can restructure their operations or realise assets in order to meet creditor claims while under a suspension of payments order. In practice, the suspension of payments procedure rarely results in the company avoiding bankruptcy proceedings altogether; rather, it is often used by troubled companies to buy time before bankruptcy procedures begin. More likely, during the suspension of payments procedure, as with during bankruptcy, the debtor will try to negotiate a scheme of arrangement with its creditors. The scheme of arrangement is a settlement designed to satisfy creditor claims while keeping the company functioning, and can be negotiated out of court or under judicial supervision.

In an out-of-court scheme of arrangement, the debtor offers to pay the creditors a percentage of the outstanding debt. If creditors accept, the remaining debt is excused. As this negotiation is extra-judicial, it can succeed only with the consent of all creditors, secured and unsecured. Secured creditors retain their full rights, and so they will usually only consent to a scheme of arrangement if they have other claims that are not secured.

Under a compulsory judicial scheme of arrangement, the debtor puts forward a debt restructuring plan. If two-thirds of creditors, representing over 75% of outstanding debt, accept the plan, their decision will be binding on dissenters. The court must then approve the plan for it to take effect.

![]() Spain

Spain

A struggling Spanish company has two options: it can either seek a suspension of payments, with a view to reorganising its financial affairs as a going concern, or it can go into bankruptcy, wherein liquidation proceedings will take place. Both of these routes can eventually result in either liquidation or an agreement with creditors.

A firm facing temporary financial difficulties will apply for a suspension of payments order. To qualify for a suspension of payments order, the company must be theoretically able to cover its total debt with its net worth. Inspectors are then appointed to supervise the negotiations with creditors. While the debtor remains in nominal control of the day-to-day management of the company, its commercial activities are supervised by the inspectors, who must approve any transactions or new contracts. The inspectors assess the company’s chances of survival, report to the courts and draw up the list of creditors.

Under the inspectors’ supervision, the company then seeks to gain the consent of a sufficient majority of creditors to a debt restructuring plan – either a debt reduction or a terming-out of maturities, or both. A sufficient majority consists of creditors representing more than 60% of the total outstanding debt if the proposal contains a postponement of less than three years, and 75% if it contains a postponement of more than three years.

Secured creditors do not have to attend the creditors’ meeting, and are not bound by its decision. However, if they choose to attend they will be subject to any settlements agreed in the meetings.

During this suspension of payments, creditors are generally unable to enforce claims against the company’s assets, although there are exceptions depending on the strength of the contractual guarantees. Nor can creditors apply to place the company in bankruptcy proceedings.

The alternative course is bankruptcy proceedings, wherein the company’s insolvency is deemed by the courts to be terminal. Either the company or its creditors can apply to the courts to declare bankruptcy. Once bankruptcy is declared, the debtor relinquishes control of the business. Technically, the debtor is liable to be arrested, but this provision is rarely put into practice.

The classification of the bankruptcy determines whether the proceedings may end in the survival of the company. Where the company’s troubles are the result of bad luck or negligence, this is possible; where they are the result of fraud, it is not.

![]() United Kingdom

United Kingdom

The UK system is regarded as one of the most creditor-friendly regimes in Europe. Secured creditors are especially well protected in the UK. The UK system provides for five main forms of insolvency procedure: administration, receivership, administrative receivership, liquidation and company voluntary arrangements.

Under the administration procedure, an administrator is appointed to handle the company’s affairs, and has a duty to the creditors as a whole. The administration order can be made by a court on the request of the company or its creditors, or out of court either at the company’s request before the insolvency or by a creditor with a secured claim on company assets. Under administration, creditors cannot enforce security or sue the company without consent of the court or administrator.

A receivership occurs when a creditor has a claim over a specific asset, and the company defaults. The resultant breach of contract allows the creditor to force a receivership without recourse to the courts. In this procedure, the receiver will dispose of the relevant asset in order to repay the debt. This receiver acts on behalf of an individual creditor.

When a creditor has a claim over substantially all of the company’s assets, he can appoint an administrative receiver to take control of the company. The administrative receiver may choose to either liquidate or rehabilitate the company.

The administrative receiver is beholden to the secured creditors. If he chooses to liquidate the company, a separate liquidator is appointed to dispose of the non-secured assets in the interests of the unsecured creditors. This practice is now most used for large-scale utility and urban regeneration projects.

A liquidation, or the disposal of all assets, can also be court-ordered or brought about voluntarily by shareholders. Here, the liquidator is bound to all creditors.

Where it is likely that the company will be able to survive as a going concern, secured creditors can consent by vote to leave the debtor company’s management in control through a company voluntary arrangement. Once agreed, however, secured creditors can change their minds and enforce their claim at any time by simply selling the asset, or where the security is based on a mortgage, applying to a court for foreclosure. This does not require court approval except in an administration.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Regulation

UK investment firms feeling the heat on prudential rules

Signs firms are falling behind FCA’s expectations on wind-down and liquidity risk management

The American way: a stress-test substitute for Basel’s IRRBB?

Bankers divided over new CCAR scenario designed to bridge supervisory gap exposed by SVB failure

Industry warns CFTC against rushing to regulate AI for trading

Vote on workplan pulled amid calls to avoid duplicating rules from other regulatory agencies

Bank of Communications moves early to meet TLAC requirements

China Construction Bank becomes sole remaining China G-Sib not to have released TLAC plans

Industry pushes to extend review for Emir active accounts rule

Fears that compressed timeframe leaves less than a year to test if controversial policy is working

Banks will not be frowned upon for discount window borrowing – Fed official

Risk Live: more banks have completed paperwork to access Fed lending facility than a year ago

Capital One puts OCC’s tough stance on mergers to the test

Proposed Discover deal should be approved but will go under the microscope, ex-regulators say

As FCMs dwindle, regulators fear systemic risk

Panellists highlight dangers of clearing membership becoming more concentrated

Most read

- Top 10 operational risks for 2024

- The American way: a stress-test substitute for Basel’s IRRBB?

- Filling gaps in market data with optimal transport