This article was paid for by a contributing third party.More Information.

Reaping the benefits of competition

By Andy Ross, chief executive, CurveGlobal Markets

My first days back at work after the festive period were spent phoning colleagues and customers to ask them about their outlook for 2021. Despite the challenges, I heard a lot of talk of positives and opportunities.

I started the new year with a tsunami of enthusiasm – for the year ahead, CurveGlobal Markets, London Stock Exchange Group and for our collective ability to change the world for the better.

CurveGlobal Markets is a listed futures exchange, the derivatives segment of London Stock Exchange. We provide choice, competition and innovation. Our zero fees, with no surcharges for block or basis trades, and no charge for market data, are great examples of the value of competition.1 We also allow clients to connect to member liquidity at LCH, where SwapClear regularly clears $3 trillion notional each day, while providing cross-margining to offset positions in listed products.

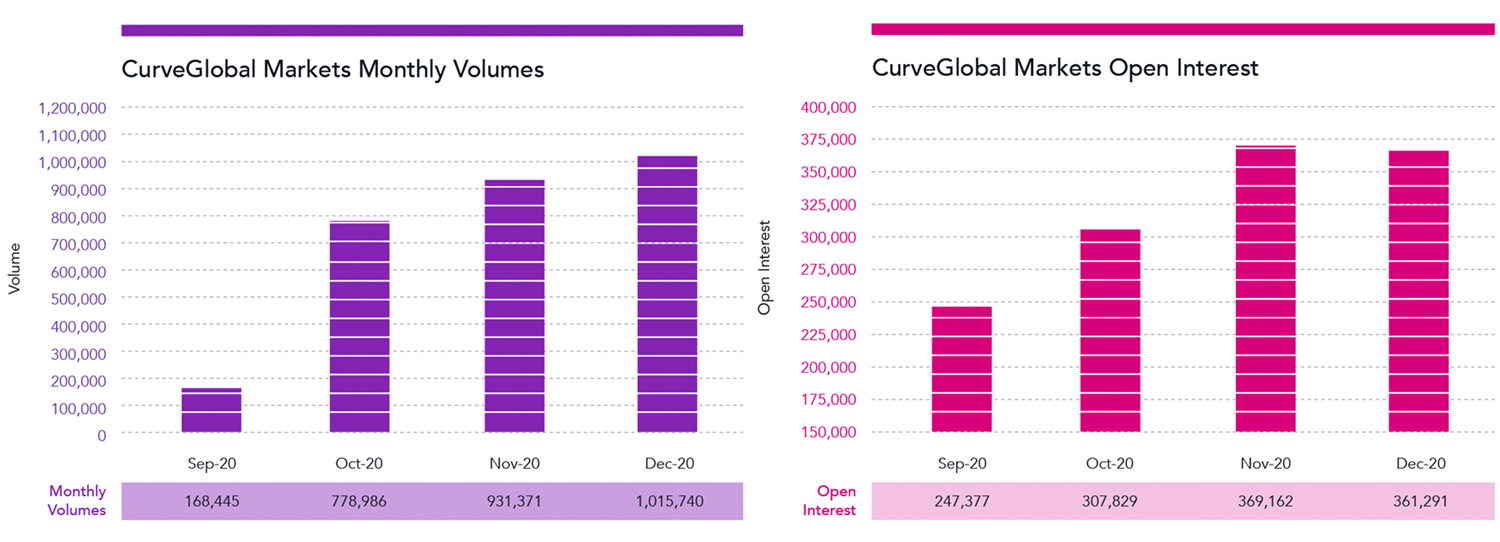

It is notoriously difficult for exchanges to gain traction and market share at the best of times. So why am I so optimistic? Well, on our record day at the end of last year, we were nearly 40% of the market in three-month sterling.2 Let’s be honest, it’s not easy persuading people working from home to look at another screen or indeed to try new things, especially with the Covid-19 lockdown.

So, why have CurveGlobal Markets’ volumes grown month over month? It appears that, if you provide good or better pricing on the exchange electronic order book, offer free fees and clearing, and allow people to trade blocks off the exchange at fractional prices, they really like it.

But, above all else, what has been so exciting is that, as we review our sales pipeline and recent wins, it’s the ease of getting clients trading. A process that a couple of years ago felt Herculean in effort is now as easy as falling off a log. Getting a client live often involved a new trading system or new clearing broker, execution broker, docs or pipes. It’ isn’t like that anymore; the infrastructure is turnkey for the asset managers, hedge funds, and prop firms alike. From seeing a price a trader likes or from being offered a price by the broker, to being execution-ready is taking less than a week – including risk sign-offs.

There are a number of macro reasons to be optimistic in 2021, from speedy Covid-19 vaccine development, polymerase chain reaction testing ability changing how we manage medical diagnosis, to computer processing power of new chips and protein unrolling. And CurveGlobal Market’s growing Sonia volumes and best-in-market pricing, and the rollout of ‘cash settled’ Gilt futures later in the first half of this year are just some of the reasons you should join us and trade at CurveGlobal Markets.

Notes

1. Free trading in place until October 1, 2021 and free clearing in place until April 1, 2021

2. Bloomberg, notional basis

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net