This article was paid for by a contributing third party.More Information.

UMR and the growth of client clearing

Following the implementation of phase six of the uncleared margin rules (UMR) this September, buy-side firms in-scope are carefully considering how to allocate capital and collateral more efficiently. Uchenna Uduji, ForexClear business manager, discusses the crucial role of clearing and the benefits for foreign exchange market participants

Following the global financial crisis that began in 2007–08, the Group of 20 initiated a regulatory review of global standards governing over-the-counter derivatives markets and participants. The International Organisation of Securities Commissions (Iosco) and the Basel Committee on Banking Supervision were tasked with creating a set of global standards to reduce systemic risk and promote central counterparty (CCP) clearing, which reduces counterparty credit risk.

A framework for margin requirements was developed for non-centrally cleared derivatives, with the simple aim of ensuring that derivative transactions are collateralised through initial margin (IM) and variation margin (VM). The Basel Committee/Iosco framework was then implemented by regulators in some jurisdictions, forming a set of rules to be phased in, with the initial phase commencing in 2016.

Scope and timelines

All entities in-scope that hold positions in non-centrally cleared derivatives transactions must exchange IM and VM to cover future and current counterparty credit risk exposures. With the exception of physically settled FX forwards and swaps, the IM requirements apply to all non-centrally cleared derivatives. FX spots are not considered derivatives.

To determine scope within UMR, a firm must calculate its average aggregate notional amount (AANA). The International Swaps and Derivatives Association (Isda) provides the following guidance: “Calculate the total notional amount of AANA-covered products for each relevant business day during the AANA calculation period, sum up the aggregate notional amounts for each relevant business day during the AANA calculation period and divide by the number of relevant business days in the period.”

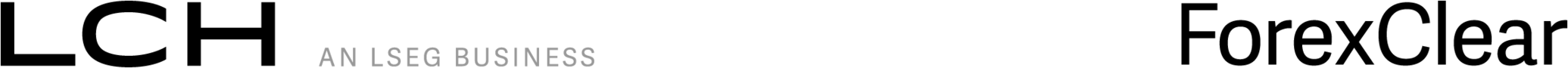

Since the go-live of the Basel Committee/Iosco framework in September 2016, firms have gradually been phased into UMR depending on their AANA level and the jurisdictions in which the framework was implemented. Initial phases saw global banks, which form the core of LCH’s ForexClear membership, fall in-scope, with phases five and six capturing smaller regional banks and asset managers. From September 1, 2022, all firms with AANA of more than or equal to $8 billion (or the approximate local currency equivalent) in the applicable jurisdictions are subject to UMR.

After the implementation of phase six, firms should still calculate AANA, as there is a possibility that institutions not caught initially may breach the AANA threshold in the future.

UMR and CCP clearing

With the implementation of UMR and margin obligations, firms are expected to consider more carefully the efficient allocation of capital and collateral. This section explores the case for clearing FX transactions through a CCP – such as LCH via its ForexClear service – by discussing its core benefits through a UMR lens:

1. Managing AANA thresholds with FX clearing

Cleared transactions are excluded from AANA calculation, and its notional cannot be counted against the gross notional for UMR. Firms can use FX clearing to manage their AANA level and ensure they remain below the UMR threshold while accessing the cleared FX liquidity pool. Additionally, regular trade compression can help reduce gross notional for firms subject to global systemically important bank calculations.

2. Managing IM minimum transfer amount (MTA) with FX clearing

Once a firm has identified it is in-scope for UMR, there is a second threshold to exceed before triggering the requirement to transfer bilateral IM with counterparties: the MTA. The MTA stipulated by regulators is set at $50 million (or the approximate local currency equivalent), which means that, for each bilateral counterparty, IM does not need to be transferred unless it exceeds the MTA.

Clearing a subset of an FX portfolio is an incredibly powerful lever that can ensure firms stay within their MTA across all bilateral counterparties. It can also reduce the operational burden required to set up margin transfer/receipts with, for example, custodians and credit support annexes. Additional clearing benefits, such as multilateral netting, ensure clearing can be used to manage IM MTA without incurring prohibitive margin cost at the CCP.

3. Multilateral netting and reduced cost of funding

Central clearing provides highly effective netting at portfolio level, with trades netted together under the same counterparty. With cleared IM generally expected to be lower than uncleared IM, firms can settle IM and VM daily with LCH ForexClear while achieving netting benefits, leading to lower cost of funding. More recently, with a higher cost of funding and changes to Isda’s standard initial margin model (Simm) bumping up bilateral margin, clearing presents an increasingly cost-effective solution.

4. Stabilising margin requirements through central clearing

While UMR requires IM to be exchanged bilaterally against each counterparty, trading activity with a counterparty may result in higher margin requirements, even if the net risk of the portfolio has not materially changed. By using a CCP, margin management is simplified and operationally more efficient.

LCH ForexClear has demonstrated resilience and stability in times of market uncertainty, such as during the Covid-19 pandemic and, more recently, the Russia/Ukraine conflict. During these periods, the LCH margin model demonstrated the efficiency of its inherent anti-procyclicality buffer, with margin increasing less than 10% during those stressed periods.

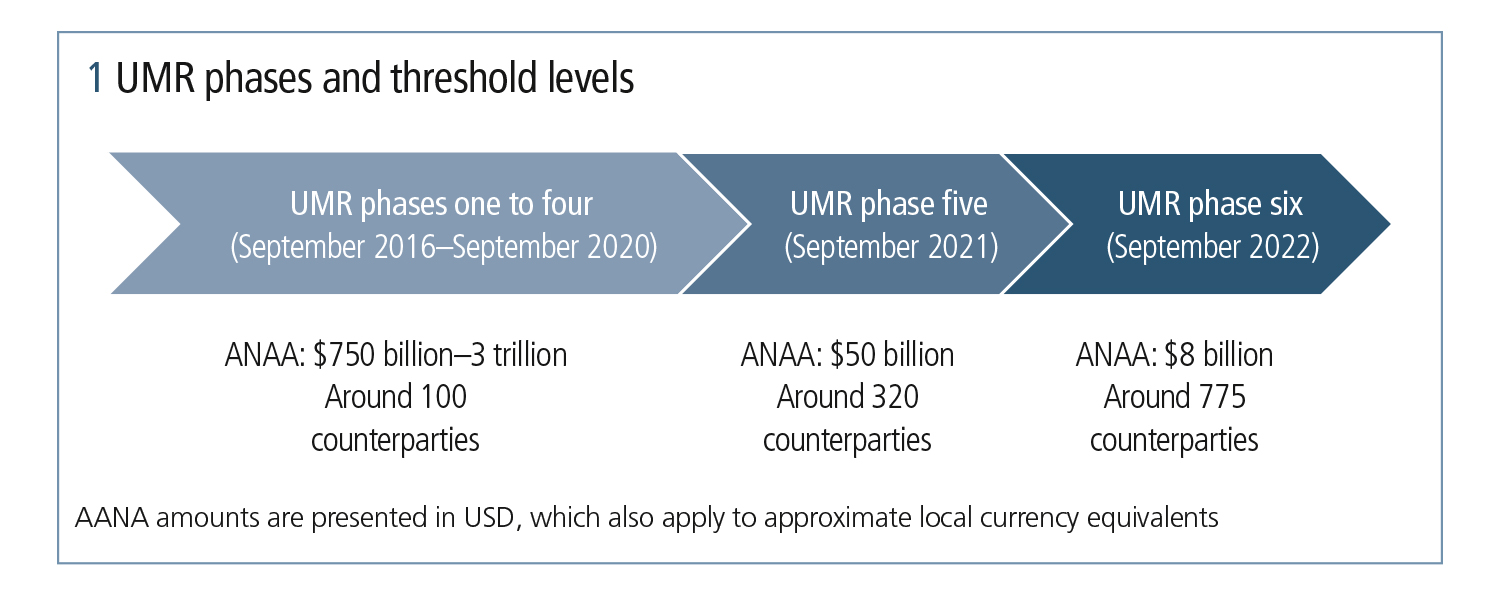

5. Optimising margin requirements with FX clearing

LCH ForexClear offers full portfolio margining across members’ and clients’ cleared portfolios, allowing offsets between various currencies and products eligible for clearing. The standard model for bilateral margin calculation, Simm, applies rigid correlation parameters between currencies and does not contain the granularity to ensure a high correlation parameter when pairs are highly correlated and vice versa.

LCH can run margin simulations on a firm’s full FX portfolio of transactions eligible for clearing at ForexClear to help identify potential benefits achievable with central clearing and estimate UMR obligations.

6. Liquidity, risk management and operational benefits

A key function of a CCP is to provide risk management to its clearing members and clients. Clearing removes exposure to multiple counterparties and replaces it with exposure to the CCP. Under the Basel Committee/Iosco framework, the use of a CCP authorised to operate in jurisdictions that have implemented the international standards for financial market infrastructures leads to the CCP benefiting from a lower credit risk weight and being treated more favourably. At its Pittsburgh Summit in 2009, the G20 set the following objective in response to the global financial crisis: “Non-centrally cleared contracts should be subject to higher capital requirements.”

Clearing also provides standardised pricing through the use of standardised collateral and discount curves. Furthermore, LCH ForexClear provides a single pool of liquidity, along with the associated capital and operational benefits. Firms benefit from the cost savings and operational gains of facing only a CCP, as opposed to multiple bilateral relationships.

Growth of client clearing at LCH ForexClear

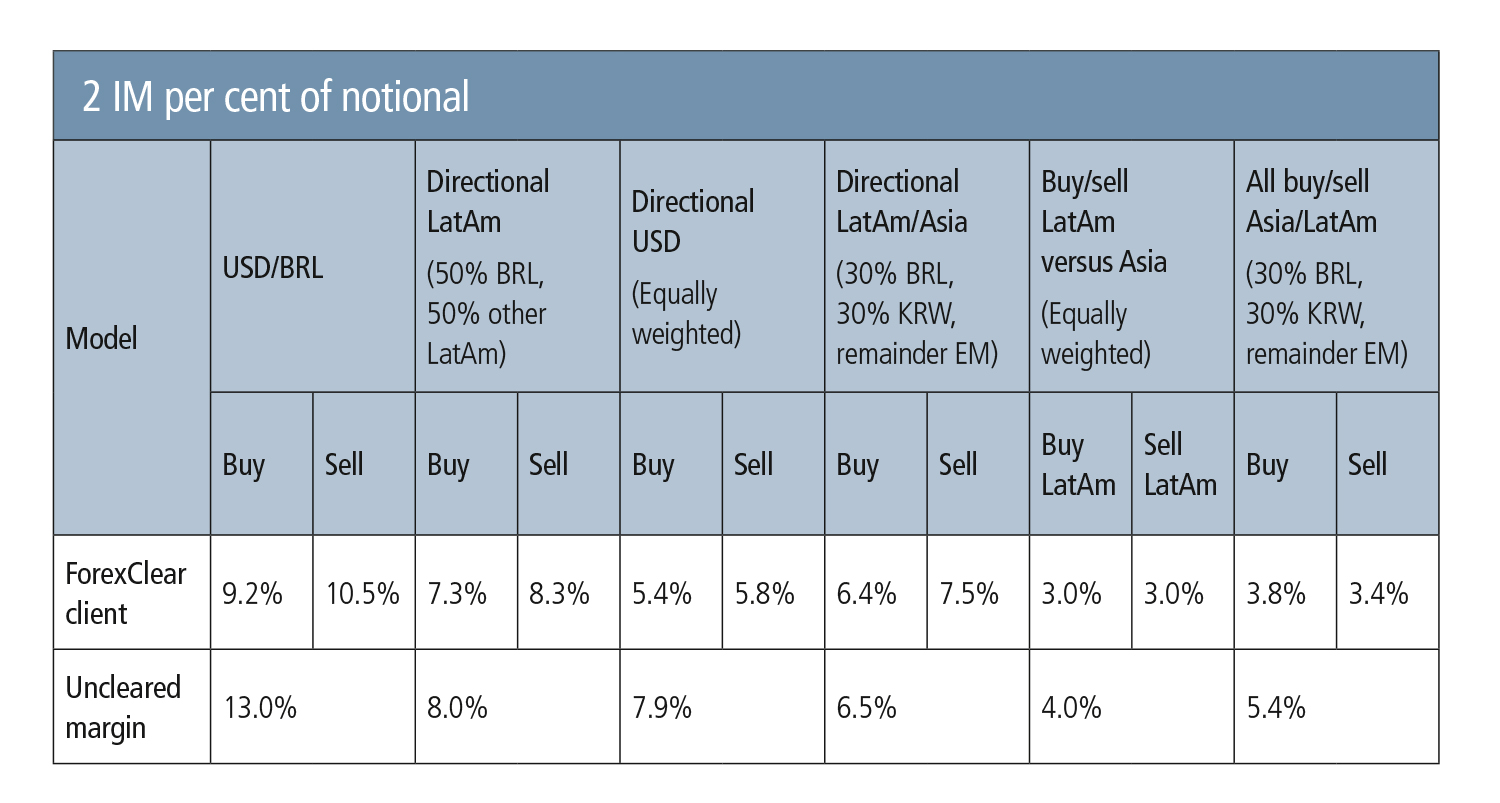

LCH ForexClear is a leading central clearing provider for FX in the industry and has seen tremendous growth in its non-deliverable forward (NDF) volumes since UMR went live. You can join LCH ForexClear as a clearing member or client via LCH’s US or International (including European) Clearing Broker models. In 2022, ForexClear cleared more NDFs than ever before – leading to record daily, monthly and quarterly figures. With close to 800 more counterparties to be phased in under UMR phase six, this growth trend is expected to continue. The firms captured by UMR phases five and six are likely to use a client clearing offering. Figure 3 details the strong growth seen in this area of LCH’s service.

Additionally, greater awareness of the impact of UMR is leading to an increase in demand for clearing, including – but not limited to – information around how a subset of a portfolio could be cleared in an optimal fashion to maximise capital benefits, as opposed to blanket clearing of a whole portfolio, at LCH ForexClear.

Furthermore, client clearing growth is being driven by increased clearing broker choice and lower cost of clearing to the buy side. In the first half of 2022, LCH ForexClear had 14 clearing brokers live on the service, offering client clearing solutions across its US and international clearing models. This has increased to 19 and is expected to grow further in 2023.

Further reading

This article covers the topics from the recent thought leadership article, LCH ForexClear: UMR and the growth of client clearing

LCH ForexClear is here to partner with the market on the recent UMR changes. Contact LCH ForexClear’s specialist sales team or visit LCH ForexClear for further information or requesting portfolio analysis.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net