Spreads on leveraged loans

Steven Miller, managing director of Standard & Poor's Leveraged Commentary & Data in New York, explains why spreads are paper thin on US leveraged loans

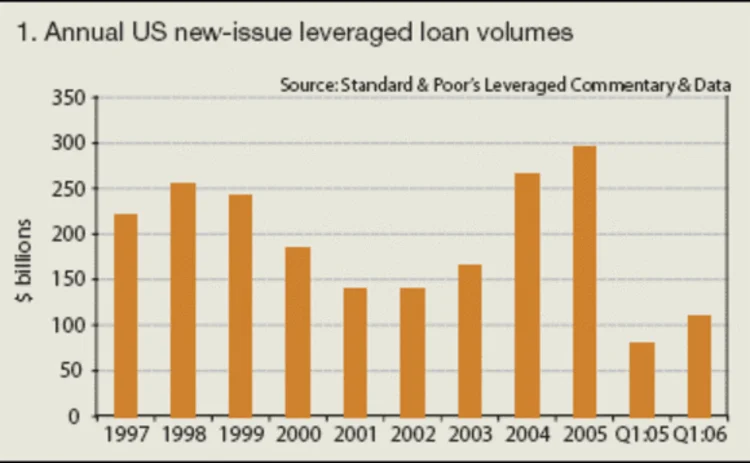

Leveraged loan volumes in the US were large and lumpy during the first quarter of 2006. Total new-money volume during the first three months of the year soared to $109 billion (see chart 1), the highest since Standard & Poor's LCD started tracking volumes in 1997, up from $74 billion in the fourth quarter and from $80 billion during the same period in 2005. This explosive growth was due largely to M&A-related jumbo financing.

It is said that one can never be too rich or too thin. But don't tell

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Foreign exchange

Stemming the tide of rising FX settlement risk

As the trading of emerging markets currencies gathers pace and broader uncertainty sweeps across financial markets, CLS is exploring alternative services designed to mitigate settlement risk for the FX market

Power-reverse to the future: falling yen revs up PRDCs again

Pressure on Japanese unit sparks revival in power-reverse dual currency notes

Credit Suisse and Commerz latest banks to ditch hold times

Mizuho also confirms zero last look add-on but MUFG’s policy unclear on the controversial FX practice

Has Covid stopped the clocks on FX timestamp efforts?

Budget reallocation may not be the only factor stalling standardisation progress, say participants

EU benchmark drama set for cliffhanger end

Access to key FX rates due to be decided six months before potential cut-off

Banks rent ready-made algos for FX trading

NatWest, XTX Markets and others develop new outsourcing model for tech

Who killed FX volatility?

Beyond central bank policy, traders see a range of hidden structural factors at work

Harnessing the benefits of more automated fx trade lifecycle operations

FX markets are unique not only in their scale but also in their complexity. There are multiple trading paradigms, and also multiple venues where trades may be executed. The FX ecosystem is highly fragmented and the case for more automation – more…

Most read

- Top 10 operational risks for 2024

- Top 10 op risks: third parties stoke cyber risk

- Japanese megabanks shun internal models as FRTB bites