Asia's stock answer

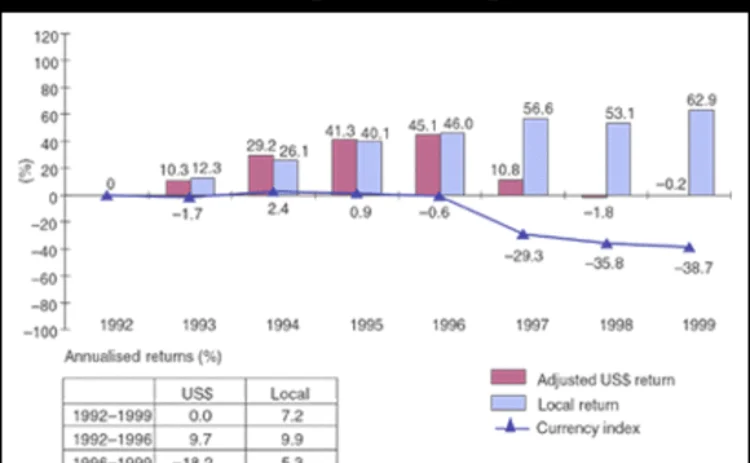

Many say that equity exposures should remain unhedged. But, as HSBC’s Tarun Kataria argues, the decline in the value of Asia’s currencies post-crisis suggests that hedging equity is crucial to secure returns

One of the many indelible imprints from my MBA programme in the 1980s is the discussion regarding equity hedging. We were told, “never hedge equity” as, for the most part, it is long-term and eventually balances out over time. Over the years, numerous corporate treasurers throughout the world have echoed this view. Nevertheless, the devastation of Asia’s currencies during the financial crisis in 1997/98, made it blatantly apparent that leaving US dollar equity unhedged did not make

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Foreign exchange

Stemming the tide of rising FX settlement risk

As the trading of emerging markets currencies gathers pace and broader uncertainty sweeps across financial markets, CLS is exploring alternative services designed to mitigate settlement risk for the FX market

Power-reverse to the future: falling yen revs up PRDCs again

Pressure on Japanese unit sparks revival in power-reverse dual currency notes

Credit Suisse and Commerz latest banks to ditch hold times

Mizuho also confirms zero last look add-on but MUFG’s policy unclear on the controversial FX practice

Has Covid stopped the clocks on FX timestamp efforts?

Budget reallocation may not be the only factor stalling standardisation progress, say participants

EU benchmark drama set for cliffhanger end

Access to key FX rates due to be decided six months before potential cut-off

Banks rent ready-made algos for FX trading

NatWest, XTX Markets and others develop new outsourcing model for tech

Who killed FX volatility?

Beyond central bank policy, traders see a range of hidden structural factors at work

Harnessing the benefits of more automated fx trade lifecycle operations

FX markets are unique not only in their scale but also in their complexity. There are multiple trading paradigms, and also multiple venues where trades may be executed. The FX ecosystem is highly fragmented and the case for more automation – more…