Index roll prompts clearout

Several high-profile defaults have led to changes in the composition of the DJ CDX and iTraxx indices

The latest series of the Dow Jones CDX and iTraxx credit derivatives indices started trading on September 20, with dramatically different portfolios for the investment-grade and high-volatility CDX indices. The CDX HY index is expected to roll on October 6, 2005.

The indices are recreated every six months to keep their maturities at or near five years, which is the standard credit default swap (CDS) contract, and to replace names that no longer meet the criteria. Names are dropped if ratings from either Moody's or Standard & Poor's fall to junk status. Participating dealers also vote on which names to include based on which are the most actively traded.

Dow Jones replaced nine names in its high-grade CDS index. The nine new names in the high-grade index are The Gap, IAC, Knight Ridder, Limited Brands, Marsh & McLennan, Radio Shack, Sara Lee, Toll Brothers and Sabre Holdings. The nine dropping out of the index are Eastman Kodak, Ford Motor Credit, General Motors Acceptance Corp, Kerr-McGee, MBNA, Liberty Media, Lear, Maytag and Sears Roebuck Acceptance Corp.

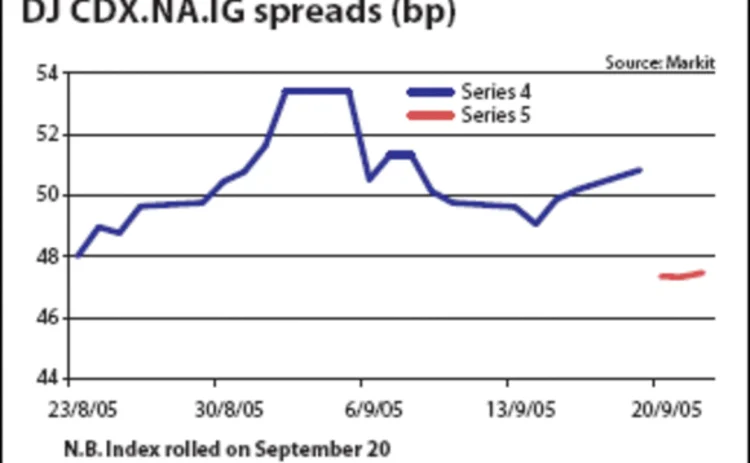

The new high-grade CDX series 5 index began trading at 47 basis points and the roll from series 4 to series 5 opened initially at 3-4bp. By removing several risky credits from the investment-grade index, traders expect the index to be less volatile and trade at tighter spreads. One of the biggest differences seen was the narrowing of the widest single name credit in the index from 471.9bp (General Motors Acceptance Corp) to 359.1bp (American Axle).

Dow Jones also replaced 15 names in the 30-name high-volatility investment-grade CDS index, the most replacements that this index has seen since inception. The new series 5 high-volatility index began trading roughly 19bp tighter than series 4. Michael Mutti, credit strategist at Bear Stearns, says: "Given the number of changes between investment grade and high-vol series 4 and 5, we don't believe there will be as many investors rolling protection from series 4 and series 5 as there have been in the past."

The CDX index consortium also launched a new 35-name index called the Crossover (XOVER) index on the day of the roll. Criteria for the new index are a triple-B rating from one of S&P or Moody's and a double-B rating from the other. Ford Motor Credit and GMAC are in this index as are several other members of the series 4 high-volatility index, including Liberty Media, Kerr-McGee, Eastman Kodak, Lear Corp and Sears. Twenty-one of the 35 crossover issuers are also in the double-B sub-index of the high-yield index.

Mutti says: "While there is clearly some overlap, the double-B index will have a funded product as well as an unfunded version so traditional high-yield index investors may find the double-B better suited to their needs. Another notable difference is that the crossover index has Ford Motor Credit and GMAC, whereas the double-B index has Ford Motor Company and General Motors Company." At the end of the first day of trading, the index was quoted at 223-224bp.

In the European iTraxx indices, there were very few changes to index composition, so strategists say the story in Europe's credit derivatives markets was much more of a technical one, as those long protection tried to sell it ahead of the roll. This resulted in a short squeeze that drove the market tighter in spite of negative headlines such as the Chapter 11 filings from Delta and Northwest Airlines and M&A activity in Europe.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Structured products

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Range accruals under spotlight as Taiwan prepares for FRTB

Taiwanese banks review viability of products offering options on long-dated rates

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Structured products – Transforming risk into opportunities

The structured product market is one of the most dynamic and complex of all, offering a multitude of benefits to investors. But increased regulation, intense competition and heightened volatility have become the new normal in financial markets, creating…

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…

Most read

- Podcast: Olivier Daviaud on P&L attribution for options

- SG trader dismissals shine spotlight on intraday limit controls

- For a growing number of banks, synthetics are the real deal