Return of the loan market

The leveraged loan market has seen a surge in demand this year, delivering returns superior to other asset classes. Steven Miller reports on the factors behind this success story, and discovers that the only short-term barrier to growth is a shortage of supply

The high-yield bond market may seem an attractive proposition for investors focused on current income, but over the past year, savvy accounts have picked up on a less well-known alternative: the market for syndicated leveraged loans. Buoyed by a number of factors, including ebbing defaults, surging asset prices and low volatility, the loan market is riding a wave of its own, generating risk-adjusted returns that outpace other asset classes.

Between October 2002 and September 2003, the leveraged loan market returned 8.96%, or nearly 800bp more than Libor, according to Standard & Poor’s and the Loan Syndications and Trading Association’s joint index. In 2002, leveraged loans returned only 2.2%.

But even after this remarkable run, the prospects continue to look solid for the remainder of 2003. Demand for secured term loans, which constitute the bulk of this asset class, remains strong. This demand is being fed by structured vehicles, such as leveraged loan CDOs (collateralized debt obligations), and by inflows into leveraged loan mutual funds.

Collateralized loan obligation issuance hit $6 billion in the third quarter, the highest level in recent memory, while mutual funds that buy loans (the so-called prime funds) finally reported inflows – albeit slight – after four years of declining assets. And banks are once again looking to step up lending after shedding assets in recent years to help combat mounting defaults and ration economic capital for more attractive opportunities.

Nevertheless despite surging demand, there is still little supply. The third quarter ended weakly and the pipeline remains light, reflecting the lackluster M&A deal flow, a traditional driver of market activity. High-profile rescue financings and loans for fallen angels – a big source of volume, fee revenue, and headlines over the past 12 months – have run their course.

However, crossover interest from hedge funds is fueling a niche of hybrid deals, which are high yielding, in common with bonds, but pegged to floating rates, like loans. If that small, steady business is opportunistic, so too is the market as a whole. No broad themes drive activity; instead we are seeing a smorgasbord of M&A, leveraged recapitalization, refinancings, and loans funding capital expenditures.

Without a big driver, the stars don’t seem to be aligned for a heady pick-up in volume in either the fourth quarter or in early 2004. Still, even without a strong final leg, 2003 will be the first year during which leveraged volume expanded since 1998 – albeit off a very low base – and institutional term loan volume has already hit record highs.

During the first nine months of 2003, $121 billion of leveraged loans were extended, up from $109 billion during the same period in 2002. Barring a collapse in the fourth quarter, the volume for the whole of 2003 will almost certainly exceed 2002’s total of $139 billion. This would be the first year of volume expansion since 1998, when leveraged lending totaled $256 billion.

Looking to the fourth quarter, buy-side and sell-side participants alike characterize the market as technically and fundamentally strong. From a technicals standpoint, investors have plenty of cash. From April through September, inflows into traditional loan accounts – prime funds and CLOs – exceeded available new issue supply by roughly $17 billion. On the subject of fundamentals, default rates tell the story. The lagging 12-month default rate plummeted by half during the first nine months of 2003, to 2.9% from 6%. Investors expect this trend to continue into 2004.

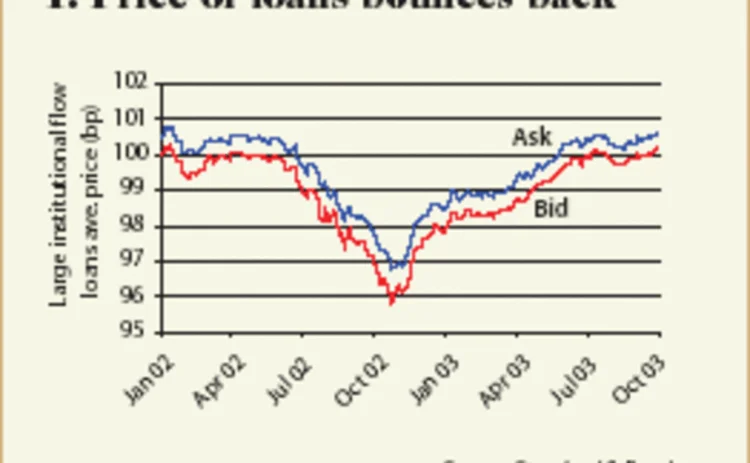

Despite investors having huge cash positions, the market is hamstrung by a lack of new issue supply. Consequently, prices in the secondary market have soared (see chart 1) and new-issue spreads have tightened. Together these factors spurred a significant round of refinancing activity, which has squeezed returns. Accounts have also accepted loans with weaker credit statistics and lower ratings (see chart 2).

A tradable asset

For a decade now, the loan market has evolved from a bank-driven market to a mature segment of the capital market driven by a large group of institutional investors. By the third quarter of 2003, institutional investors’ share of the leveraged loan market, excluding arranger commitments, grew to a new high of 66%, from 65% three months ago and from 60% in 2002.

Along with a bigger share, the institutional investor base expanded again in the third quarter, to 122 from 116 during the second quarter and from 86 in 2002. Many of these buyers are hedge funds and other hot-money accounts that only played in loans that backed fallen angels facing liquidity problems and structured with extremely wide margins of 500bp over Libor or more. Looking just to the core group of active institutional players – those with 10 or more primary participations over the past year – there is a less dramatic growth trajectory: to 91 accounts from 76 last year.

What has been missing from the loan market in recent years is a robust group of bank lenders. Banks, of course, have generally de-emphasized credit products in recent years for more lucrative, fee-based business. This has been particularly true in the leveraged loan market where the number of active bank lenders – those that bought shares of 10 or more syndicated loans – fell from 110 in 1999 to just 36 in 2002. But with default rates down and banks again focused on expanding revenues, some have stepped up their lending efforts. This started with investment-grade loans last year and then migrated to crossover issuers with ratings of triple-B and high double-B.

While still not at the level of years past, the number of commercial banks active in 10 or more leveraged loans surged in the third quarter, to 49 from 36 last year, though the overall pool of traditional lenders (namely, banks and finance companies) slipped to 104 from 112. This is the highest level of active participation since 2000.

Default cycle winds down

The 12-month lagging default rate for institutional loans, after soaring from less than 1% in January 1999 to a peak of 7.4% in June 2002, has since receded to 2.9% as of September (see chart 3). As this lower rate implies, the volume of loan defaults has fallen drastically. Indeed, during the first nine months of 2003, 12 issuers defaulted on $3 billion of institutional loans. This compares with 19 issuers on $7 billion during the first nine months of 2002. Defaults will probably tread water, perhaps trending slightly higher until December, when the only four second-half 2002 defaults roll off the lagging 12-month numbers.

Looking to 2004, institutional investors remain optimistic. Most issuers with problems have either defaulted already or have implemented balance sheet restructurings, typically tapping the high-yield bond market to lengthen debt maturities and stave off default. The new paradigm? Defaults will occur opportunistically rather than systemically, at least for the coming year or so. Most investors predict that defaults will be in the 1–2% range in 2004, which would mean five to 10 defaults totaling $1.5–3 billion. The numbers support this low default rate view. The percentage of loans rated CCC or CC, namely those most vulnerable to default, dropped to 2.3% in September from 3% in August and 5.2% at year-end 2002.

The economic outlook also supports a low default rate scenario in 2004, according to S&P’s chief economist, David Wyss, who believes that GDP growth was 5.1% in the third quarter, and predicts that the fourth quarter will be nearly as strong, at 4.7%. The economy, Wyss expects, will get another boost from the next round of tax cuts during the second and third quarters of 2004, with overall GDP growth next year at 4–4.5%.

Looking out to 2005, however, much of the fiscal stimulus will be fully absorbed, and by then interest rates will be trending higher, says Wyss. As a result, GDP growth will slow to 3–3.5%. Wyss offers the usual caveats: disruption in Iraq and the Middle East generally, terrorist activity, currency fluctuation, energy prices, and other exogenous events.

Though loan market defaults are winding down, the 1999–2002 period created a rich legacy of default statistics that investors can mine for lessons. In fact, between 1995 and the third quarter of 2003, arrangers put in place roughly 1,120 institutional loans for issuers that file publicly. Of those, 117 defaulted. As factors such as ratings improve, default experience improves, and the time to default lengthens.

The loans that S&P rated BBB defaulted 4.9% of the time since 1995. For BB loans the default experience was 6.8%, and for single-B loans the rate was 13.6%. The same goes for increases in Ebitda. It’s no surprise that loans launched with a negative Ebitda out of the box, which naturally include the majority of those blueprint telecom deals – were the biggest defaulters at 21.2%. This slides steadily to 7.3% for issuers with Ebitda of $250 million or more. Loans that relied on significant Ebitda adjustments, for example those with a half a turn or more of debt, suffered defaults more than twice as frequently as loans that did not.

Risk-adjusted returns

With a full cycle complete, it’s easy to see how compelling loans appear from a risk-return standpoint. Between January 1997 and August 2003, loans generated an average annual return of 5.14%, according to the S&P/LSTA index. This is a relatively anemic performance relative to other asset classes (see chart 4).

However, on a risk-adjusted basis, the loan market shines because during this period its volatility, as measured by the standard deviation of monthly returns, was just 0.6%. The volatility of loans is low for three reasons. First, loans are floating rate and therefore have little interest rate risk. Second, loans are senior secured instruments that are at the top of the capital structure. Finally, they are prepayable as well as being short-duration instruments with an average life of 2.5 years.

The calculations yield a Sharpe ratio for loans of 0.48. As chart 5 shows, this beats high yield at 0.13 based on the Merrill Lynch US high-yield corporate index, 10-year Treasuries at 0.41 and the S&P 500 at 0.22. Investment-grade bonds, though, outperformed loans at 0.78 based on the Merrill Lynch US high-grade corporate index.

After the bull market of the past 12 months, there is little easy money left on the table for loan investors. The numbers are clear: since bottoming out at 95.81% of par in October 2002, the average price of large, liquid loans rallied 4.51 percentage points by the end of September, to 100.13.

With levels already so high, investors believe 2004 will mostly be a year of coupon clipping in a low default environment. But with interest rates at multi-generational lows, floating-rate loans today represent a hedge for investors against interest rate increases. As a result, inflows into retail loan funds have turned positive this year for the first time since 1999. Investors also report that institutional money for unleveraged accounts is on the rise.

Steven Miller is head of the leveraged loan commentary and data unit at Standard & Poor’s

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Structured products

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Range accruals under spotlight as Taiwan prepares for FRTB

Taiwanese banks review viability of products offering options on long-dated rates

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Structured products – Transforming risk into opportunities

The structured product market is one of the most dynamic and complex of all, offering a multitude of benefits to investors. But increased regulation, intense competition and heightened volatility have become the new normal in financial markets, creating…

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…

Most read

- Top 10 operational risks for 2024

- Top 10 op risks: third parties stoke cyber risk

- Japanese megabanks shun internal models as FRTB bites