This article was paid for by a contributing third party.More Information.

Delivering certainty in uncertain times

TriOptima explains how it combines the reduction of gross notional exposure and the conversion of net risk exposure to deliver outsized results, partnering its portfolio compression network with core net ICE Libor over-the-counter (OTC) swap portfolios

triReduce’s benchmark conversion service offers users an iterative approach to mitigating uncertainty about the future of ICE Libor swaps. Swap market participants can proactively reduce both their gross and net exposure to the ICE Libor benchmark at the same time as increasing their adoption of the alternative reference rate for each respective currency. This service will be provided for trades cleared in all major central counterparties (CCPs) as well as for ICE Libor-referencing trades held in non-cleared portfolios. A single process, in which participants retain control of the transition within their portfolios, is key to managing the change in your own mid-market valuations. By ensuring all compression and conversion takes place iteratively and at each firm’s own valuations, the service brings clarity to discussions about how to adopt alternative risk-free rates (RFRs) in swap portfolios.

Reviewing the data requirements

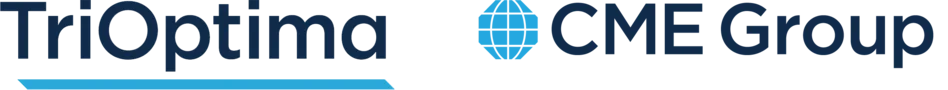

To better understand what is required, figure 1 illustrates triReduce’s benchmark conversion service. As they do today, participants will submit their existing swap portfolios, where it is likely they will have existing ICE Libor- and non-ICE Libor-referencing trades, including alternative RFRs. This enables the service to compress where possible and convert into the alternative RFR where compression is not possible.

Participants will provide discount factors and their own mid-market valuations, as well as any measures of risk they would like to control through the process for their existing trades and for additional template trades. These template trades are a standard representation of alternative RFR trades that will be used to establish additional liquidity at specific maturities to facilitate the conversion.

With this information and the corresponding risk-based limits that participants define, triReduce’s benchmark conversion service will return a proposal of fully terminated, amended and replacement trades that reduce exposure to ICE Libor transition in a controlled manner. Once accepted by each participant within a finite window of time, the proposal is passed on to the CCP for processing in the case of cleared trades.

Reduced ICE Libor OTC swap exposure

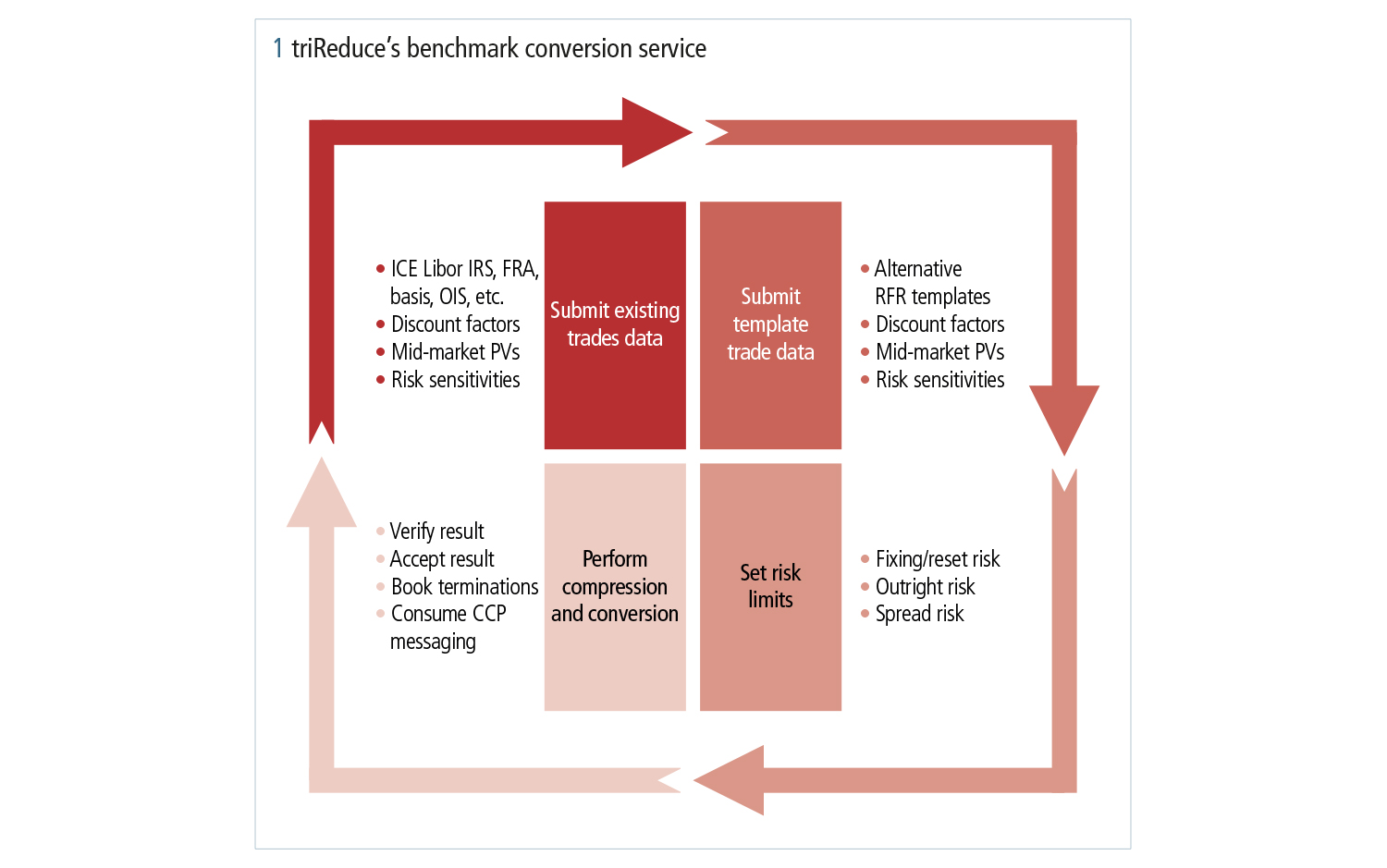

The result is a reduction in ICE Libor swap exposure achieved through a simultaneous reduction of gross notional exposure and conversion of net risk exposure. TriOptima combines these two objectives and delivers outsized results by bringing together its world-leading portfolio compression network and new participants with core net ICE Libor OTC swap portfolios (see figure 2).

Ensure your readiness to take control of the ICE Libor transition for your over-the-counter swap portfolio by contacting your local TriOptima office or emailing benchmarkconversion@trioptima.com to discuss benchmark conversion

Libor Risk – Quarterly report Q2 2020

Read more

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimise portfolios and analyse data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and forex trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimisation and reconciliation services through TriOptima, and trade processing services through Traiana.

All information contained herein (“the information”) is for informational purposes only, is confidential and is the intellectual property of CME Group Inc. and/or one of its group companies (“CME”). The information is directed to equivalent counterparties and professional clients only and is not intended for non-professional clients (as defined in the Swedish Securities Market Law (Lag (2007:528) om värdepappersmarknaden)) or equivalent in a relevant jurisdiction. This information is not, and should not be construed as, an offer or solicitation to sell or buy any product, investment, security or any other financial instrument, or to participate in any particular trading strategy. The information is not to be relied upon and is not warranted, either expressly or by implication, as to completeness, timeliness, accuracy, merchantability or fitness for any particular purpose. All representations and warranties are expressly disclaimed. Access to the information by anyone other than the intended recipient is unauthorised and any disclosure, copying or redistribution is prohibited without CME’s prior written approval. If you receive this information in error, please immediately delete all copies of it and notify the sender. In no circumstances will CME be liable for any indirect or direct loss, or consequential loss or damages including without limitation, loss of business or profits arising from the use of, any inability to use, or any inaccuracy in the Information. CME and the CME logo are trademarks of the CME Group. TriOptima AB is regulated by the Swedish Financial Supervisory Authority for the reception and transmission of orders in relation to one or more financial instruments. TriOptima AB is registered with the US National Futures Association as an introducing broker. For further regulatory information, please see www.nex.com and www.cmegroup.com.

Copyright © 2020 CME Group Inc. All rights reserved.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net