This article was paid for by a contributing third party.More Information.

An imperfect solution: Derivatives create new challenges for buy side

The Buy-side Derivatives 2016 survey, conducted recently by Asia Risk and sponsored by Calypso Technology, reveals derivatives to be powerful but unwieldy management tools. Used to safeguard a firm’s predictable sources of return, they also pose the greatest operational and risk management challenges to its portfolio. The survey also asks the buy side’s opinion of blockchain, and the market disruption it threatens.

Buy-side firms have learned to embrace derivatives as a tool for keeping complex risks in check. However, like a lion-tamer with a whip, institutions must take care to master these instruments if they are to avoid inflicting pain on themselves.

This year’s buy-side derivatives survey finds that, while the instruments have earned a stellar reputation among firms struggling in the low-interest rate, high-regulation environment, not all appear adequately equipped to stop these problem-solvers turning into perils of their own.

It is not as though the demands on the buy side are not challenging enough. Asset managers have the responsibility to safeguard client cash from market turbulence while offering a return on its investment. Insurance companies must generate the yield in their general account portfolios necessary to honour policyholder claims and meet long-term obligations tied to mammoth annuity portfolios. Elsewhere, hedge funds require access to leverage and synthetic exposure to exotic asset classes to post the kind of gains that discourage client redemptions, and pension funds are under pressure to minimise funding volatility and harmonise the duration of their assets and liabilities.

These demands may be the same as in previous years, but firms’ abilities to meet them have been inhibited, thanks to depressed returns across asset classes, declining liquidity and regulatory constraints on both buy-side and sell-side activities. It is small wonder, then, that buy-side firms are relying on more complex products to help navigate this more complex environment – namely, derivatives.

Derivatives as problem-solvers

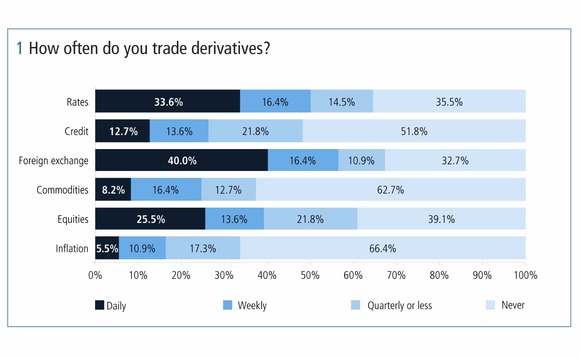

Responses to this year’s survey reveal a healthy take-up of derivatives across the sector. The most commonly traded contracts among respondents, as last year, are those linked to interest rates and foreign exchange (figure 1). This is in keeping with data from the Bank of International Settlements, which shows that 82% of interest rate and approximately 50% of foreign exchange contracts were struck between financial institutions other than dealers, as of December 2015. Equity and credit-linked products were the two next most-traded products among respondents.

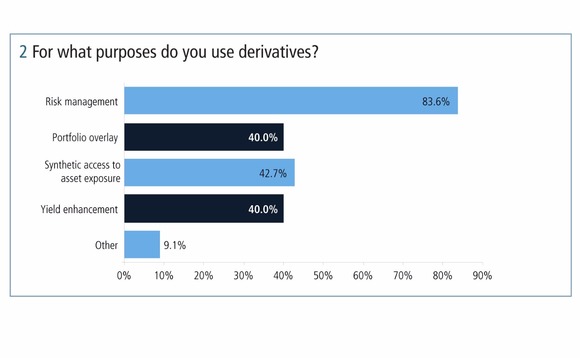

Buy-side firms use a variety of contract types, but when asked for what purpose they use derivatives, one answer resounded above all others: risk management (figure 2). Neil Snyman, head of liability-driven investment (LDI) at Aviva Investors in London, says risk management of the firm’s asset-liability exposures is its number one reason for using derivatives products. He explains they are frequently used to isolate certain asset components – for example, stripping foreign exchange risk from a credit investment, in order to “keep exposure where we see value and remove exposures where we don’t.”

He’s not alone. At Standard Life Investments in Edinburgh, Martin Robertson, head of derivatives trading, says the products are used for “hedging risk across various asset classes and across global markets.”

Today, there is broad recognition that derivatives can play a powerful role in shielding portfolios from market risk and transforming erratic cash flows into predictable sources of return. Even those yet to dabble in the market are no strangers to the benefits. Semper Capital Management, a New York-based asset manager specialising in commercial and residential mortgage-backed securities, anticipates using listed derivatives such as eurodollar futures and swap futures as an interest rate duration hedge to combat prepayment risk in its existing portfolio, according to Zach Cooper, deputy chief investment officer.

Among pension funds, a deterioration of the plan’s funding position is the overriding risk management problem for which derivatives can provide a solution. Ryan Labs Asset Management is a New York-based investment manager that offers institutional investor access to actively managed fixed-income accounts alongside a range of LDI strategies for pension funds and its own parent company, Sun Life Financial. Chris Adair, senior vice-president for applied strategy and overlay at the firm, who works on solutions for pension plans, explains these customers’ unique needs: “Plan sponsors are focused on synthetically creating a duration hedge to reduce the overall funding volatility of the plan. It is very client-specific in terms of what they are using and how they are deploying derivatives. You could have one client that is fairly funded, with a large allocation to fixed income, but is using treasury futures to hedge its liability pool. Then you have clients that are underfunded and their balance sheet cannot afford a sterner contribution policy from employees, so they need to lean on the growth portfolio to fill the funding gap. Their allocation to swaps tends to be greater.”

As swaps offer exposure to rates on an unfunded basis, their use can free up cash to invest in higher-yielding assets to help close this funding gap. The use of derivatives to gain synthetic access to certain asset classes is not just limited to pension funds, either – 43% of survey respondents said this was one reason they deployed derivatives. Asset managers are increasingly doing so in order to hoard cash that can then be invested tactically in real assets as opportunities present themselves.

The hunt for yield

Others are using the derivatives themselves to enhance portfolio returns: “There has been more use of derivatives for investment purposes. Banks are spending more time talking to us about opportunities in asset swap trades and yield enhancement through a combination of derivatives and cash assets,” says a head of derivatives portfolio management in New York.

Structured products, such as bond repacks, which typically combine a sovereign bond with an embedded interest rate swap, are one such example – and have been finding favour with insurance companies in recent years.

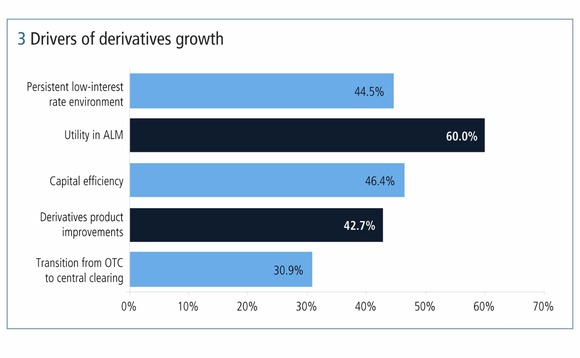

Hunger for yield across the buy side has only grown more acute as markets contend with yet another year of rock-bottom interest rates. The persistent low-rate environment was cited by 45% of respondents as a key driver of the growth in derivatives usage (figure 3).

“On the portfolio overlay side we have clients that are grappling with low interest rates and want to use derivatives to hedge out their interest rate exposure in an LDI context,” says Ryan Labs’ Adair. “We also have clients that want to take a tactical view on rates. For example, they think rates may move higher soon and so are reluctant to invest in physical bonds right now, so choose to get exposure to rates through unfunded derivatives.”

However, the main driver of derivatives growth, according to 60% of respondents, is their utility to asset-liability management (ALM). This may in part reflect a heightened recognition of the importance of ALM among insurers and pension funds in the low-rate environment. Buy-side regulation may also be playing a role.

“Our insurance liabilities are valued relative to a swap curve and, through that, the matching asset becomes swaps,” explains Aviva’s Snyman. So both market- and supervisory-driven factors may be behind the boom.

Derivatives as problem-posers

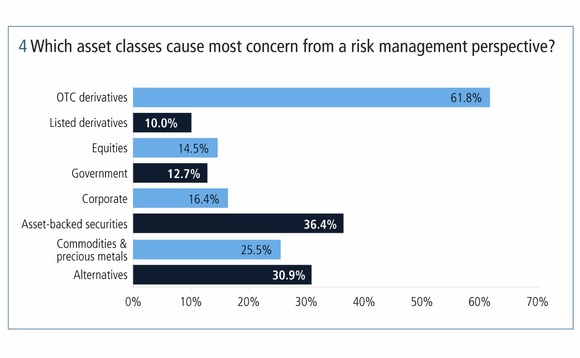

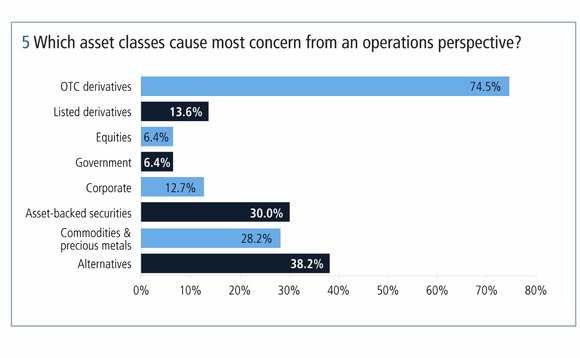

Buy-side firms praise derivatives’ usefulness when it comes to risk management but, ironically, survey respondents say these very same instruments pose the greatest operational and risk management challenges to their portfolios (figures 4 and 5) – and bilateral, over-the-counter (OTC) products most of all.

Those surveyed were not short of reasons why this is the case. Accuracy of pricing was one common response alongside increased trading costs. A regulatory-driven shift towards cleared derivatives has drained the old-style OTC market of liquidity and thrust complex capital, accounting and margining charges onto the sell side. One striking statistic captures the scale of the transformation this has wrought: outstanding notionals on OTC contracts shrunk 30% in 2015 alone.

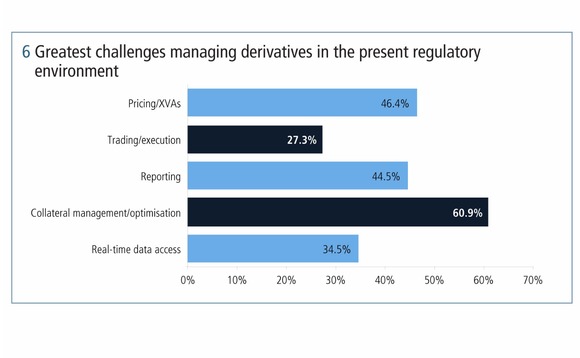

From the buy-side perspective, these changes have been made manifest through derivatives valuation adjustments (XVAs) on OTC contracts, the size of which differs between dealers and muddies the water when it comes to pricing. Forty-six per cent of respondents said pricing and XVAs were their biggest challenges in managing derivatives (figure 6).

The introduction of margining requirements for non-cleared derivatives will layer on additional complexity when it comes to trading OTC. Implementation of the new regime began for the world’s biggest banks on September 1. The buy side will get its first taste of posting regulatory mandated variation margin on March 1, 2017; and all swaps entities will need to begin delivering initial margin from September 1, 2019.

Already the shockwaves triggered from the first wave of implementation are making themselves felt. “We have already noticed some derivatives pricing impacts as a consequence of these new rules,” says Standard Life’s Robertson.

Yet, in spite of the new regime already being upon the market, surprisingly few buy-side firms surveyed appear confident of their readiness for when their turn comes. Less than one-third said they were either fully or partially compliant with Basel Committee on Banking Supervision/International Organization of Securities Commissions’ margin standards, from which the regional regulations derive, and a huge 67% said they did not know about their level of compliance. That percentage will need to shrink dramatically in coming years if buy-side firms wish their derivatives programmes to continue.

Cleared derivatives are already subject to the exchange of margin, and now that non-cleared contracts must follow suit, the number of collateral arrangements needed to support derivatives transactions will rise. Indeed, data from the most recent margin survey from the International Swaps and Derivatives Association (Isda) shows that the use of credit support annexes (CSAs), which facilitate the posting and receiving of collateral, increased across every asset class in 2014. The use of CSAs by insurance firms that year alone reached 88%, while for mutual funds the figure was 68.8% – and these percentages will edge closer to 100 as the non-cleared margining rules continue to roll out.

Collateral management

This being the case, the value of an efficient collateral management infrastructure should become self-evident to an ever-larger number of firms. This year’s survey respondents indicated that collateral management and optimisation are the greatest challenges they face when it comes to managing derivatives – suggesting that updating the systems and processes related to these tasks is a high priority.

Standard Life Investments has gotten to grips with this challenge: “Our collateral management infrastructure and activity over the last few years has been a key focus area and complements our portfolio management infrastructure in order to deal with the ever-increasing market complexities in this space,” says Robertson. “Our end-to-end OTC clearing and bilateral models have been updated in recent years, driven from our portfolio management platform with collateral/margin management a key factor in the end-design. Our middle-office and collateral management services are now aligned with one service provider, which provides the foundation to a modern and effective portfolio and collateral management model built with scalability, flexibility and optimisation in mind.”

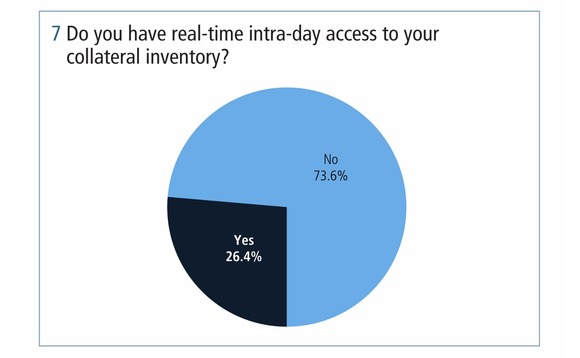

However, survey responses suggest there is still much work to do across the industry as a whole and that firms lack certain tools that could help streamline their collateral management processes. For example, almost three-quarters of respondents said they do not have real-time intra-day access to their collateral inventory (figure 7). Without this capability, institutions lack the insights that could facilitate more efficient collateral trading and generate improved revenues. Cash and securities sitting unproductively in a collateral inventory that could be better deployed elsewhere only serve to drag on the performance of a firm’s portfolio.

It may be the case, though, that some survey respondents have fully outsourced their collateral management processes and that a third party handles inventory review and optimisation.

This is the case at Danish pension fund PKA. “Since 2009 we have outsourced our collateral management needs. We receive daily statements, which declare all our current positions – that is our set-up at present,” says Inger Pedersen, head of fixed income at the fund. However, she adds that the firm does retain intra-day access to its collateral inventory.

Attaining efficient collateral management is an iterative process too. Aviva’s Snyman explains that, although he is satisfied with his firm’s set-up at present, the evolving regulatory and market environment means it will need to keep investing in its systems to stay ahead of the requirements.

Collateral management is just one facet of buy-side firms’ broader portfolio management infrastructure, and the growing complexity of derivatives markets should have strengthened the incentive for these institutions to invest in souped-up technologies to better control their exposures and margining obligations. Yet this year’s survey results show that remain areas of weakness remain among firms’ systems.

For example, while roughly one-fifth of respondents said their current set-up supported real-time, consolidated portfolio views, portfolio gains and losses, and simple risk calculations extremely well, barely one in 10 could say the same when it came to advanced risk calculations – such as credit valuation adjustment and convexity – and fewer than one in 10 said so when it came to performance measurement and benchmarking.

Improving in these areas would grant firms mastery of their derivatives portfolios and allow them to be more nimble in reacting to fast-emerging risks. Whether they can be convinced the benefits are worth the increased upfront investment, though, remains to be seen.

Blockchain – Much to prove

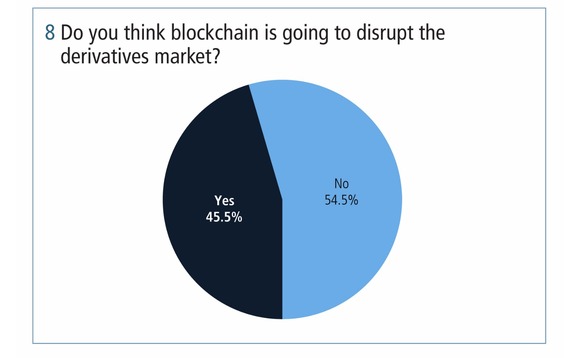

In a first for this annual survey series, respondents were asked their views on how blockchain technology could transform the derivatives market. The potential for this technology to uproot clearing and settlement in financial markets has been much discussed on the conference circuit – and divided opinion in the industry. Survey respondents were split down the middle on the question, with 45.5% saying blockchain would disrupt the industry, and 54.5% saying it wouldn’t (figure 8).

Aviva’s Snyman is a stakeholder in the latter camp. “Derivatives aren’t commodities like bonds, so the transfer mechanism isn’t as standard,” he says, suggesting that it will be more difficult to apply the technology to this market than it would be the cash securities markets.

The promise of blockchain was also discussed at Isda’s North America regional conference in September, where panellists expressed scepticism that it would trigger a sea change in how derivatives markets operate. One likened the technology to scientists’ exploration of string theory, a branch of physics much discussed but from which few practical applications have been derived. For now, both the buy side and sell side will have to wait to see if the promise of blockchain will be fulfilled.

Read/download the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net