This article was paid for by a contributing third party.More Information.

Managing the secured versus unsecured basis risk: Hedging with a secure benchmark

With huge volatility in the spread between secured and unsecured funding rates, hedgers require accurate, bespoke instruments to avoid risk, explain Frank Odendall and Maesa Beany of Eurex. New Secured Funding Futures, using Stoxx® GC Pooling EUR Deferred Funding Rate as a benchmark, will hedge against any widening rate discrepancy.

The financial crisis of 2008 showed that the Euribor discounting of derivatives portfolios was flawed because of inherent credit risk. Subsequently, the Eonia, perceived as a near risk-free funding rate, was implemented at great one-off cost to some market participants – the Libor/overnight index swap (OIS) spread reached 364 basis points (bp) in October 2008.

This state of affairs doesn’t take into account the secured, collateralised repo financing, whereby – according to data from the European Central Bank (ECB) and European Repo Council (ERC) – around 80–90% of interbank funding is currently on a collateralised basis and very short term (80% up to one month).

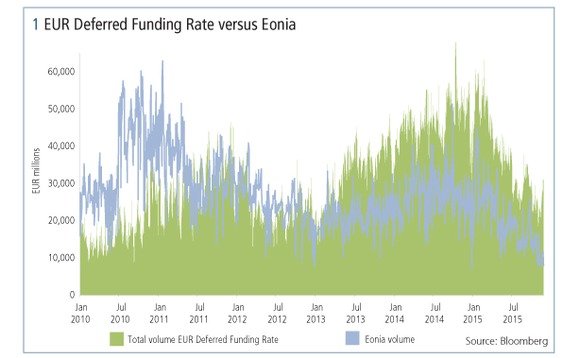

Eonia funding volumes have often dropped to as low as €7 billion (under €3.3 billion at year end), meaning an individual bank’s financing can now directly impact the Eonia rate. It is apparent that Eonia no longer mirrors true funding behaviour and costs, nor does it adequately reflect the ECB’s liquidity provision (figure 1).

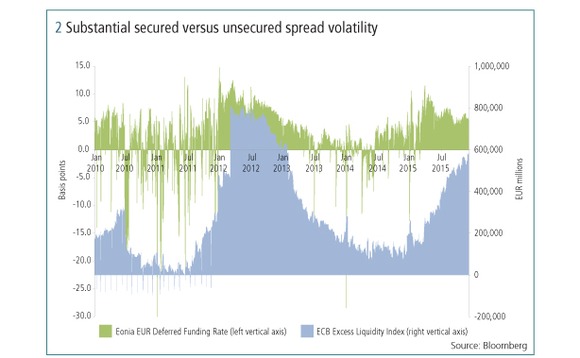

Unsecured (Eonia) and secured rates (for example, the STOXX GC Pooling EUR Deferred Funding Rate1) can differ substantially, and their spread is highly volatile (figure 2), especially during periods of increased central bank activity. As a result of the latest market developments, Eonia swaps – which have traditionally been used to hedge a repo’s interest rate risk – are generating an increasing amount of basis risk. This calls into question their adequacy as a hedging tool.

The spread between unsecured and secured funding rates, currently at 5bp, is highly volatile, and secured rates can persistently deviate from unsecured rates.

In addition, the spread is highly correlated to the amount of excess liquidity, with repo rates anticipating changes in monetary policy significantly earlier than Eonia. Currently, EUR excess liquidity is well below the high levels it reached in 2012. It is uncertain how high the spread could rise if the current trajectory of excess liquidity were to continue or how additional liquidity injections by the ECB would impact the spread.

The impact of the basis between secured and unsecured does not only highlight mishedging of repo transactions. More significantly, a large proportion of EUR-denominated derivatives somehow reference Eonia directly or indirectly. For example, despite increasingly less unsecured overnight interbank financing, the vast majority of derivatives contracts and credit support annexes still apply Eonia when charging clients on their outstanding loans. Some counterparties, especially those with high-positive mark-to-markets on their derivatives portfolios, are currently incurring systematic losses as Eonia is charged on the balance, but only repo rates are achievable through reverse repos overnight.

There were no tools available that allowed the hedging of the aforementioned basis until Eurex Exchange launched its STOXX GC Pooling EUR Secured Funding Futures in November 2014 (OMEA < Cmdty> on Bloomberg). These are based on short-term repo transactions traded on Eurex Repo’s regulated and active GC Pooling market.2 They are the first pan-European contracts that reference interest rates on collateralised funding, and the most capital-efficient instrument to hedge against a further widening of the unsecured versus secured interest rate spread.

The underlying of the futures contract is based on a STOXX benchmark and liquidity is supported by market-makers. The standard Eurex trade entry services are available: for example, block trade, exchange for physicals or exchange for swaps supporting an OTC trade execution.

STOXX, the index provider, developed a series of International Organisation of Securities Commissions-compliant short-term benchmark interest rates based on the significant trading volumes on GC Pooling in 2013. The ECB frequently referred to the STOXX GC Pooling rates in its analysis of European money markets in its annual money market survey in April 2015. In September 2015, the ECB announced the replacement of the Eurepo index with the STOXX GC Pooling rates.

As uncertainties in the repo market persist, more precise and tailored hedging instruments should become increasingly appealing. The STOXX GC Pooling EUR Secured Funding Futures might be an attractive solution for those market participants who are looking to hedge their repo funding costs more accurately or are concerned about a further widening of the unsecured versus secured interest rate spread.

1 STOXX GC Pooling EUR Deferred Funding Rate is the rate calculated independently by STOXX and based on the Eurex repo GC Pooling market. It is the rate resulting from the volume-weighted average repo transactions on open order book of EUR OverNight, TomNext and SpotNext transactions with the same value date in the GC Pooling ECB basket and ECB extended basket.

2 Eurex Repo’s regulated, anonymous GC Pooling interbank repo market is the pan-European marketplace for short-term financing against HQLA eligible assets. It has seen significant growth in members and volumes over recent years and has developed to the focal point of European liquidity trading with 127 members, approx. €150 billion outstanding repo notional, and is cleared by Eurex Clearing AG.

Read/download the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net