SSgA looks to credit volatility

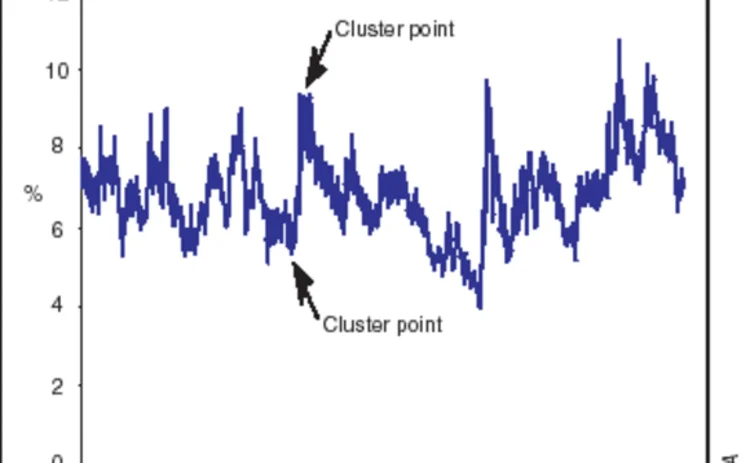

Boston-based State Street Global Advisors (SSgA) has around $30 billion invested in US Treasuries. And now it wants to be the first major asset manager to put in place a Garch trading model to take bets on US Treasury market volatility – a change in its quantitative modelling that the firm wants to make next year.

“I’m not aware of any other fund manager using a model like ours,” says Mark Hooker, principal at SSgA and head of its advanced research centre in London, a stand-alone unit dedicated

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Markets

Banks mull whether to stick or twist with SDPs

Fewer providers are going all-in on single-dealer platforms, which may lead to consolidation

Market for ‘orphan’ hedges leaves some borrowers stranded

Companies with private credit loans face punitive costs from banks for often imperfect hedges

Green knights? Banks step into struggling carbon credit markets

Clearer global standards and a new exchange may attract dealer entry, but supply and demand challenges remain

Morgan Stanley back on top for US insurer FX forwards trades

Counterparty Radar: Bank added $1.7bn with Mass Mutual in Q4 to overtake Citi as biggest dealer

Euronext microwave link aims to cut HFT advantage in Europe

Exchange plans to level playing field between prop firms and banks in cash equities with cutting edge tech

As dispersion hikes in price, equity traders slice and dice

Banks tout alternative versions of relative value vol strategy, including reverse dispersion

Crédit Agricole hires head of USD swaps and UST trading

John O’Callaghan joins French bank in New York from Garda Capital

Hidden Road ready for rush hour after FCM approval

Prime broker is trading “trillions” of notional with “a few hundred” counterparties in FX and crypto

Most read

- Top 10 operational risks for 2024

- The American way: a stress-test substitute for Basel’s IRRBB?

- Filling gaps in market data with optimal transport