Credit data: the retail apocalypse continues

Consumers are spending, but brick and mortar retailers continue to struggle

US retailers appeared to have turned a corner in 2018. The Trump administration’s tax cuts lifted consumer spending and retail sales grew by more than 6% that summer. After a period of steady decline, the credit ratings of major US retailers began rising again.

The optimism was short-lived. The industry’s fortunes deteriorated sharply in 2019, with 23 major bankruptcies – including clothing retailers Diesel and Forever 21 and department store Barneys – and nearly 10,000 store closures. According to Credit Benchmark data, sourced from financial institutions, credit quality in the US retail sector has dropped 5% since April 2019.

The UK retail sector has fared even worse. With Brexit uncertainty sapping consumer sentiment, and no fiscal stimulus to boost spending, the credit risk of UK retailers has increased by 13% since 2017.

A sustained turnaround is unlikely. Bricks and mortar retailers appear to have no answer for Amazon and other online competitors. Many are loaded with debt and struggling to cut costs. Over half of UK and US general retailers are already in non-investment-grade categories. Even a mild pullback in consumer spending could push the sector over the edge.

This month, we also look at recent data on single-name sovereigns and credit risk of airlines as well as leisure and recreation industries.

Global credit industry trends

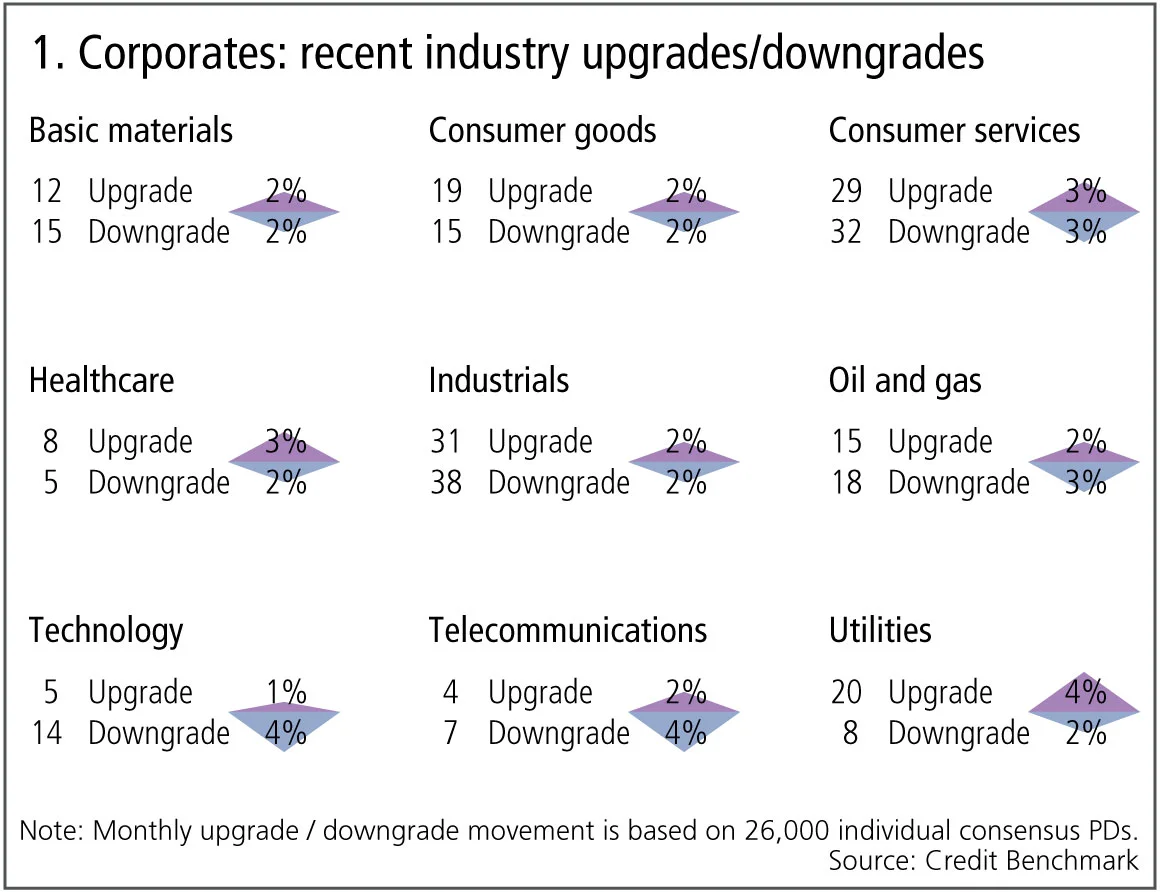

The latest consensus credit data shows credit activity for corporates and financials has reduced, with 4.3% of entities moving by at least one notch, compared with 4.9% last month. Figure 1 shows detailed industry migration trends for the most recent published data, adjusted for changes in contributor mix.

Figure 1 shows:

- Globally, corporate downgrades and upgrades are in balance.

- Upgrades outnumber downgrades in two of the nine industries, three industries are biased towards downgrades and four are in balance.

- Technology has more downgrades than upgrades for the fourth month.

- Oil and gas and telecommunications see downgrades dominating for a second month.

- Utilities sees upgrades outnumber downgrades for the second month.

- Healthcare sees upgrades outweighing downgrades after two months of balance.

- Industrials and consumer goods are in balance after at least a quarter of downgrades dominating.

- Basic materials is in balance after downgrades outweighing upgrades for two months.

- Consumer services is in balance for the second month.

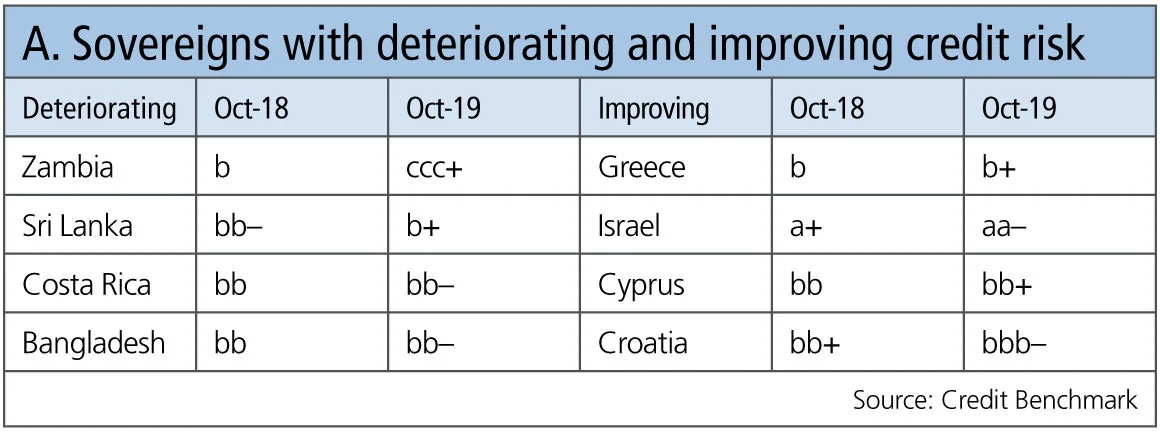

Sovereign movements

Sovereign credit ratings have been very active in the past year. Civil unrest has been a growing issue, with countries as diverse as Chile, Hong Kong and the Lebanon demonstrating that apparently minor issues can trigger major political tensions. But some countries that have not been prominent in the news have seen modest but persistent trend changes in bank views of credit. Table A shows some of the less well-known 12-month changes where there have been multiple incremental movements in bank opinions in recent months, leading to at least one full notch change over the past 12 months.

Table A shows:

- Zambia stands out as showing persistent credit deterioration, with multiple banks changing their views and a cumulative multiple-notch downgrade in the past 12 months.

- Bangladesh, Costa Rica and Sri Lanka also show sustained, but so far single-notch, deterioration.

- Countries showing sustained improvements include Croatia, Cyprus, Greece and Israel. So far these have resulted in single-notch upgrades but further increases are possible if the monthly trend improvements continue.

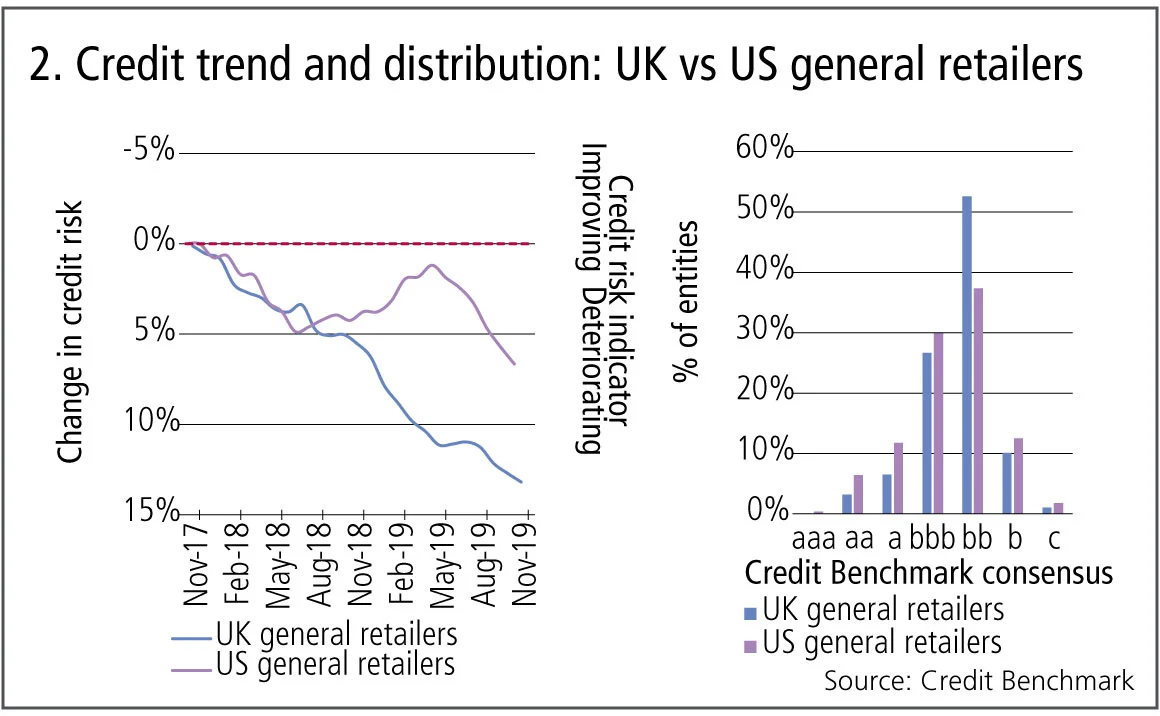

UK and US general retailers

The ‘retail apocalypse’ shows no signs of slowing down, with multiple chains, including Bed Bath & Beyond, Chico’s, Gap and Sears all announcing major store closure plans for 2020. The shift to online shopping is one of the main drivers, but many physical retailers are also saddled with heavy debt burdens. Already weak balance sheets will face further strain if trade wars push up consumer goods prices or lead to supply disruptions.

Figure 2 shows the credit trends and distributions of 700 UK and 280 US general retailers.

Figure 2 shows:

- UK general retailers have been continuously deteriorating for the past two years, with credit risk increasing 13%.

- US general retailers deteriorated at a similar pace to UK general retailers until July 2018; the sustained improvement – probably driven by the Trump stimulus – lasted nearly a year.

- Since April 2019, credit risk of US general retailers has again been deteriorating and has since increased by more than 5%.

- UK and US general retailers have 64% and 52% of entities in non-investment grade, respectively, with over 50% of UK general retailers having a credit category of bb.

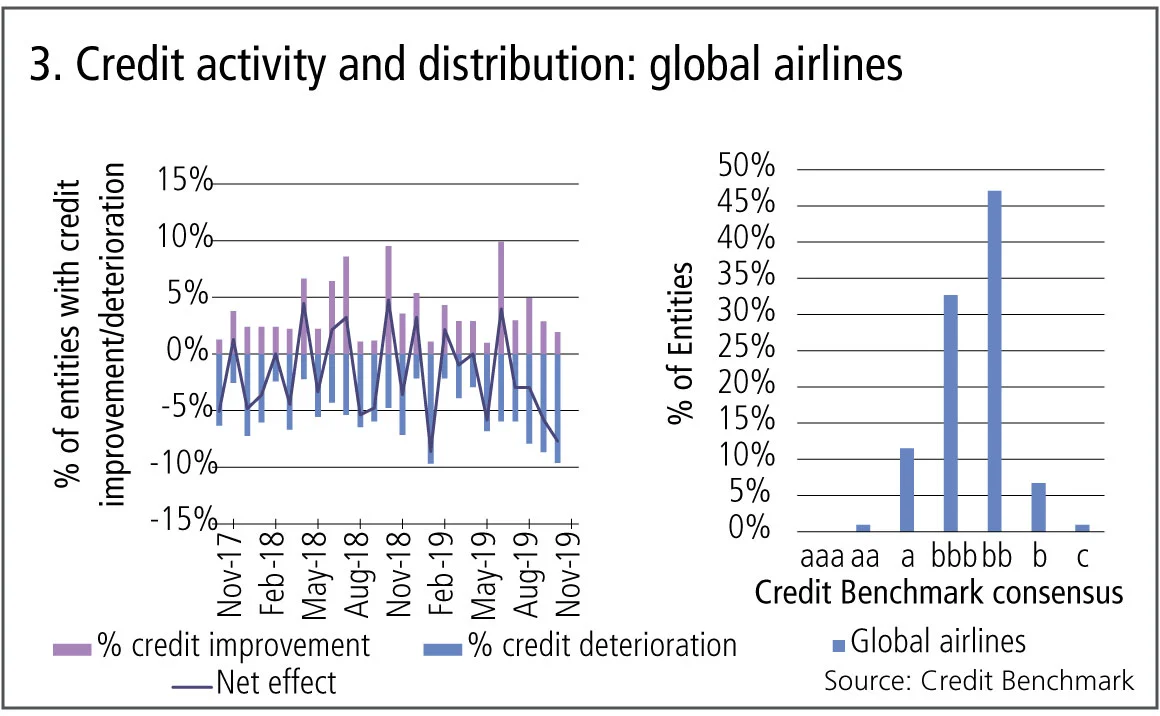

Global airlines

This month, state-owned South African Airways went into “voluntary business rescue” – similar to Chapter 11 in the US. It joins the growing list of airlines – Primera, Skywork, Thomas Cook and Condor, and Wow – that have been close to or have already collapsed.

Figure 3 shows the credit activity and distribution since October 2017 for 100 airline companies.

Figure 3 shows:

- Global airlines have seen more deteriorations than improvements in eight of the last 12 months.

- The increasingly negative net effect shows the balance between improvements and deteriorations is progressively more skewed towards deteriorations.

- The majority of global airlines have a credit category of bb, with 1% having a consensus of c.

Leisure and recreation industries

Even in difficult economic times, there are some industries that seem to thrive. The ‘wellness’ industry is booming, growing by an average of 6.4% between 2015–17 compared with global GDP of 3.6%. An emphasis on health and fitness has been a boon for gyms and leisure centres, and “athleisure” has become a phenomenon in the apparel industry, projected to be a $350 billion market globally by 2020. Major multinational sporting events such as the football, cricket and rugby world cups are attracting growing global audiences and boosting athletic participation.

Figure 4 shows credit trends since October 2017 for 70 European recreational services, 90 global leisure goods and 30 US leisure goods.

Figure 4 shows:

- US leisure goods had the sharpest deterioration of the three aggregates in the year from October 2017, a 20% increase in credit risk. However, this was succeeded by an equally steep improvement; the credit risk of US leisure goods is now lower than it was in October 2017.

- With the exception of the latest month, all three industries have been improving in credit risk since at least May 2019.

- Global and US leisure goods show a flattening in recent months. It is not yet clear if this is due to supply chain headwinds or just a temporary pause in a secular uptrend.

About this data

Credit Benchmark collects monthly credit risk inputs from 40-plus of the world’s leading financial institutions, making it possible to follow credit trends across geographies and industries. In all, the dataset contains consensus ratings on about 50,000 rated and unrated entities globally.

David Carruthers is head of research at Credit Benchmark.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Comment

Op risk data: Tech glitch gives customers unlimited funds

Also: Payback for slow Paycheck Protection payouts; SEC hits out at AI washing. Data by ORX News

Op risk data: Lloyds lurches over £450m motor finance speed bump

Also: JPM trips up on trade surveillance; Reg Best Interest starts to bite. Data by ORX News

Georgios Skoufis on RFRs, convexity adjustments and Sabr

Bloomberg quant discusses his new approach for calculating convexity adjustments for RFR swaps

In a world of uncleared margin rules, Isda Simm adapts and evolves

A look back at progress and challenges one year on from UMR and Phase 6 implementation

Op risk data: Morgan Stanley clocked in block trading shock

Also: HSBC deposit guarantee gaffe; Caixa hack cracked; reg fine insult to cyber crime injury. Data by ORX News

Digging deeper into deep hedging

Dynamic techniques and gen-AI simulated data can push the limits of deep hedging even further, as derivatives guru John Hull and colleagues explain

How AI can give banks an edge in bond trading

Machine learning expert Terry Benzschawel explains that bots are available to help dealers manage inventory and model markets

Op risk data: US piqued by Pictet tax breach

Also: US Bank’s Covid failings; South Korea’s short-selling clampdown. Data by ORX News