Strength from swaps

Asian nations are becoming increasingly assertive in co-ordinating financial stability efforts in the Asia Pacific, notably via a raft of new swap agreements between the region's largest economies. Are these efforts having the desired impact? Christopher Jeffery reports

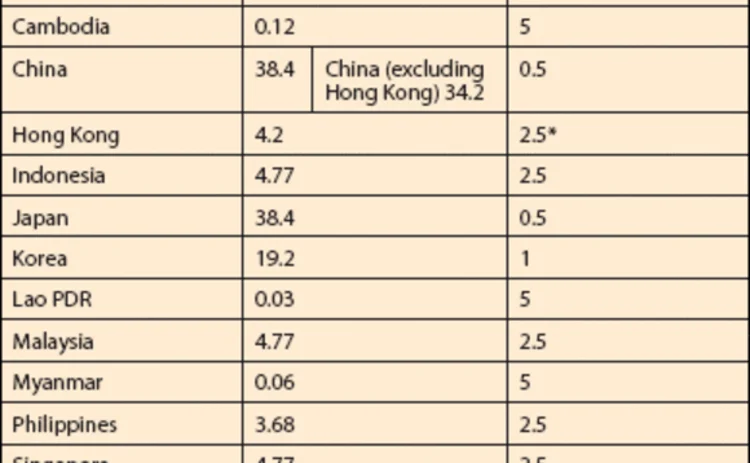

The global financial crisis has had a marked negative impact on a number of Asian economies. This is particularly the case in South Korea, where domestic banks and the branches of foreign banks have struggled to meet their short-term US dollar funding needs. It's also been the case in Indonesia, whose high fiscal deficit has undermined the country's financial status and banks have faced difficulty to meet corporate medium-term US dollar debt funding needs.

US dollar funding problems have

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Financial stability

A regulatory storm hits China

Regulators are imposing a new wave of tighter financial supervision

Haldane dismisses talk of monetary and macro-prudential tensions

Bank of England’s Andrew Haldane says it is a virtue that different tools can be used to meet conflicting objectives

Central banks laying the seeds for crisis, says UK MP Baker

Chair of UK parliamentary group for economics says a sharp correction in developed world sovereign bond prices could spark a collapse in confidence

Q&A: Mark Branson on the too-big-to-fail problem, modelling and Basel III

Switzerland went first – and furthest – on post-crisis banking reforms, making its industry a test case for the impact of the new regime. But it has not yet solved the too-big-to-fail problem, Mark Branson, chief bank supervisor at Eidgenössische…

Risk Annual Summit: Depositors will trust EU guarantee despite Cyprus, says BdF official

Policy-makers have incentive to accelerate deposit guarantee plans, says Sylvie Matherat of the Banque de France

Risk Annual Summit: Banking union set for mid-2014, says ECB

National supervisors made “gigantic mistakes”, says ECB's financial stability head

RBI sees developing repo markets necessary in meeting Basel liquidity rules

India central bank views repo as an increasingly important market in the wake of Basel III implementation

ESRB narrows its macro-prudential tools

The European Systemic Risk Board is about to announce a slimmed-down list of potential macro-prudential tools, but who has the power to use them is still the subject of debate. By Michael Watt

Most read

- Top 10 operational risks for 2024

- Japanese megabanks shun internal models as FRTB bites

- Top 10 op risks: third parties stoke cyber risk