Strict hedge fund rules in Korea hinder market growth

The newly born Korean hedge fund market has made swift progress – but regulatory obstruction makes it difficult for funds to get both clients and prime brokers

Following a three-year gestation period, the Korean hedge fund market burst into life on December 23, 2011. By the end of February 2012, 12 Korean managers had registered 17 funds with a total of $500million of assets under management – and market observers are bullish there is much more to come.

The Korea Institute of Finance estimates that total assets under management (AUM) could hit 13 trillion won ($11.5 billon) in the next two years – on a par with the Japanese market, which has had two decades to reach that level. Given the country’s status as Asia’s third-largest economy and predictions of continued growth, this surely means South Korea is on the radar for international banks looking for new sources of income for their prime brokerage businesses.

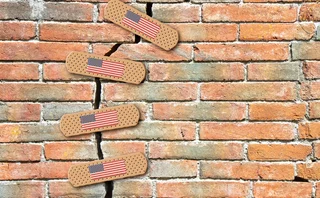

Not so, says one senior Asian prime broker: just as South Korea’s hedge fund market took four years to emerge from a regulatory cul-de-sac, the supervisors have erected barriers to entry around the market, making it difficult for non-local players to participate. “It’s as if you create a Korean F1 race with all the cars made by Korean manufacturers with just Korean drivers racing on a Korean circuit,” he says.

According to Warren Park, senior analyst at Hana Institute of Finance in Seoul, the issue has much to do with the need to establish few, but stronger, players among the domestic finance sector. He cites as an example stipulations from the domestic regulator, the Financial Services Commission, that prime brokers must hold 3 trillion won of capital. According to Park this figure is “quite arbitrary” from a risk management perspective, but that it has been set at that level so that “the top three or four firms can raise that much capital”.

A strong regulatory framework has been a feature of the Korean hedge fund market from when it was first mooted in 2008. Then it was stipulated that at least 50% of the assets of onshore private placement funds had to be invested in distressed companies in the wake of the financial crisis. Unsurprisingly no hedge funds were established.

The Financial Services Commission (FSC), the domestic regulator, then set up another task force in 2010 and arrived at a new set of guidelines enacted in September last year. On the plus side for potential hedge funds, the 50% rule was removed but several others were added that meant significant amounts of cash would be needed to set up or invest in a fund.

Investors must stake a minimum investment of 500 million won ($450,000), while securities firms wishing to set up a fund must have 1 trillion won in capital, and asset managers 10 trillion won in AUM. According to the FSC, it looked at regulations on size, capacity, manpower and reputation in order to limit risk in the hedge fund industry.

Prime brokers don’t escape either. A firm wishing to enter the Korean market in order to service local hedge funds needs 3 trillion won of capital – a high figure for domestic firms and one that effectively excludes their international peers from the market altogether, says Park. “International firms would need to register as a fully registered subsidiary so effectively offshore prime brokers are excluded because this would require ringfencing all that capital within Korea. The regulator would like to see that they participate indirectly by working with a local securities firm,” he says

And unlike most markets, funds can’t use prime brokers from their own firm, so Samsung can’t use its own prime broker to service its hedge fund. David Bennett, in prime services sales at Barclays Capital in Singapore, says this is to avoid perceived conflicts of interest over financing rates by prime brokers to their affiliate hedge funds.

These rules contrast with the way prime brokers usually operate internationally. Hannah Goodwin, regional head of prime brokerage Asia-Pacific at Citi in Hong Kong, says: “It is closed off to non-Korean service providers at this point which is different to any other place. Most international prime brokers run their business off a London entity and so a Singaporean hedge fund will still interact with an international prime broker.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Industry calls for major rethink of Basel III rules

Isda AGM: Divergence on implementation suggests rules could be flawed, bankers say

Saudi Arabia poised to become clean netting jurisdiction

Isda AGM: Netting regulation awaiting final approvals from regulators

Japanese megabanks shun internal models as FRTB bites

Isda AGM: All in-scope banks opt for standardised approach to market risk; Nomura eyes IMA in 2025

CFTC chair backs easing of G-Sib surcharge in Basel endgame

Isda AGM: Fed’s proposed surcharge changes could hike client clearing cost by 80%

UK investment firms feeling the heat on prudential rules

Signs firms are falling behind FCA’s expectations on wind-down and liquidity risk management

The American way: a stress-test substitute for Basel’s IRRBB?

Bankers divided over new CCAR scenario designed to bridge supervisory gap exposed by SVB failure

Industry warns CFTC against rushing to regulate AI for trading

Vote on workplan pulled amid calls to avoid duplicating rules from other regulatory agencies

Bank of Communications moves early to meet TLAC requirements

China Construction Bank becomes last China G-Sib to release TLAC plans

Most read

- Top 10 operational risks for 2024

- Japanese megabanks shun internal models as FRTB bites

- LCH issued highest cash call in more than five years