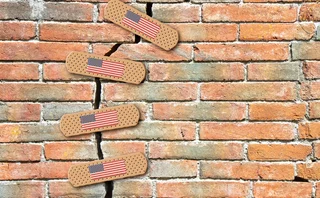

Regulatory straitjacket?

South Korea introduced a raft of new legislation with the aim of helping make Seoul a world-class financial centre prior to the financial crisis. But the events of 2007–08 proved a game changer as regulators grappled with the damage wreaked by kikos and other problems. Subsequent new rules have created significant barriers to entry and may be thwarting the country’s international ambitions. Harry Thompson reports

In the good times before the global financial crisis, Korea appeared to be a ‘model student’ of the International Monetary Fund. To build on this, it was making noises about opening up its capital markets to international competition. The government’s stated aim for some time has been to turn Seoul into an international financial hub or, at the very least, a regional one. And the authorities have introduced several pieces of significant new regulation during the past two years to help this

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Industry calls for major rethink of Basel III rules

Isda AGM: Divergence on implementation suggests rules could be flawed, bankers say

Saudi Arabia poised to become clean netting jurisdiction

Isda AGM: Netting regulation awaiting final approvals from regulators

Japanese megabanks shun internal models as FRTB bites

Isda AGM: All in-scope banks opt for standardised approach to market risk; Nomura eyes IMA in 2025

CFTC chair backs easing of G-Sib surcharge in Basel endgame

Isda AGM: Fed’s proposed surcharge changes could hike client clearing cost by 80%

UK investment firms feeling the heat on prudential rules

Signs firms are falling behind FCA’s expectations on wind-down and liquidity risk management

The American way: a stress-test substitute for Basel’s IRRBB?

Bankers divided over new CCAR scenario designed to bridge supervisory gap exposed by SVB failure

Industry warns CFTC against rushing to regulate AI for trading

Vote on workplan pulled amid calls to avoid duplicating rules from other regulatory agencies

Bank of Communications moves early to meet TLAC requirements

China Construction Bank becomes last China G-Sib to release TLAC plans

Most read

- Top 10 operational risks for 2024

- Japanese megabanks shun internal models as FRTB bites

- Market for ‘orphan’ hedges leaves some borrowers stranded