So, we made some predictions five years ago...

Risk30: looking back at Risk25's 'firms of the future'

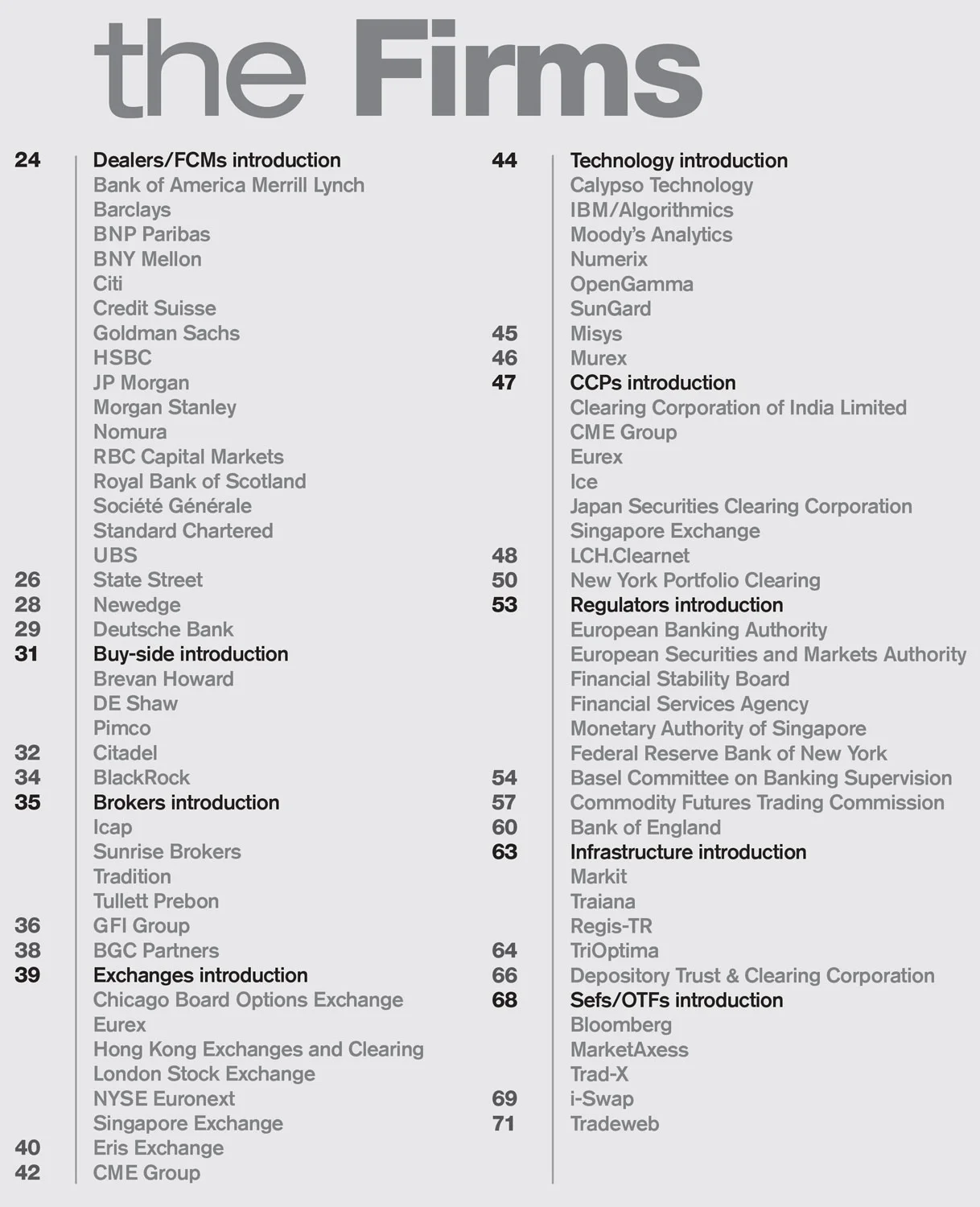

Five years ago, as part of Risk’s 25th anniversary issue, we picked a list of companies we felt would be most influential in over-the-counter derivatives markets over the following five years.

At the time, it was fun. But if you’re going to make those sorts of predictions, then you have – at some point – to own up to any blindspots and bad calls. That point has now arrived.

To be fair, plenty has changed since mid-2012. When the selection was made, markets were fairly jittery – Mario Draghi had just made his famous pledge to do “whatever it takes” to protect the euro; the full violence of post-crisis prudential reforms was not clear; and pending market structure reforms promised drama they have yet to deliver.

So, how does our list – and the accompanying analysis – look today?

Overview: Risk25 write-up and profiles

Click here for the 2012 article

At first glance, the list doesn’t look too bad – in the narrow sense that most of the firms included are still operating in the OTC markets in some form. But as a list of the market’s most influential names, a second glance reveals some misfires.

There is one name that doesn’t exist anymore – New York Portfolio Clearing (NYPC) – along with Project Trinity, the ambitious horizontal clearing initiative of which it was part. Trinity got a lot of attention in the anniversary issue, via interviews with the other legs of the triumvirate, the Depository Trust & Clearing Corporation and LCH, but whatever promise it had was shut down in 2013 when Ice acquired NYSE Euronext, of which NYPC was a potentially disruptive part.

Two other firms – BNY Mellon and State Street – have exited or dialled back the clearing business that was one reason for their inclusion. Others – such as Royal Bank of Scotland – have retreated so far from OTC markets that they are barely visible.

In the credit column, it was clearly correct to stuff the list with clearing houses, and to select BlackRock, Citadel and Pimco as agents of change. The bold choice of Eris Exchange also looks sound – the venue, which has its roots in Chicago’s futures markets, continues to make inroads into the swaps community. Elsewhere, the selection of Sefs correctly favoured incumbents rather than insurgents.

Dealers: Risk25 write-up and profiles

Click here for the 2012 article

“The dealers have all booked tremendous profits from the over-the-counter market and will not give those up without a fight. Initially, at least. Over time – and depending very much on unfinished capital, liquidity and margining rules – some of the outer circle may find the business no longer hits the required return on capital. One or two of the bigger dealers may come to the same conclusion.”

That was written in August 2012. Two months later, UBS unveiled its new strategic direction, in which large portions of the OTC business were deemed non-core (see here for our profile of UBS's George Athanasopoulos). Others made more gradual retrenchments – Barclays, BNP Paribas, Credit Suisse, Deutsche Bank and Morgan Stanley among them.

This strategic shake-up means the leading dealers now have more diverse motives and interests – lessening their influence as a group – and has opened the door to traditional and non-traditional competition, from regional dealers to non-banks. Market structure change has also introduced new players to the OTC market.

Today, the circle of swaps FCMs consists solely of the larger dealers – although some regulators are keen to reduce the burden on the business, which could eventually open the door again to today’s fringe players

We saw that coming, but our guess was mandatory clearing would let swaps outsiders break into the market – not as liquidity providers, but as futures commission merchants (FCMs) that would surround sticky clearing relationships with ancillary business such as collateral transformation and management.

That has not happened. The logic could be seen in Societe Generale’s 2014 decision to buy out its co-owners of Newedge – adding futures clearing and brokerage as a way of rounding out the bank’s fixed-income business – but the arrival of the leverage ratio and the slow roll-out of clearing in Europe prompted BNY Mellon and State Street to ice their own plans.

Today, the circle of swaps FCMs consists solely of the larger dealers – although some regulators are keen to reduce the burden on the business, which could eventually open the door again to today’s fringe players.

It is also fair to say the power of the top dealers has not diminished that much – it can still be seen in initiatives such as the International Swaps and Derivatives Association’s standard initial margin model, Acadiasoft’s margining utility, and Isda’s new project to create a common domain model for the swaps market.

Buy-side: Risk25 write-up and profiles

Click here for the 2012 article

“Buy-side firms are seizing the moment. They could have adopted a defensive attitude while over-the-counter markets were being rebuilt, speaking up only when their business model was threatened. Instead, a handful of firms have become activists, influencing key issues like the design of collateral segregation regimes, clearing documentation, credit checks and block trading.”

Has that moment passed? Sort of. Firms such as BlackRock and Pimco had loud voices – often, behind the scenes – while the Dodd-Frank Act and European Market Infrastructure Regulation were being drawn up, but they seemed content to take a back seat once those regimes were more or less in place.

They are now speaking up more selectively – in the context of clearing house resolution, for example or, most recently, attempts to transition the swaps market away from Libor.

The buy-side is more visible in other ways as well. For Risk25, Citadel was selected as a buy-side representative, but in the accompanying interview, founder and chief executive Kenneth Griffin warned dealers of his plans to launch an interest rate swaps market-making business via the firm’s Citadel Securities entity. He made good on that promise after the US swaps clearing mandate took effect. In 2014, the firm became the first swaps market outsider to break into that business – a historic feat.

Citadel Securities remains an exception, however – as Griffin predicted it would. Bond and credit derivatives platforms see some opportunistic buy-side market-making, and some firms are said to be eyeing opportunities to step in when banks become subject to new trading book capital rules, but most of the insurgent threat to dealers in OTC trading has so far come from regional banks.

What Risk25 did not foresee was the extended period of low volatility that has hurt hedge funds and active managers over the past couple of years, spurring the continued growth of the largest asset managers and of passive and rules-based investing. No systematic funds or managers made the list in 2012 – they would today.

Brokers: Risk25 write-up and profiles

Click here for the 2012 article

“Interdealer brokers have long known the future is electronic … those with execution platforms that attract the most liquidity will win the day. In many respects, brokers will begin to resemble exchanges, leading some to predict acquisitions between the two sectors will pick up. Scale will be important, although there may still be room for specialist, niche brokers, participants say.

The customer base may also change. With banks increasingly weighed down by higher capital requirements and rules prohibiting proprietary trading, hedge funds may start to play a larger role as market-makers.”

That’s not wrong. But it’s also not quite right.

Strategically, voice still plays a big role – and brokers only look like exchanges in a vague, impressionistic sense

Scale certainly proved important – mergers and acquisitions have cut the six brokers listed in 2012 down to three today. It’s also correct to say those three have more diverse client bases than they did five years ago, with more buy-side firms included (though not because hedge funds have stepped into a market-making role).

Strategically, though, voice still plays a big role – and brokers only look like exchanges in a vague, impressionistic sense. As Icap built its portfolio of post-trade and market structure assets, it seemed to suggest a possible new direction for the sector as a whole but, in the end, the strategic conflict was resolved this year by splitting Icap in two (see our profile of Michael Spencer here). The voice-broking business merged with Tullett Prebon, leaving it in a three-way fight for global dominance with BGC and Tradition.

Exchanges: Risk25 write-up and profiles

Click here for the 2012 article

“Volumes make or break exchanges, so the nervy, post-crisis environment is bad news for the sector – cash equity trading is depressed and volumes continue to slide, and many futures markets are struggling. This is one reason exchanges are looking – mostly without success – for merger partners …

While the big players regroup, smaller exchanges offering products geared to the incoming regulatory environment are gaining a foothold.”

Back in 2012, the poster children for this trend were Chicago-based Eris, and Project Trinity’s plan to deliver clearing efficiencies by knitting together products traded at three different venues. Today, Eris is on the up, having lured some traditional swaps users and liquidity providers to the venue; but bigger exchanges are also getting in on the act.

Germany’s Eurex had already ‘futurised’ the OTC dividend swap, and is now trying to repeat the trick with its total return futures, which launched this year as a listed alternative to the total return swap. At CME, market participants that used to trade so-called invoice spreads – a package of interest rate swap and US Treasury bond – are increasingly turning to futures for the Treasury leg of the trade, as regulation has driven up the cost of holding bonds on bank balance sheets.

Central counterparties (CCPs): Risk25 write-up and profiles

Click here for the 2012 article

“While creating new hubs for bilateral risk may remove the opaque interdependencies that have been part of the OTC business to date, it also results in new points of vulnerability. There may need to be a guarantor for the guarantor, and central banks are the only institutions with deep enough pockets to play that role, but they are understandably wary of giving CCPs their overt backing. That means there need to be clear, sensible plans for the resolution of failed clearers. Those plans do not yet exist.”

This remains almost as true today as it was in 2012. While the Financial Stability Board issued guidance on CCP resolution in July this year, it continues to work on the issue, as do national regulators and clearing houses themselves.

Domestic supervisors have largely resisted the temptation to insist on the use of a local clearer, and LCH has made a success of protecting – and growing – its market share over the past five years

Where ‘firms of the future’ missed a trick was in the competitive environment for CCPs. As LCH’s then-chief executive, Ian Axe, warned in our interview, a common fear at the time was that clearing mandates would result in swaps liquidity splitting across a galaxy of small, national CCPs. But domestic supervisors have largely resisted the temptation to insist on the use of a local clearer, and LCH has made a success of protecting – and growing – its market share over the past five years. It is telling that, today, the most likely source of fragmentation is a post-Brexit grab for euro-denominated clearing from the EU.

Swap execution facilities : Risk25 write-up and profiles

Click here for the 2012 article

“At least 15 firms are likely to launch Sef offerings, including the established interdealer brokers, existing multi-dealer trading venues and new start-ups … The one thing they all have in common is the need to attract liquidity. Few participants think every one of the current batch of would-be Sefs is viable. Some may not make it off the launchpad, while others will need to quickly attract business or fold. Either way, the winners and losers in this new market should be decided fairly quickly.”

And they were. Ultimately, the task of attracting liquidity proved impossible for every start-up Sef bar trueEX – which has carved out a niche for itself as a portfolio optimisation utility for buy-side firms. The winners have been platforms that already had liquidity, and the struggle between these firms continues to this day.

Infrastructure: Risk25 write-up and profiles

Click here for the 2012 article

“Two of the more interesting ideas to come out of the industry this year – credit-checking hubs for trades that need to go to a central counterparty and the triBalance risk-rebalancing service offered by TriOptima – have come from infrastructure providers. This is not just plumbing, but an attempt to fix big problems for a market that is changing more rapidly than many participants can handle. There is plenty of scope for further innovation in the years ahead.”

You can tell what a good idea triBalance was by the fact lots of other people have now had it as well. In 2013, Risk lifted the lid on start-ups LMRKTS and NetOTC – the former expanding, the latter shelved – and more new players in the portfolio optimisation space have since arrived in the form of Quantile Technologies and BGC’s CapitaLab.

The credit-checking hub is also now part of the OTC market’s daily life, although there was only room for one – Traiana’s version quickly crowded out rival Markit.

Fresh innovations include a couple of big highlights: the creation and launch in 2016 of the OTC market’s margining utility, run by bank-owned Acadiasoft; and the ongoing expansion of repo clearing.

Technology: Risk25 write-up and profiles

Click here for the 2012 article

“Rather than focusing on complex financial engineering, dealers are now more concerned about clearing, liquidity, funding, collateral, documentation and regulatory compliance. This means banks need systems that can provide rapid valuations and real-time risk management – and, crucially, it means storing, sifting through and making sense of huge amounts of data.”

Like a malfunctioning GPS system, a lot of the analysis was directionally correct, but selected the wrong path

That captures some of the themes now shaping use of technology in the OTC markets, and hints at the importance now being assumed by cloud computing and machine learning – but, again, it’s pretty vague.

Interviews with Misys and Murex put some meat on the bones, with the latter in particular anticipating growing demand for new analytics and also increased outsourcing by banks – both very much on-point trends today.

Conclusion

It’s difficult to see the future.

Like a malfunctioning GPS system, a lot of the analysis was directionally correct, but selected the wrong path. Frequently, the Risk25 predictions envisaged a more complex route than the one the industry actually took.

As an example, the Risk25 article correctly foresaw the increased popularity of agency trading among dealers – but it predicted this would come about via the aggregation of Sefs.

That said – and please let us know if we’re going too easy on ourselves – we probably just about scraped through in credit.

So, would we repeat the exercise in our next anniversary issue? I don’t know. It’s hard to say right now.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Markets

Credit determinations review proposes independent members

Isda AGM: Linklaters unveils key recommendations for CDS committee overhaul

Saudi Arabia poised to become clean netting jurisdiction

Isda AGM: Netting regulation awaiting final approvals from regulators

Buy side looks to fill talent gap in yen rates trading

Isda AGM: Japan rate rises spark demand for traders; dealers say inexperience could trigger volatility

JP Morgan’s new way to trade FX overlays

Hybrid execution method allows clients to put dealers in competition via a single trading agreement

Pension funds eye 30-year Bunds as swap spread tightens

Long-dated bonds continue to cheapen versus euro swaps, and some think they might fall further

Banks mull whether to stick or twist with SDPs

Fewer providers are going all-in on single-dealer platforms, which may lead to consolidation

Market for ‘orphan’ hedges leaves some borrowers stranded

Companies with private credit loans face punitive costs from banks for often imperfect hedges

Green knights? Banks step into struggling carbon credit markets

Clearer global standards and a new exchange may attract dealer entry, but supply and demand challenges remain

Most read

- Top 10 operational risks for 2024

- Japanese megabanks shun internal models as FRTB bites

- LCH issued highest cash call in more than five years