Swaps data: breaking down CCPs’ $750 billion funding bill

Amir Khwaja of Clarus FT considers how initial margin, variation margin and default fund contributions can quickly add up

Initial margin, variation margin and default resources are three key weapons used by central counterparties (CCPs) to protect against risk. Under the voluntary Committee on Payments and Market Infrastructures and the International Organization of Securities Commissions public quantitative disclosures, over 200 quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk and more are published each quarter.

The most recent available data is for the quarter ending September 30, 2017, and shows some interesting insights. For instance, across the three metrics, the total funding requirement for all CCPs could be as high as $750 billion. Variation margin calls could be as much as 2.5 times the average, while over half of initial margin is posted as government bonds.

Initial margin required

Initial margin required from participant members is a good measure of the size of risk managed by a CCP and, aggregating this information for a wide selection of major clearing houses, we get a grand total of $500 billion.

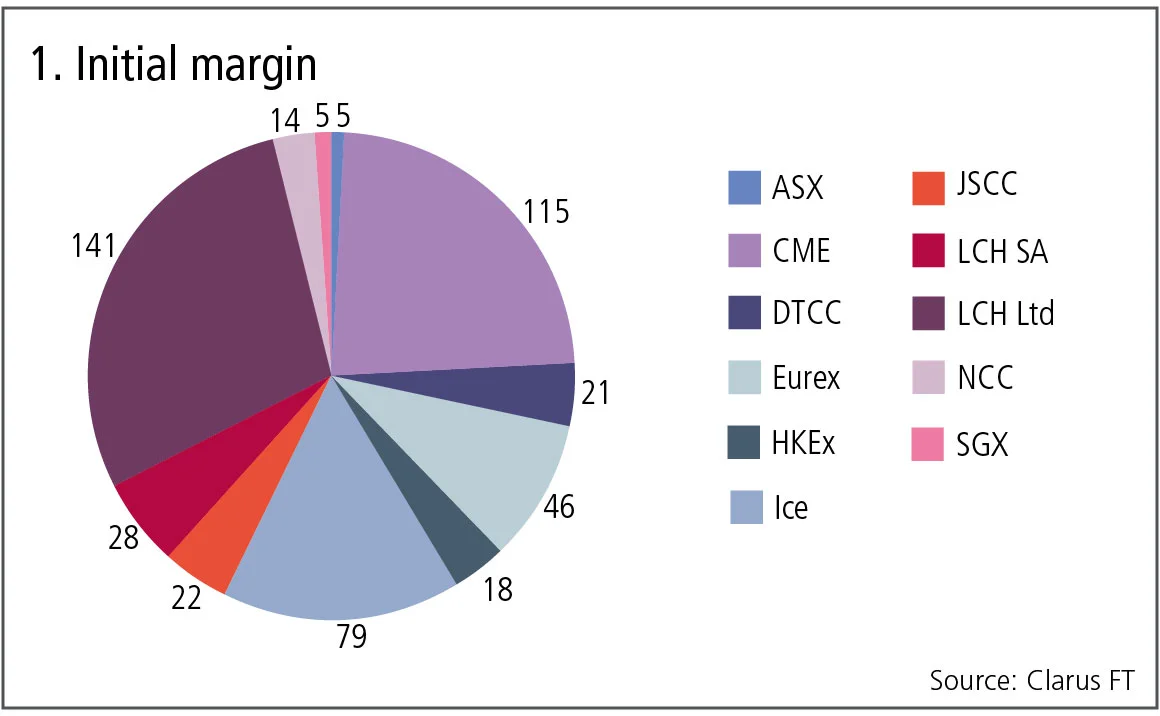

Figure 1 is the breakdown for a clearing house, with the constituent CCPs aggregated in billions of dollars.

Figure 1 shows:

- LCH Ltd with $141 billion of initial margin is the largest, of which SwapClear contributes $121 billion.

- CME is next with $115 billion.

- Ice has $79 billion, aggregating Ice Clear Credit, US futures and options, Ice Clear Europe Credit and its futures and options – no data is available for other Ice-owned CCPs.

- Eurex with $46 billion.

- LCH SA with $28 billion and the Japan Securities Clearing Corporation with $22 billion.

- The Depository Trust & Clearing Corporation with $21 billion, of which the government securities division contributes $11.7 billion.

Initial margin type

A grand total of $500 billion of initial margin is required, which is a large sum indeed. Remember, this is the amount that members are required to post at the CCP, so it is real money and not a notional number.

Let’s look at data on how these clearing houses hold initial margin funds.

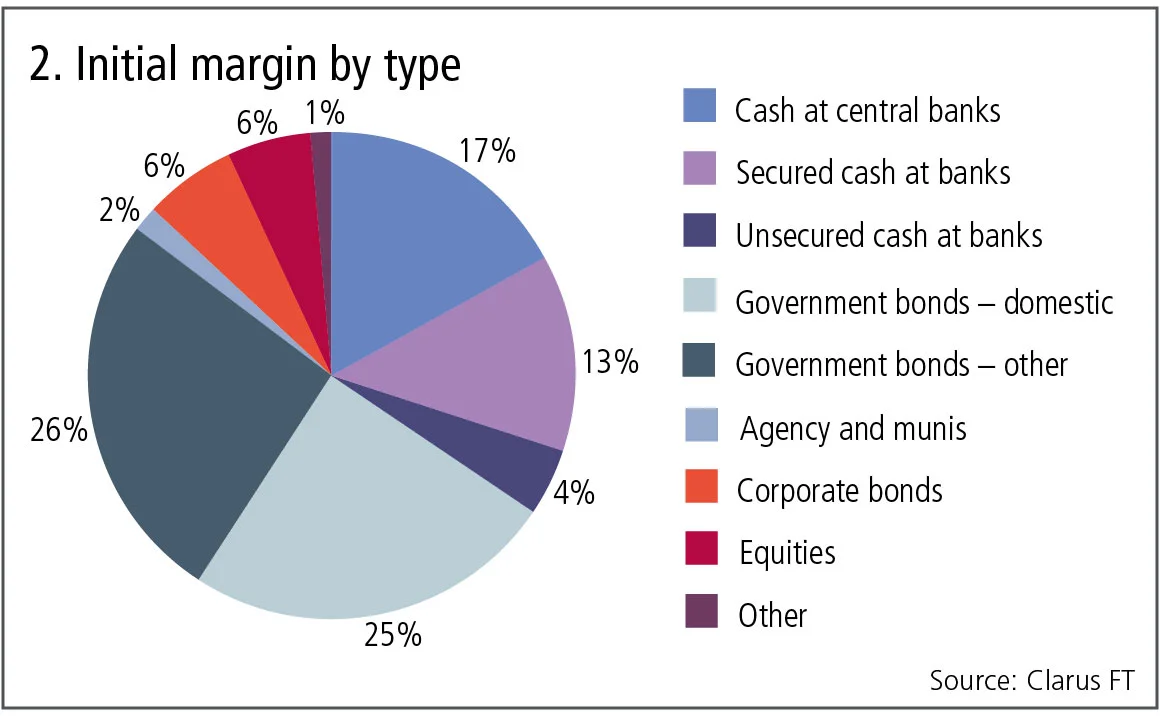

Figure 2 shows:

Government bonds are by far the largest at 51%, made up of almost equal amounts of domestic – meaning the sovereign of the CCP’s location – and other, meaning foreign country sovereigns.

- Cash at central banks is the next largest at 17%.

- Secured cash at commercial banks is 13% and includes reverse repo transactions.

- Corporate bonds and equities are 6% each.

- Unsecured cash at commercial banks is 4%.

Clearing houses will impose larger haircuts on riskier securities, and these figures use pre-haircut amounts, there is additional data on the post-haircut amounts of these types, but this does not materially alter the above percentages.

Total variation margin

CCPs also collect and post daily variation margin to participant members to reflect the daily profit and loss of their positions. Let’s look at the size of these flows.

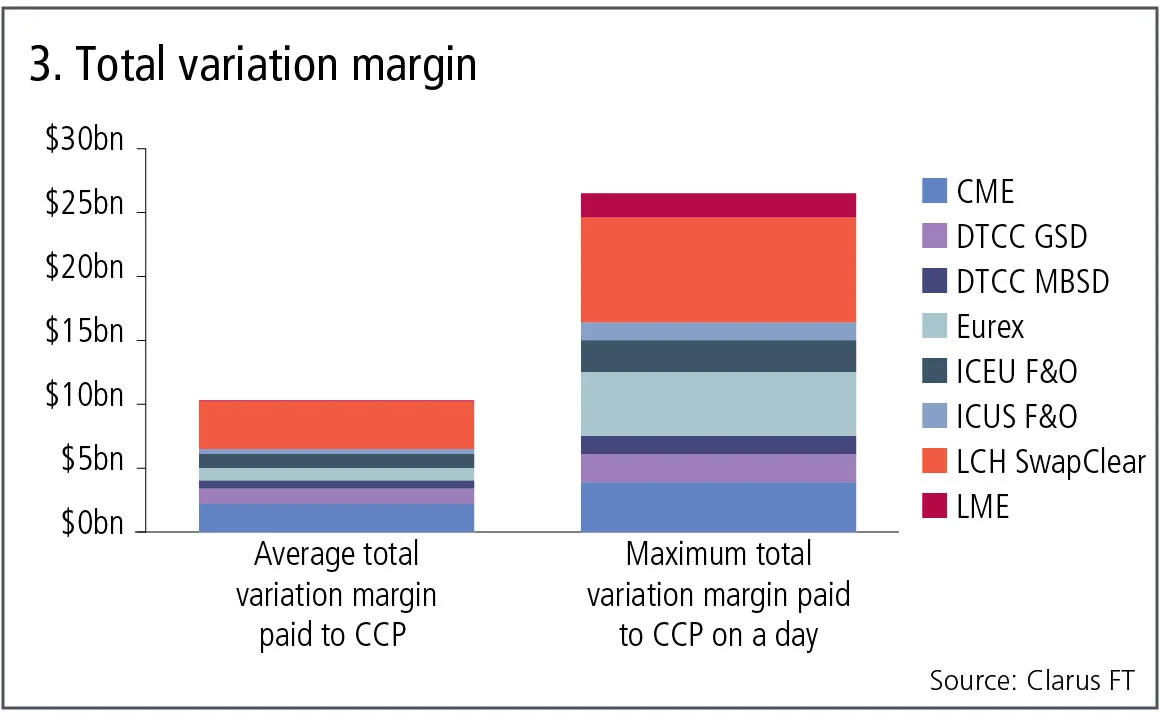

Figure 3 shows:

- Average total variation margin paid to a CCP and the maximum total variation margin paid to a CCP on a day in the quarter ending September 30, 2017, for selected CCPs with large variation flows.

- The grand total for these eight CCPs is $10 billion, meaning on average this amount is being collected by CCPs from members and the same amount posted to other members.

- LCH SwapClear at $3.7 billion and CME at $2.2 billion are the largest two contributors.

- The total of maximum total variation in a day in the quarter is $26 billion, so two and a half times as large as the average.

- LCH SwapClear at $8.2 billion and Eurex at $5 billion are the largest two contributors.

Default resources

Besides initial margin and variation margin, the other important measure of a CCP’s significance is the default fund or guarantee fund. These are the resources that will be called into action should a defaulting member’s variation margin, initial margin and pre-funded default fund contribution not be sufficient to close out their positions. As such it provides the backstop that gives a high level of confidence to the safety and risk management provided by a CCP.

Let’s look at these default resources for the same clearing houses that we aggregated initial margin by their constituent CCPs.

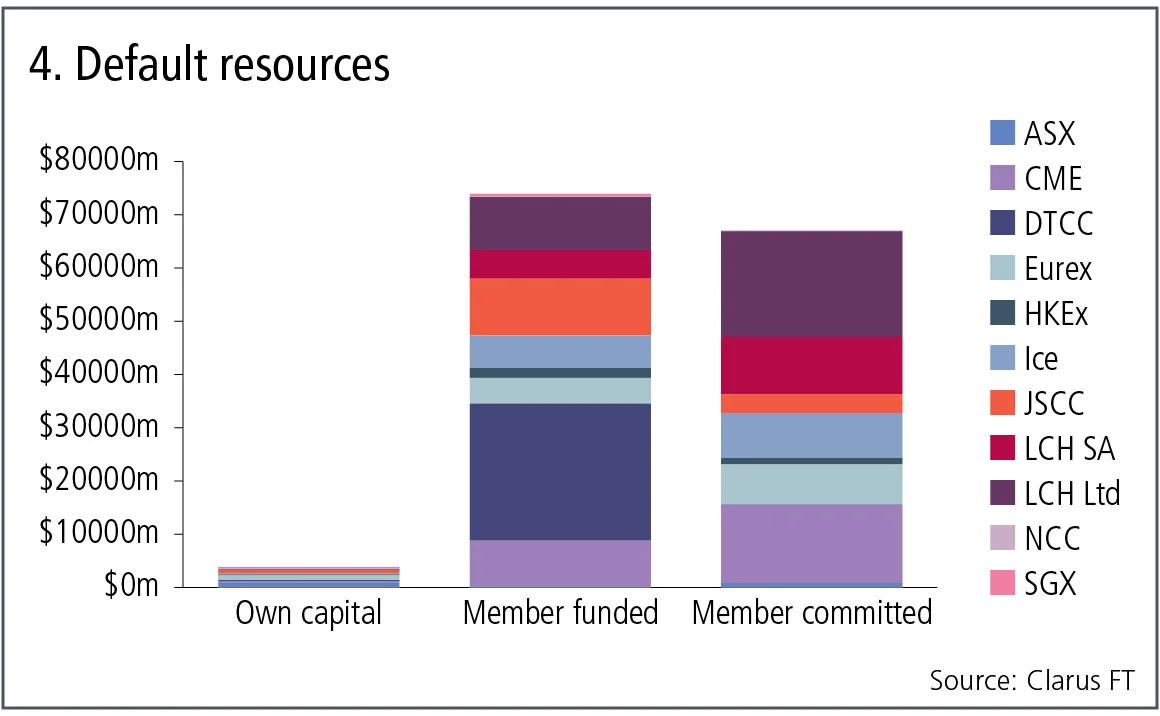

Figure 4 shows:

- Three columns: the clearing houses’ own capital; member-funded contributions, so already held by the CCP; and member-committed contributions that would be available in the event of a default, should they be needed.

- Clearing houses’ own capital of $3.8 billion is the smallest of these figures and there has been much comment over recent years on “skin in the game” and whether CCPs should be required to have more of their own capital. However, there has been no movement by the regulators who authorise, monitor and stress test CCP models and resources, which by implication means they are satisfied by the amount of this capital.

- Member-funded contributions are very significant at $74 billion – this is cash or securities provided by members to CCPs.

- DTCC has the largest amount of member-funded contributions at $26 billion, followed by LCH Ltd at $10 billion.

- Member-committed contributions are next at $67 billion.

- LCH Ltd has the largest share at $20 billion, followed by CME at $15 billion.

Initial margin, variation margin, default resources

In the preceding section we have looked at the three key numbers, initial margin, variation margin and default resources and shown that for selected major CCPs, these amount to:

- $500 billion of initial margin.

- $10–26 billion of variation margin.

- $78–145 billion of default resources.

- A grand total of $670 billion.

A big number, but one that is likely to be higher if more CCPs are included, for example B3 in Brazil or Shanghai Clearing in China, perhaps by $30 billion to $80 billion.

Irrespective of whether the number is $670 billion or $750 billion, the size of these numbers shows the systemic importance of CCPs as a major part of financial market infrastructure.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Comment

Op risk data: Tech glitch gives customers unlimited funds

Also: Payback for slow Paycheck Protection payouts; SEC hits out at AI washing. Data by ORX News

Op risk data: Lloyds lurches over £450m motor finance speed bump

Also: JPM trips up on trade surveillance; Reg Best Interest starts to bite. Data by ORX News

Georgios Skoufis on RFRs, convexity adjustments and Sabr

Bloomberg quant discusses his new approach for calculating convexity adjustments for RFR swaps

In a world of uncleared margin rules, Isda Simm adapts and evolves

A look back at progress and challenges one year on from UMR and Phase 6 implementation

Op risk data: Morgan Stanley clocked in block trading shock

Also: HSBC deposit guarantee gaffe; Caixa hack cracked; reg fine insult to cyber crime injury. Data by ORX News

Digging deeper into deep hedging

Dynamic techniques and gen-AI simulated data can push the limits of deep hedging even further, as derivatives guru John Hull and colleagues explain

How AI can give banks an edge in bond trading

Machine learning expert Terry Benzschawel explains that bots are available to help dealers manage inventory and model markets

Op risk data: US piqued by Pictet tax breach

Also: US Bank’s Covid failings; South Korea’s short-selling clampdown. Data by ORX News

Most read

- Top 10 operational risks for 2024

- Japanese megabanks shun internal models as FRTB bites

- LCH issued highest cash call in more than five years